- Aug 31, 2010

- 687

- 1,216

Couldnt find a proper thread for it, but the ever excellent football finance writer "Swiss Ramble" has published his writeup of our finance report for 22/23

https://swissramble.substack.com/p/tottenham-hotspur-finances-202223

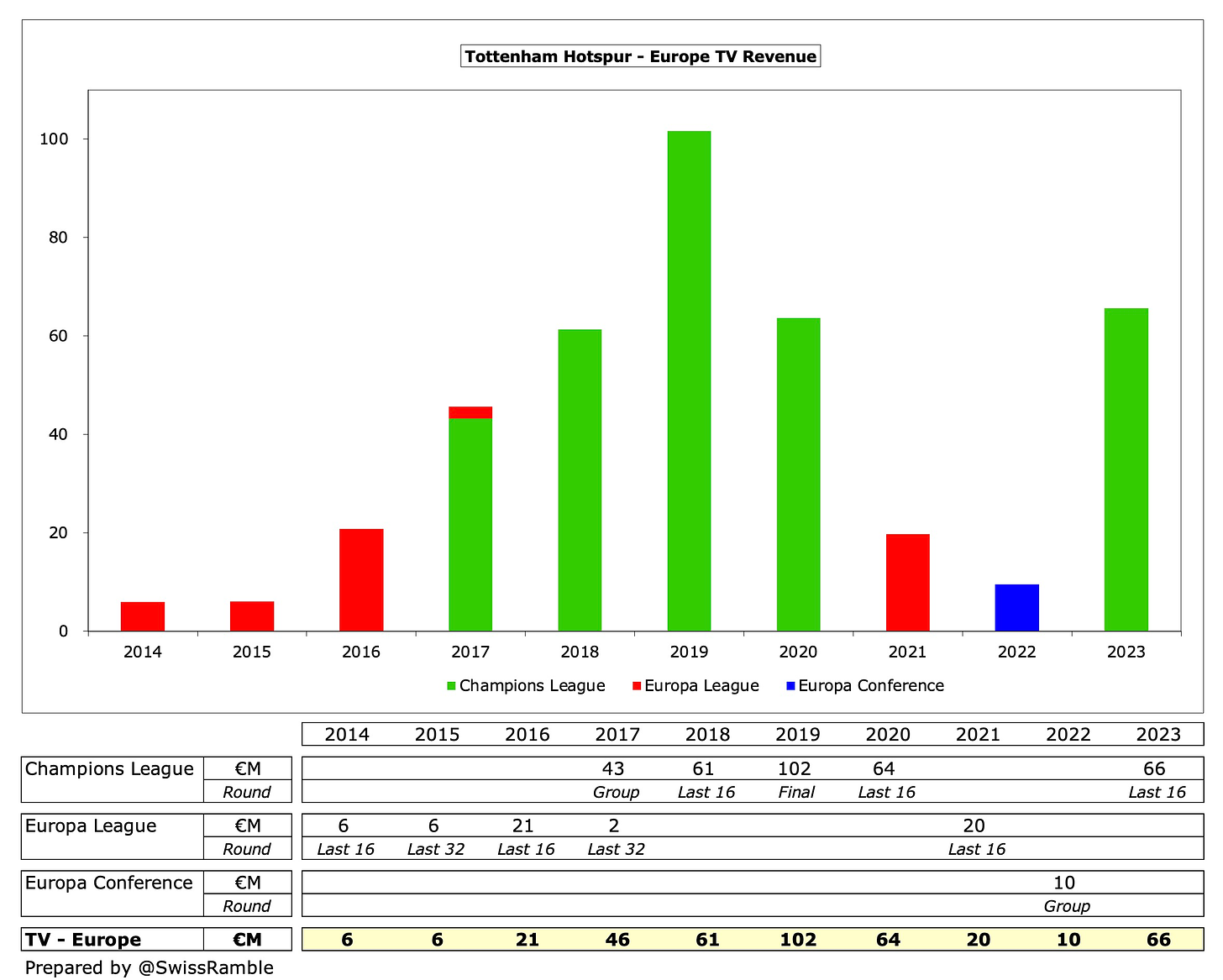

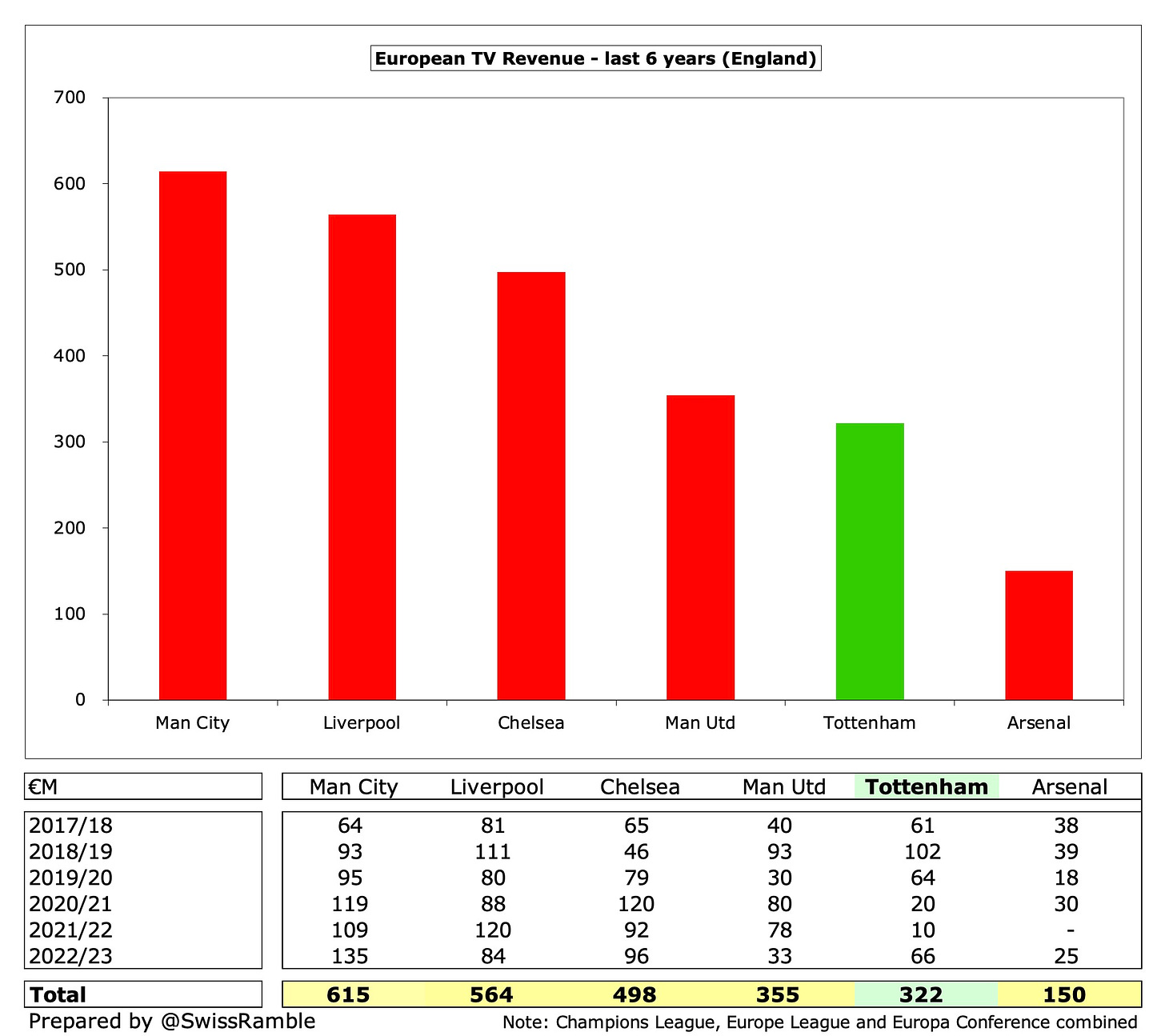

Tottenham Hotspur’s 2022/23 accounts cover a season when they finished 8th in the Premier League, thus failing to qualify for Europe for the first time since 2010. However, they did reach the last 16 of the Champions League last year, before being eliminated by Milan.

The challenges on the pitch were underlined by the dismissal of head coach Antonio Conte in March 2023. The Italian was initially replaced by his assistant Cristian Stellini, but he lasted less than four weeks before Ryan Mason took over on an interim basis until the end of the season.

Ange Postecoglou was then lured from Celtic in June, after the popular Australian manager had won the domestic treble in Scotland.

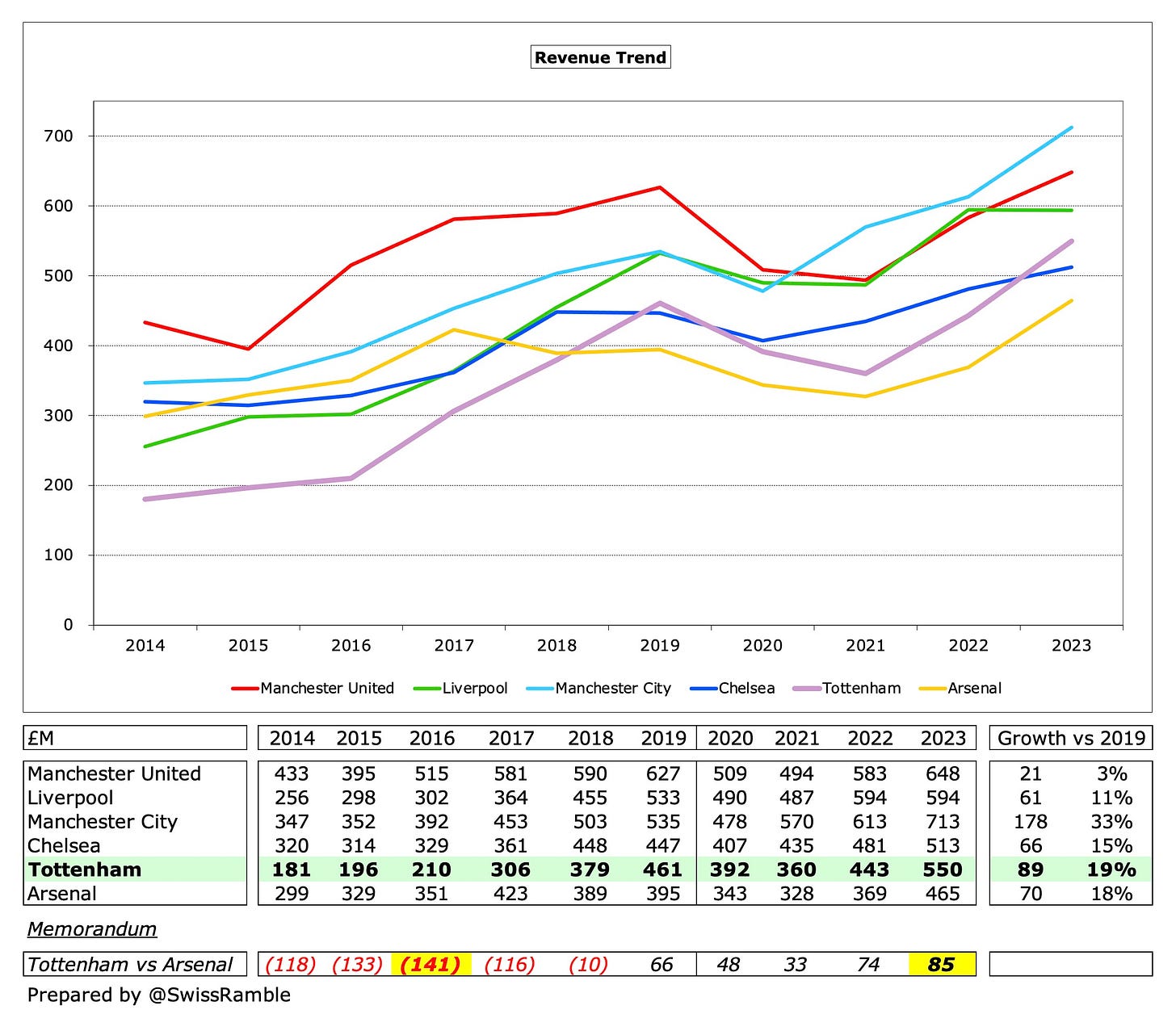

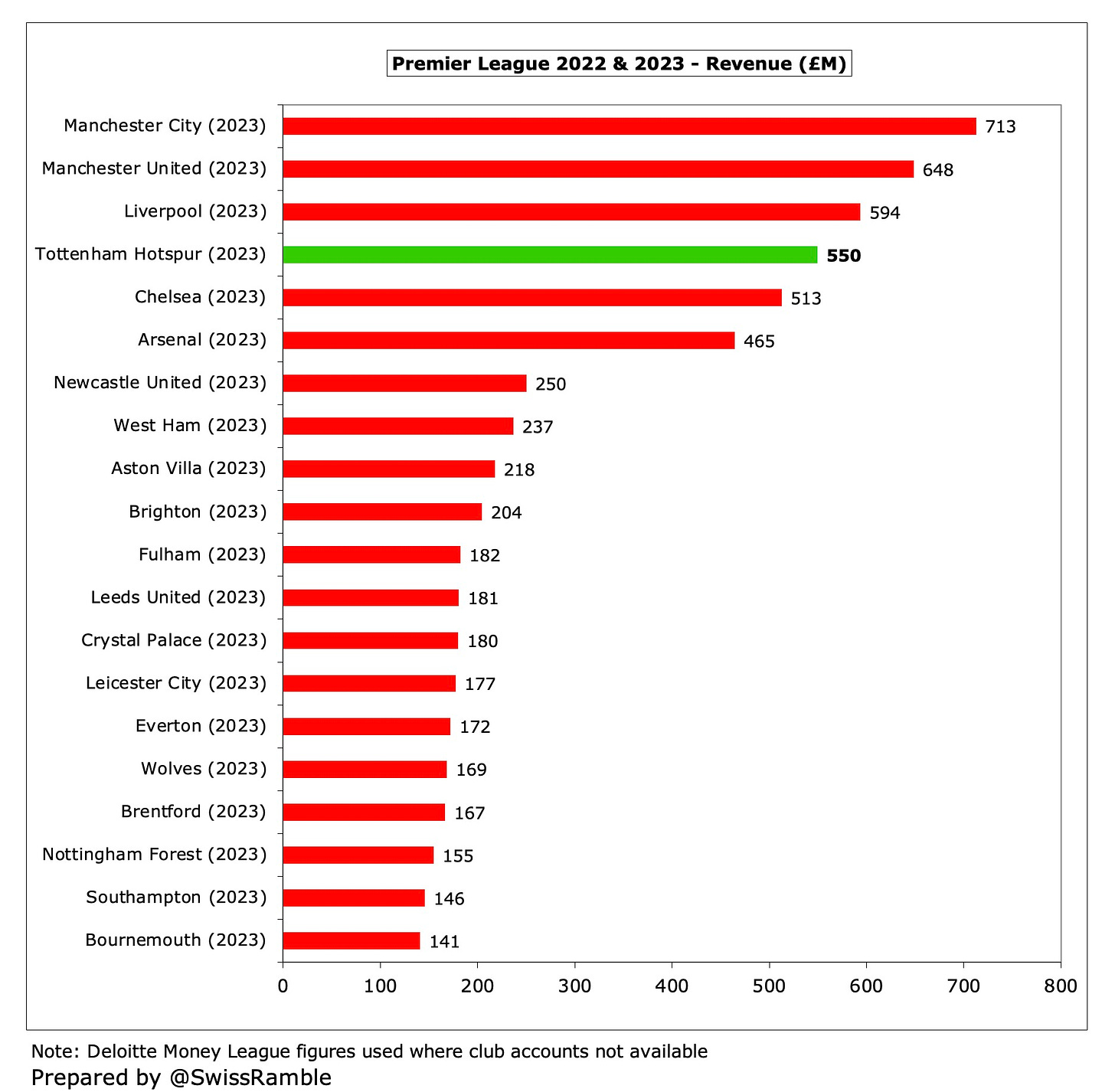

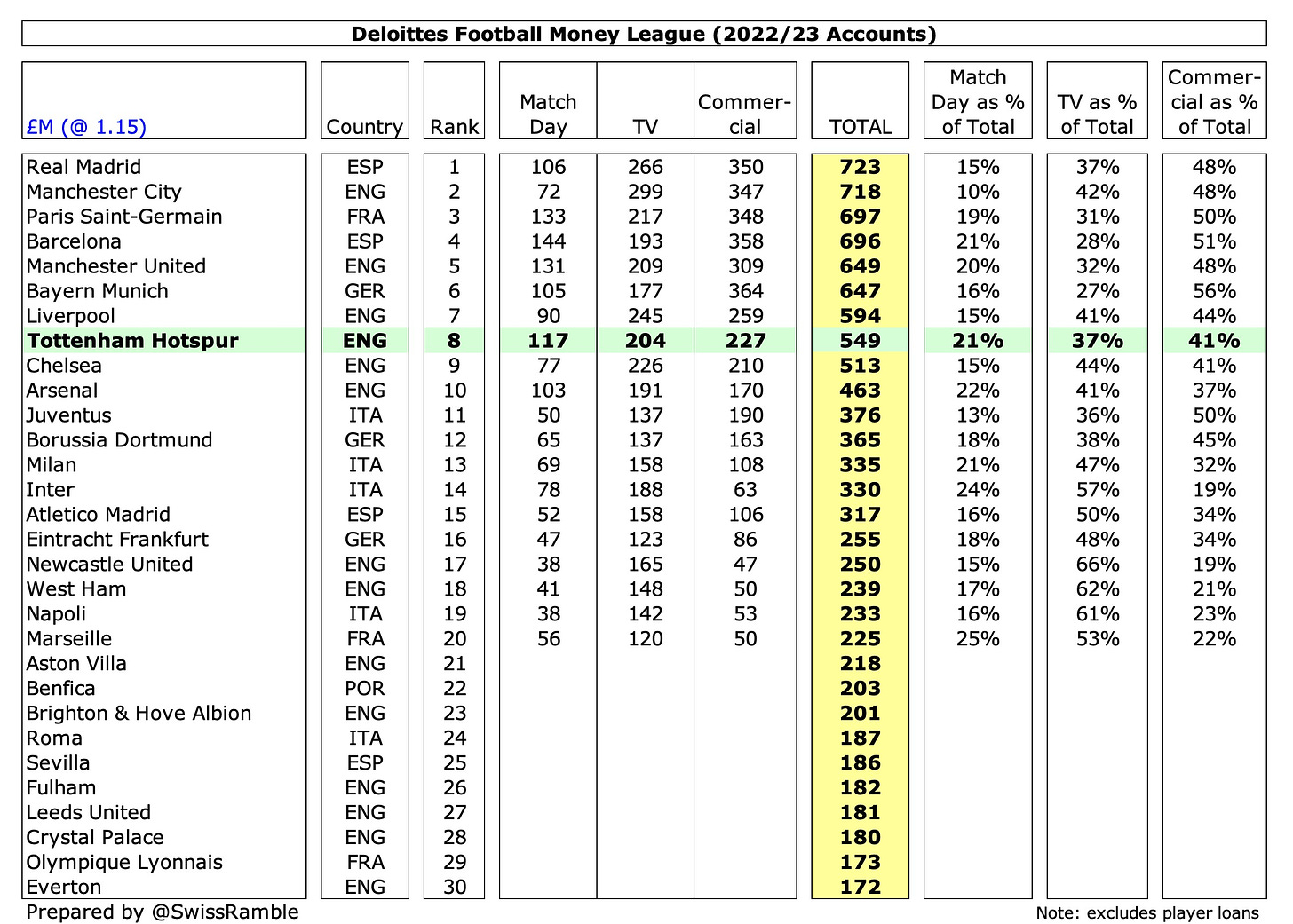

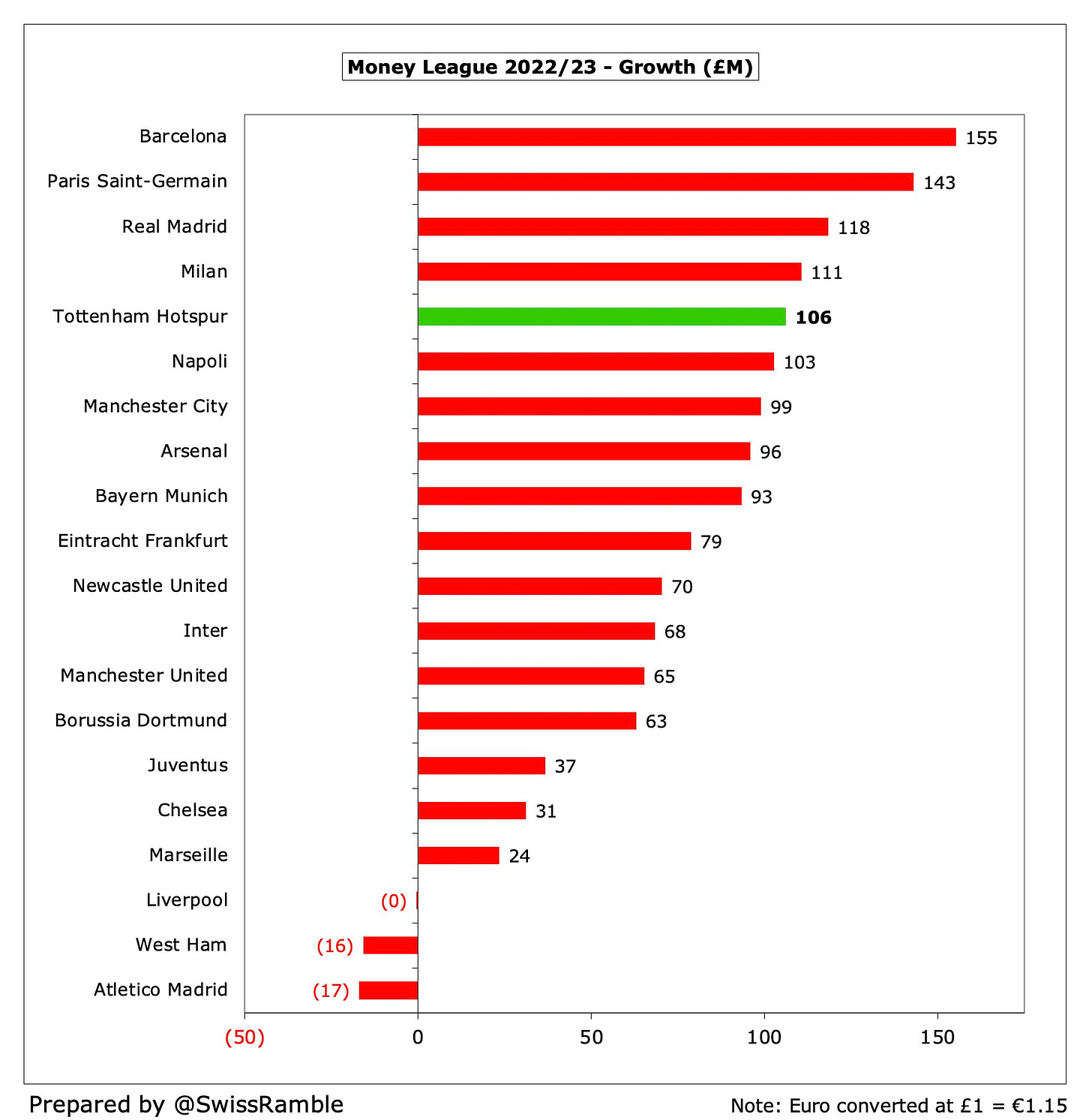

Revenue rose £107m (24%) from £443m to £550m, which was a new club record, breaking through the half a billion pounds barrier for the first time. This was predominately due to participation in the Champions League and hosting major events at the Tottenham Hotspur Stadium.

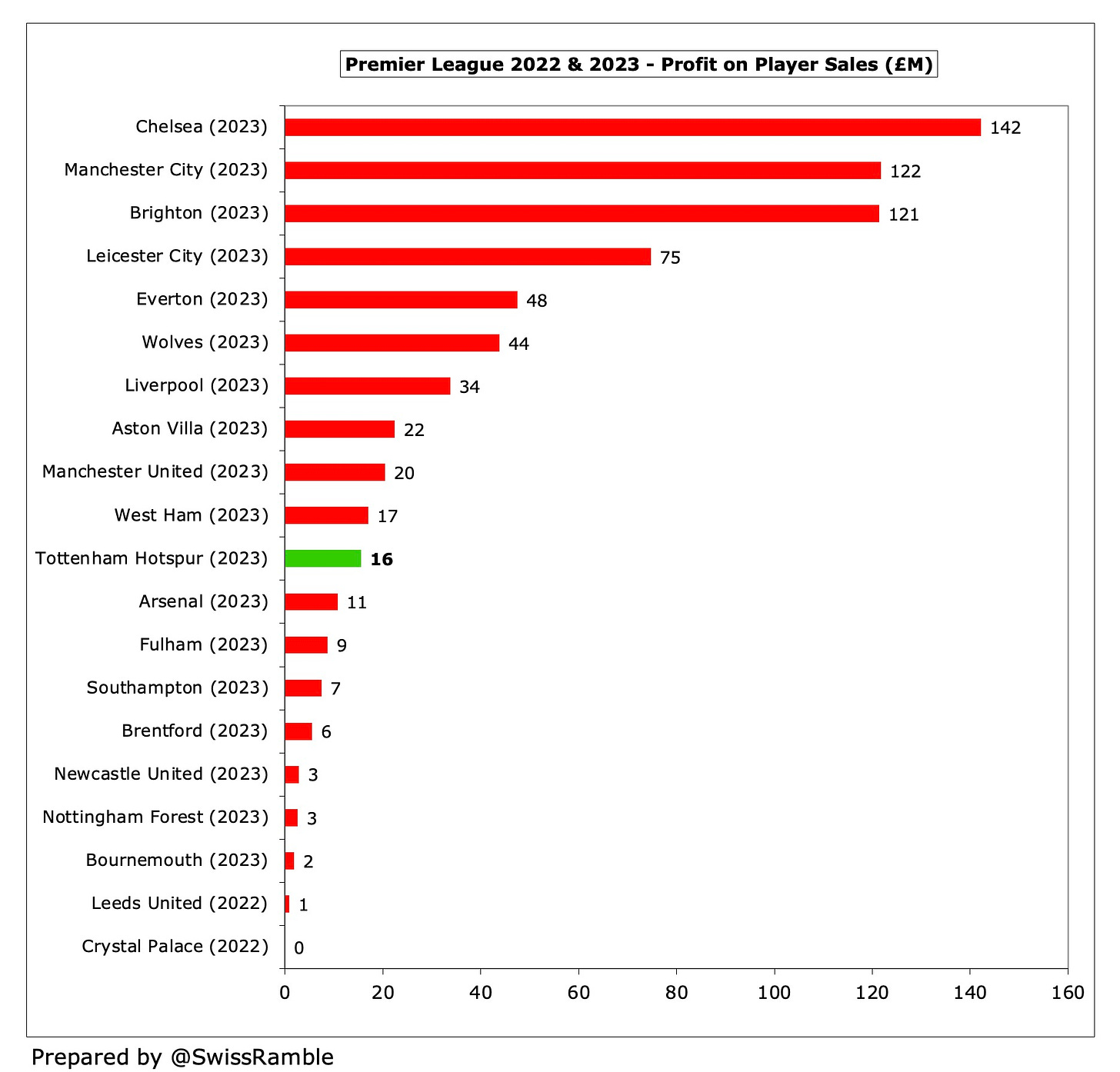

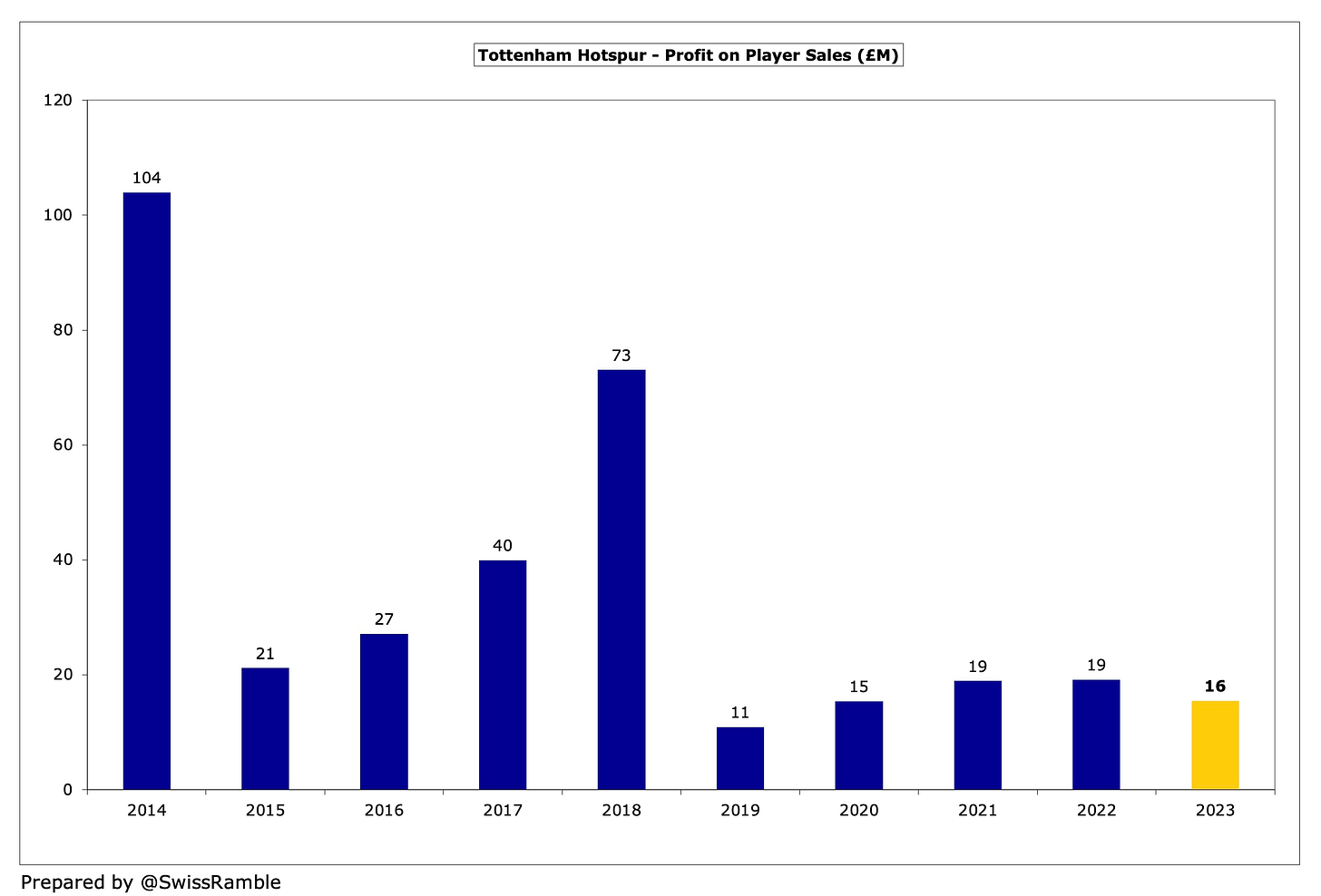

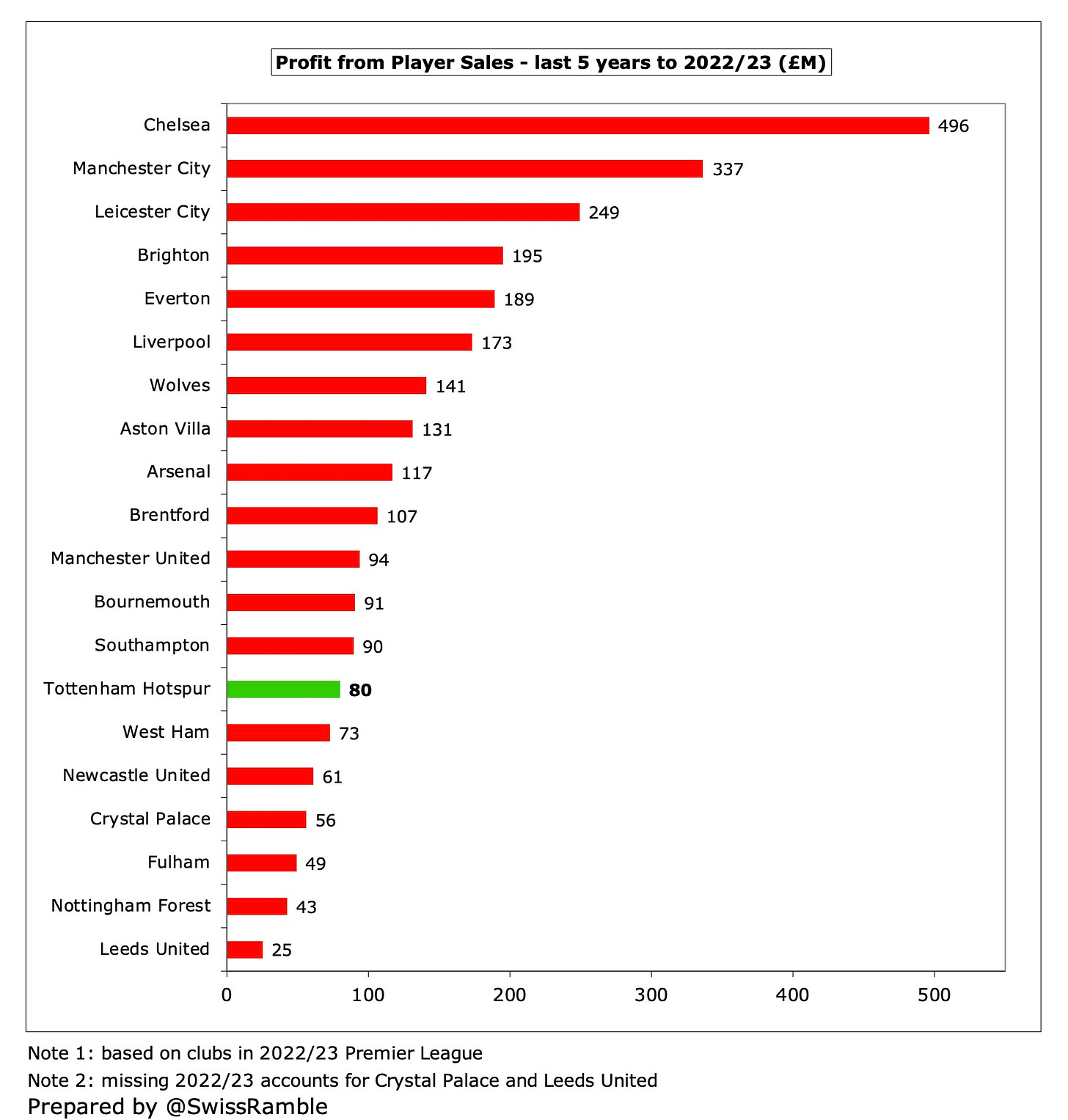

However, the revenue growth was wiped out by a substantial increase in operating expenses, which were up £132m (27%) from £483m to £615m, while profit from player sales dropped from £19m to £16m.

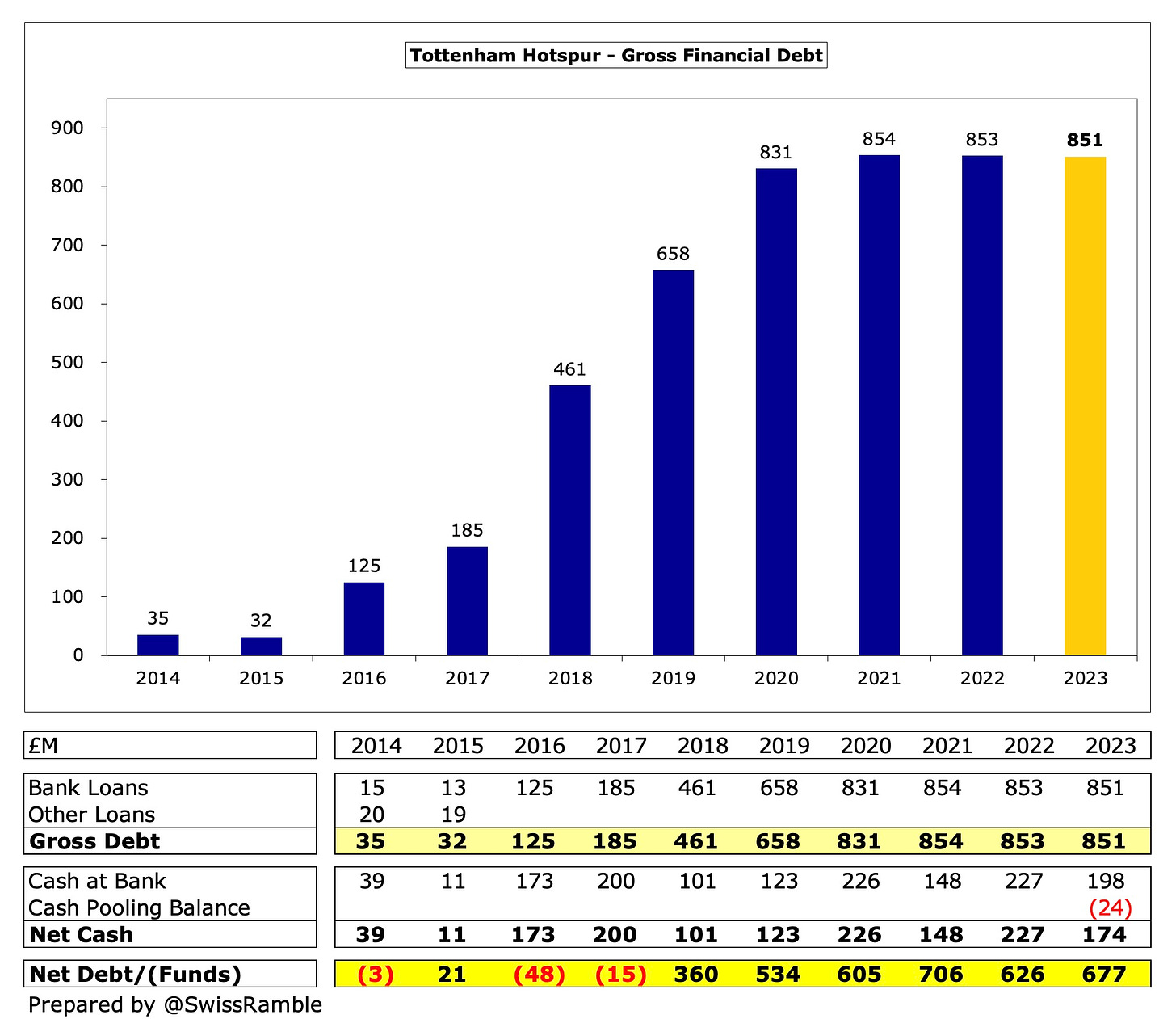

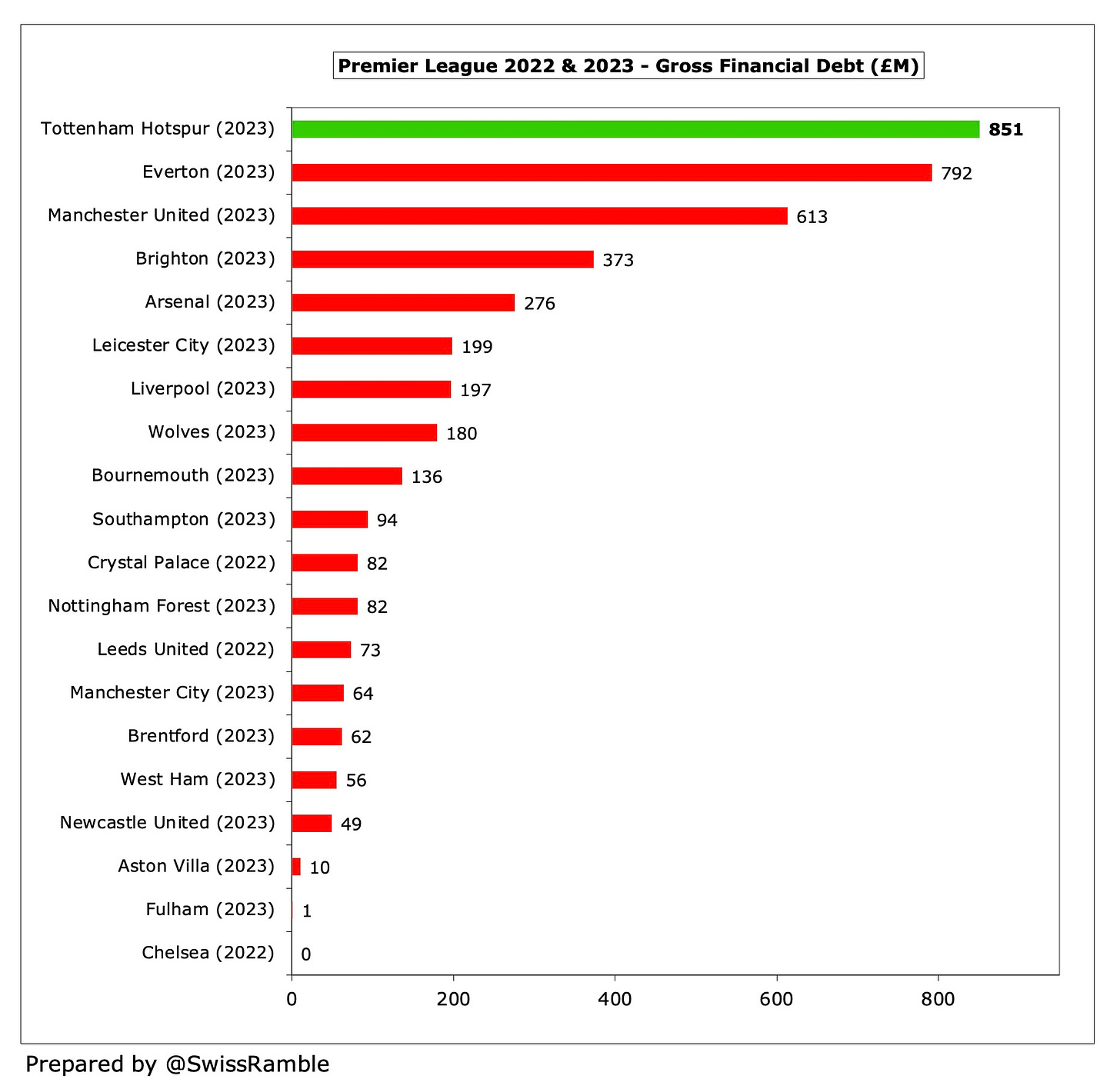

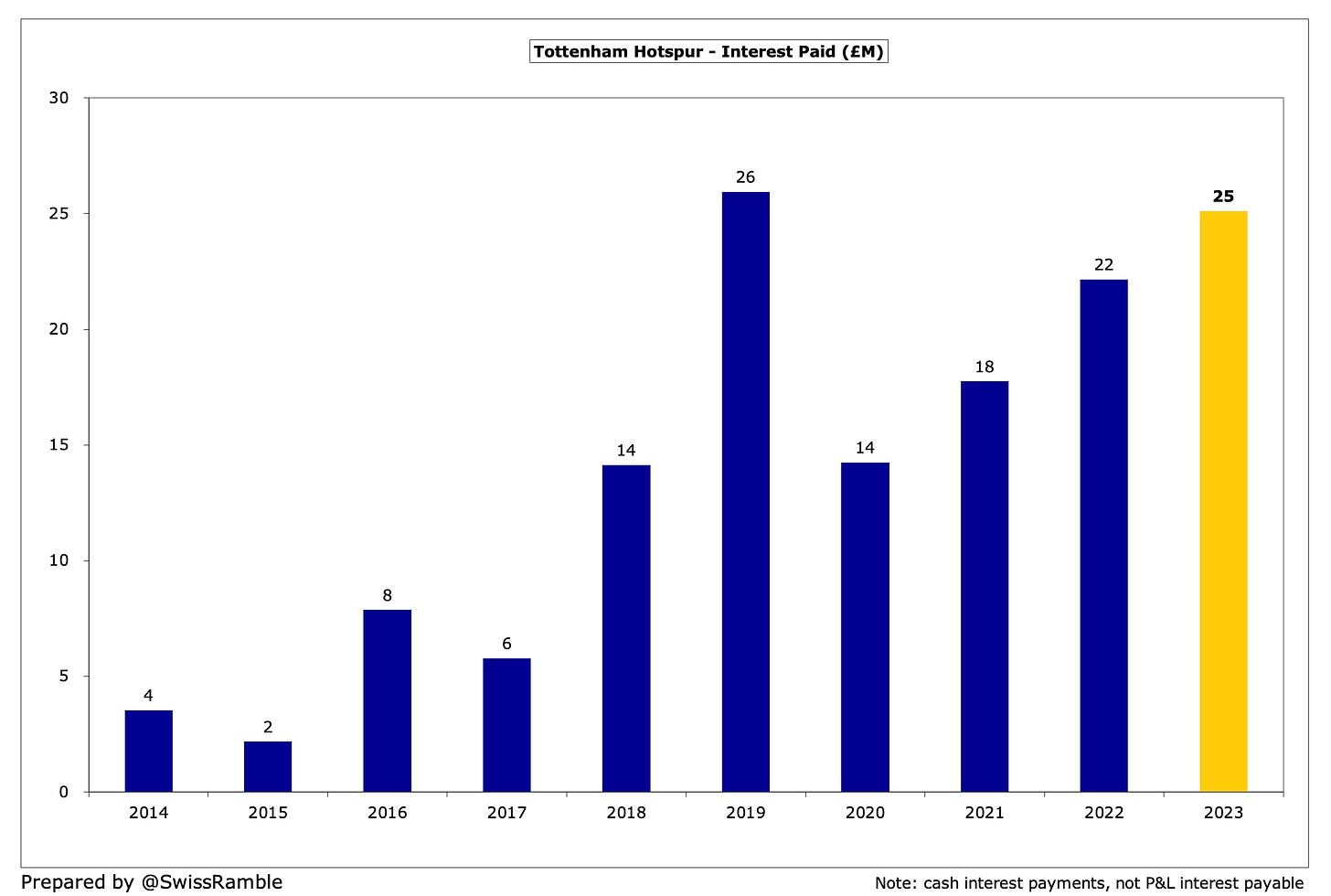

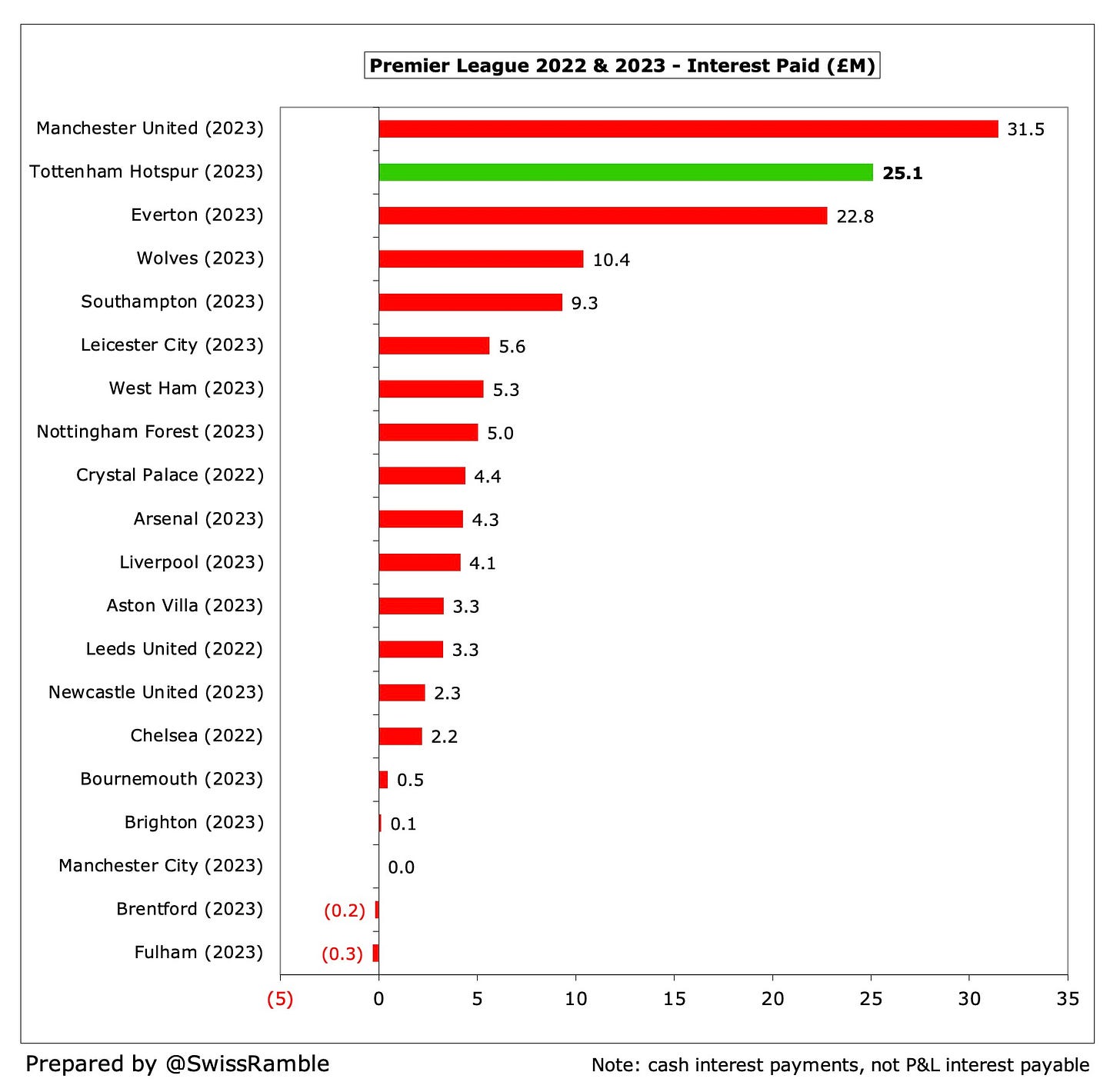

In addition, net interest payable increased by £4m (10%) from £41m to £45m. It’s worth noting that this substantial charge contributed almost half of the club’s £95m pre-tax loss.

The loss after tax was a bit smaller at £87m, thanks to an £8m tax credit, though this was also a lot higher than the prior year’s £50m.

There were two main reasons for Tottenham’s revenue growth.

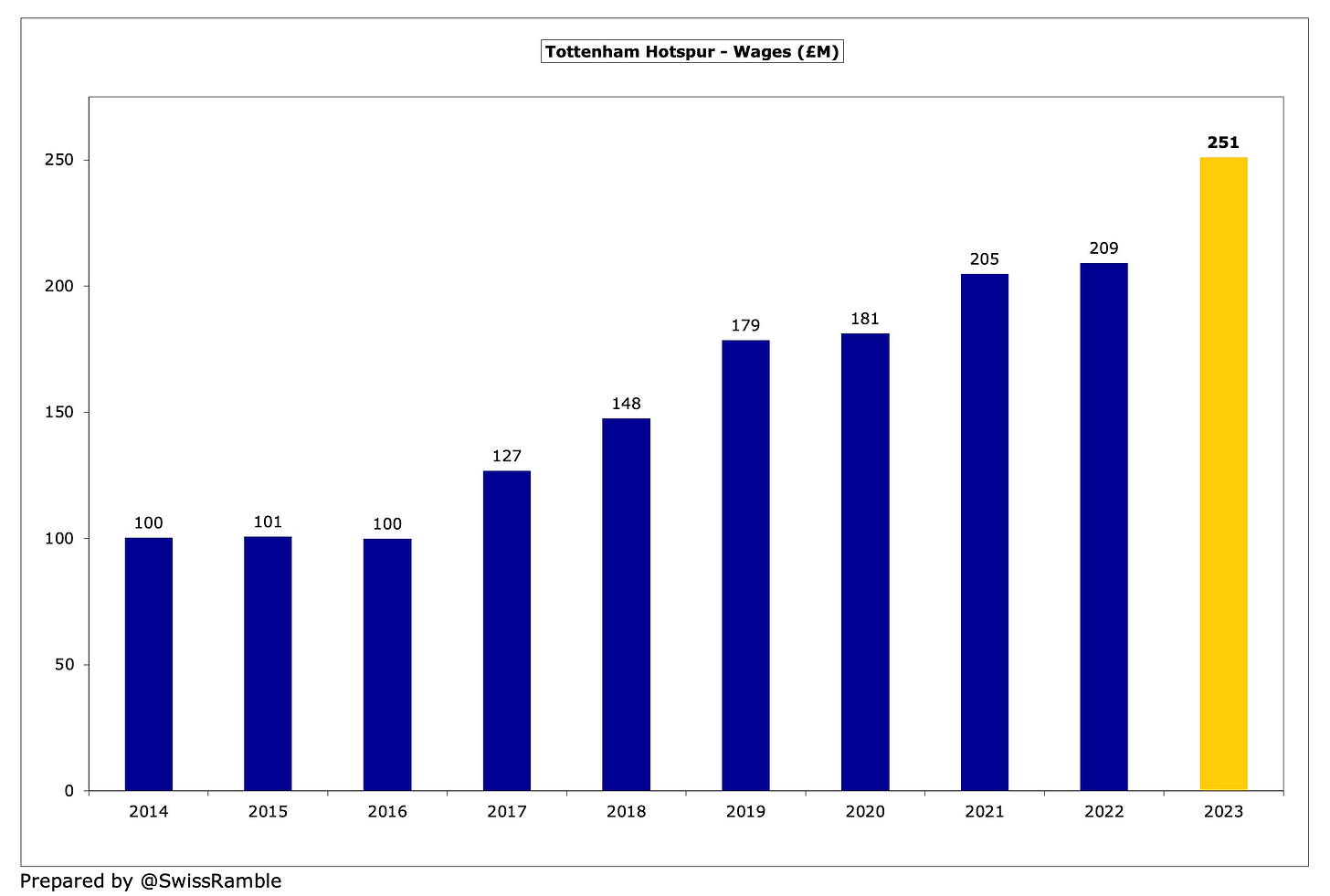

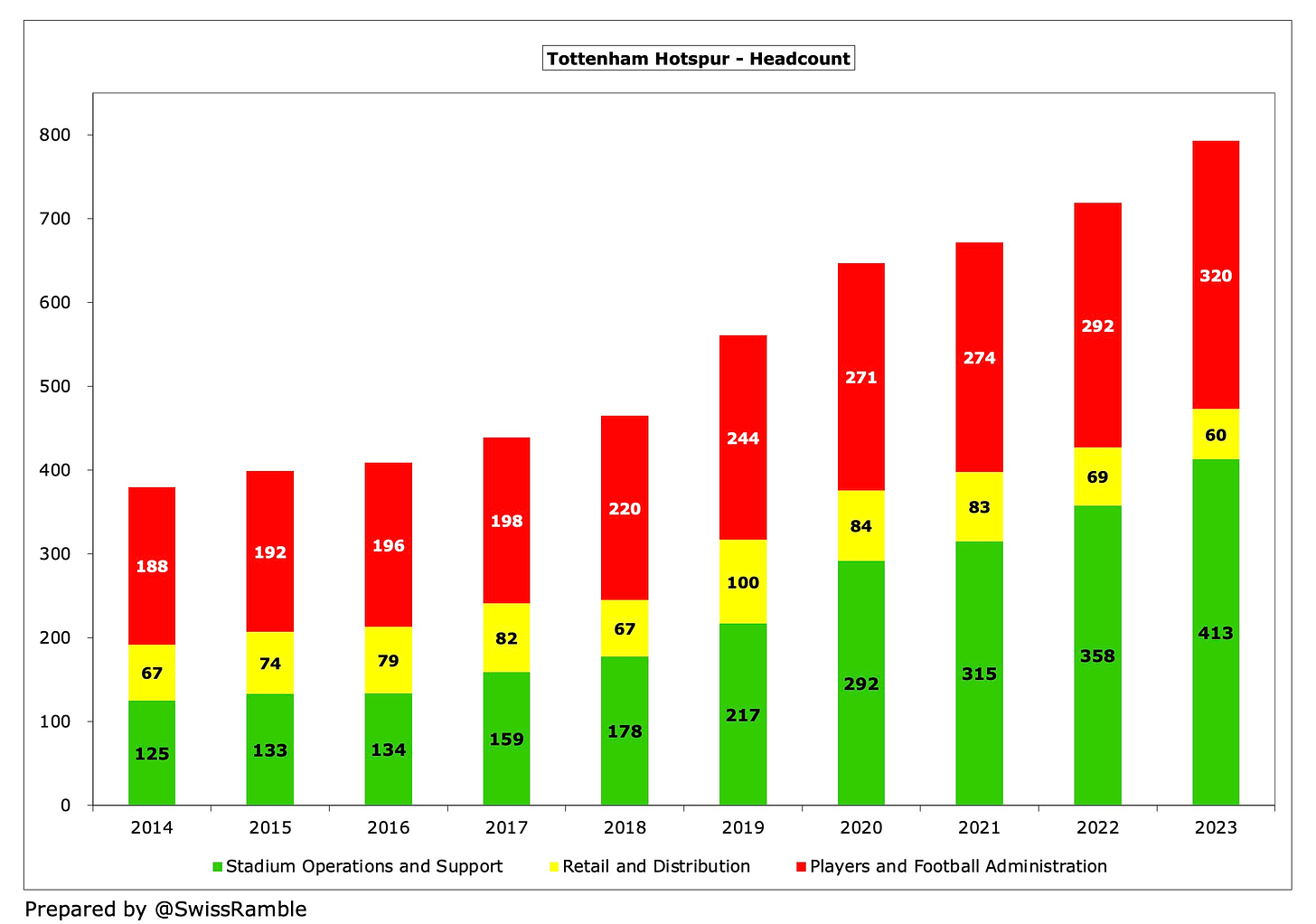

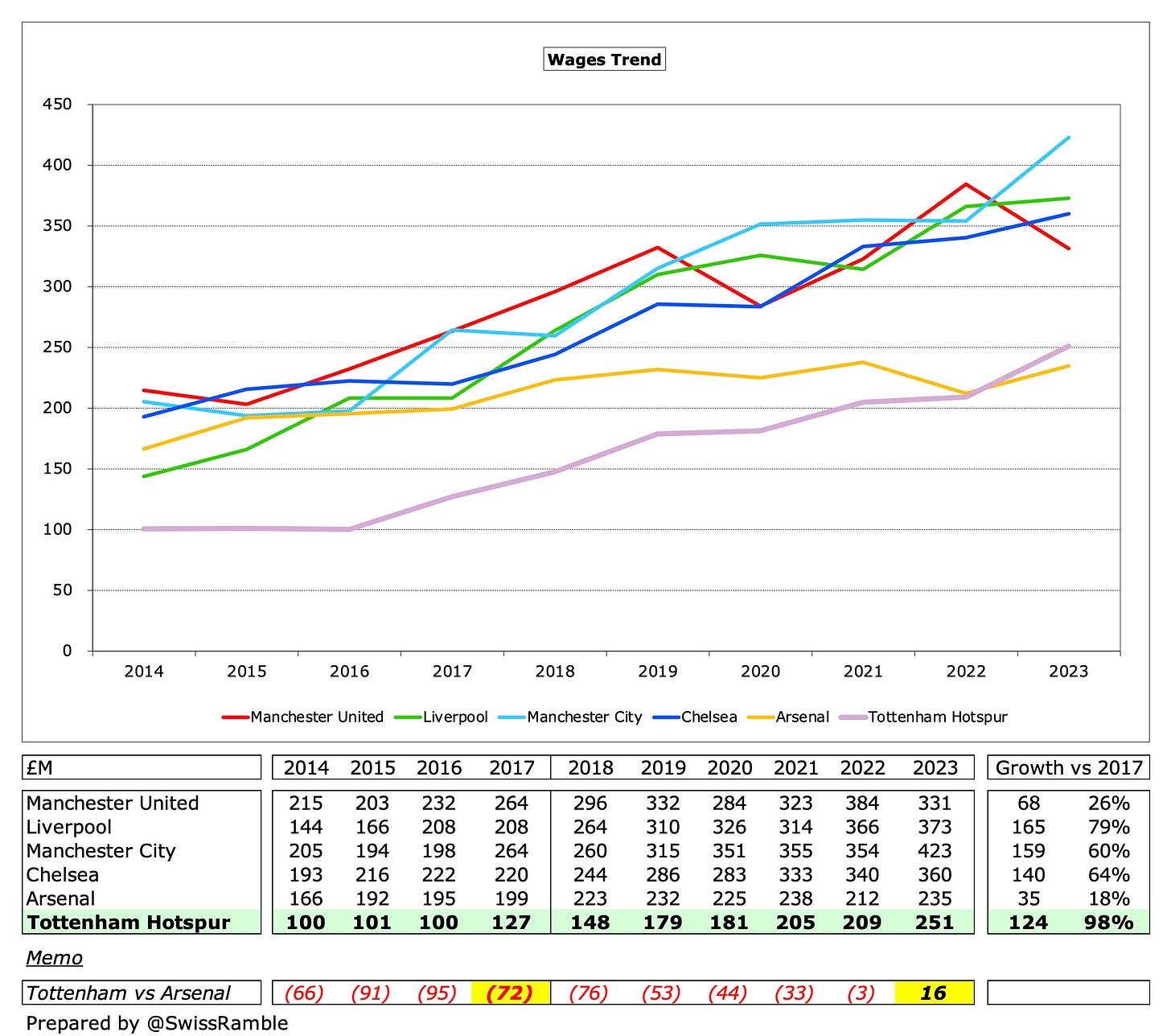

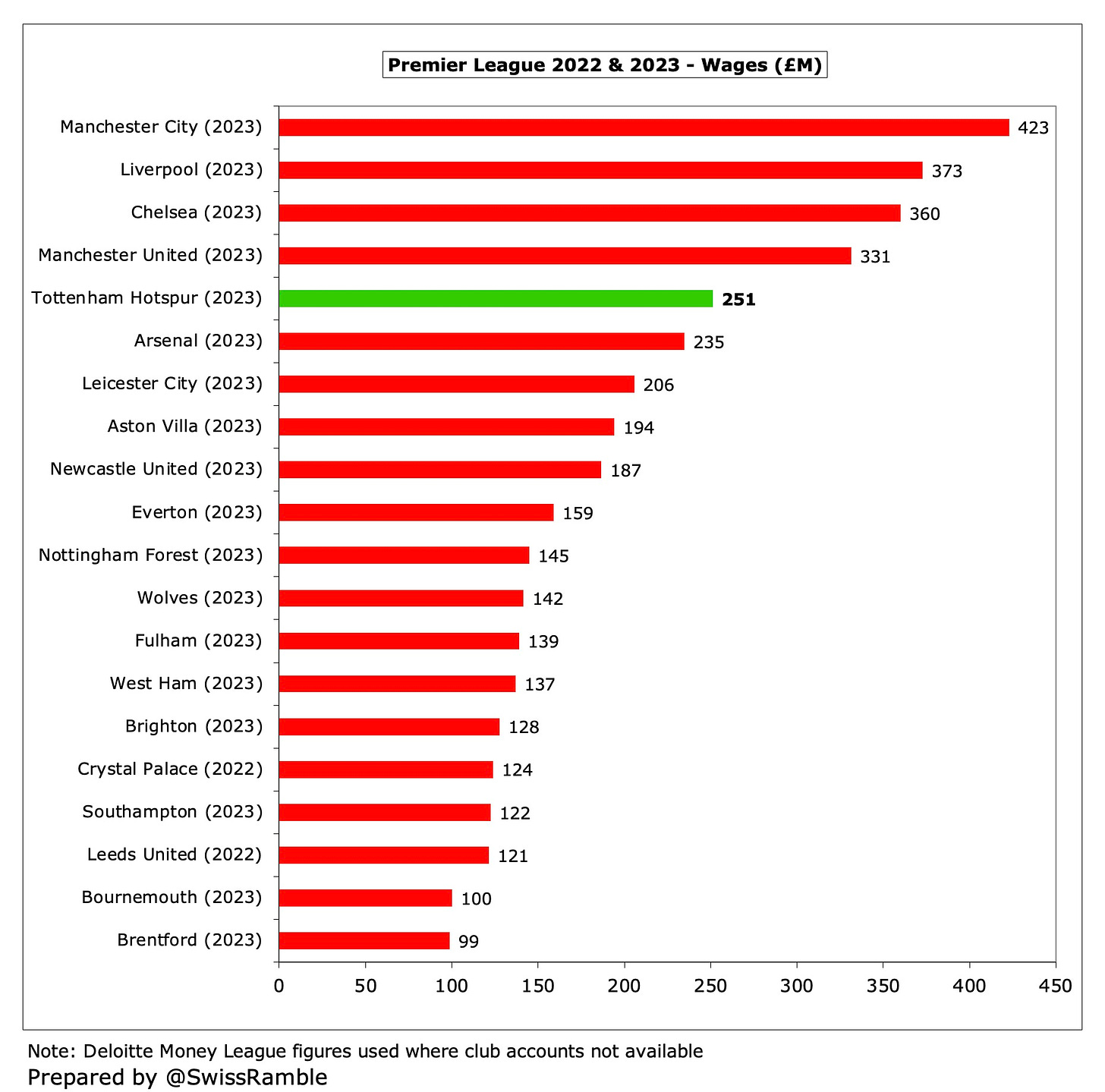

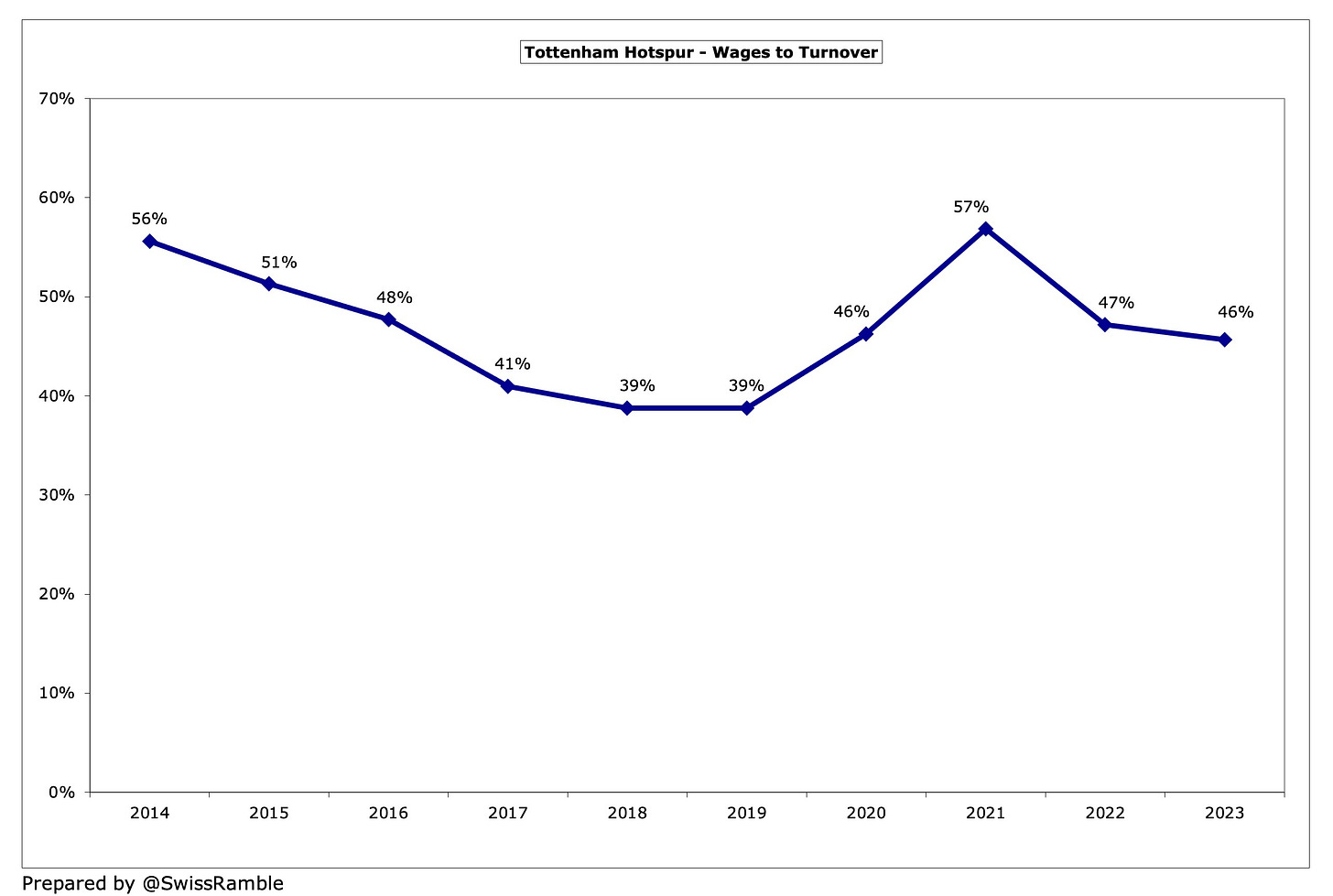

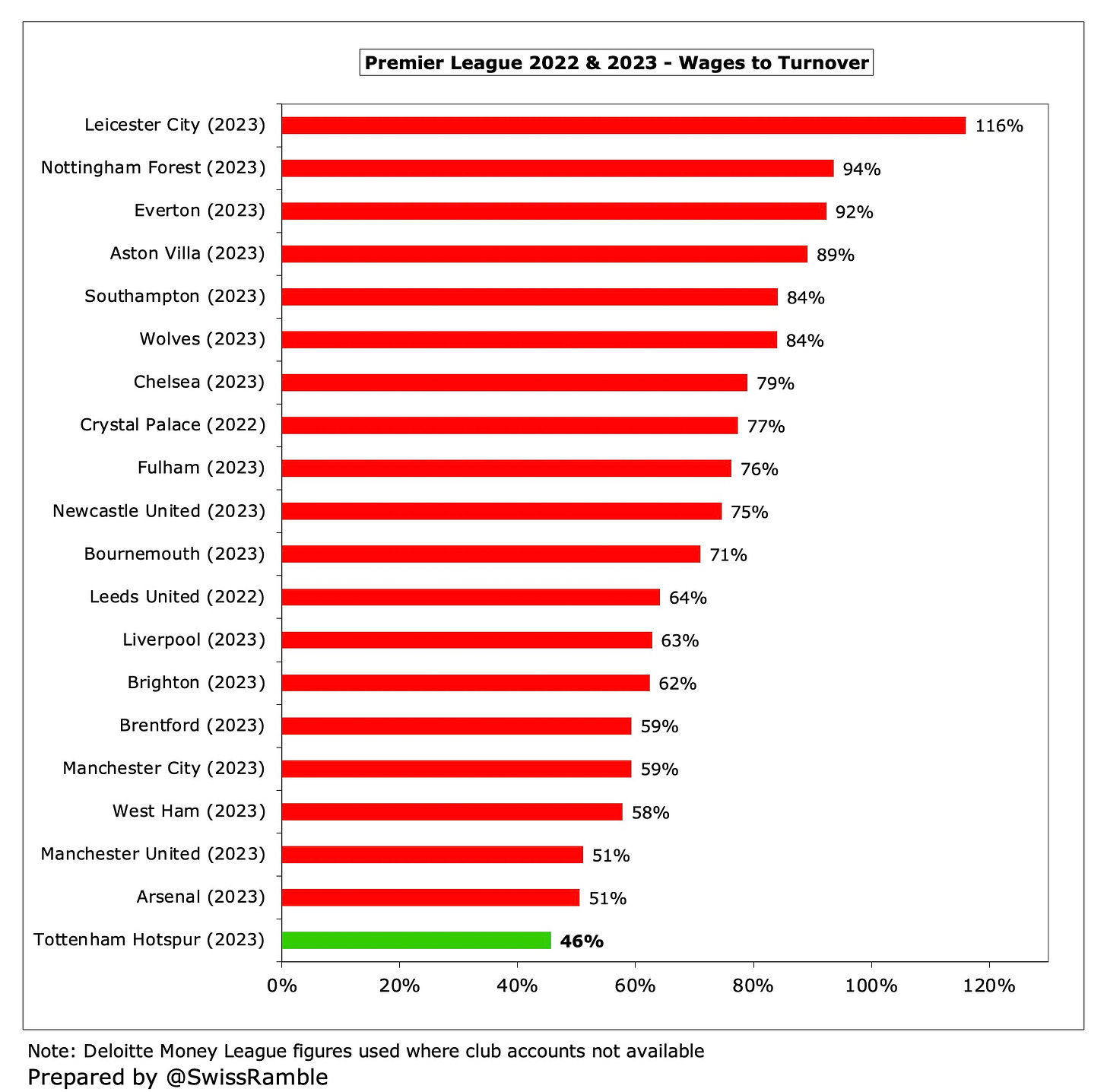

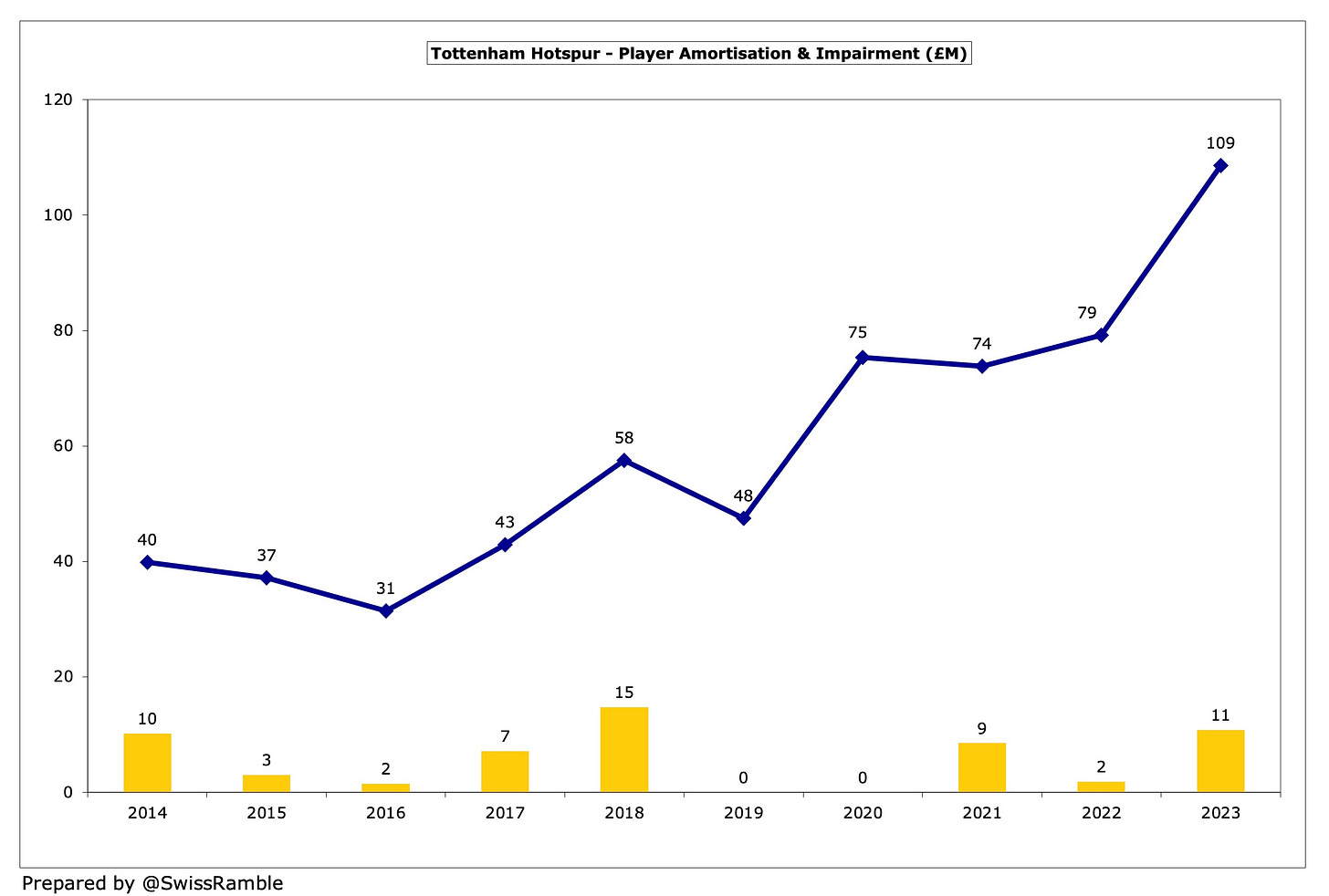

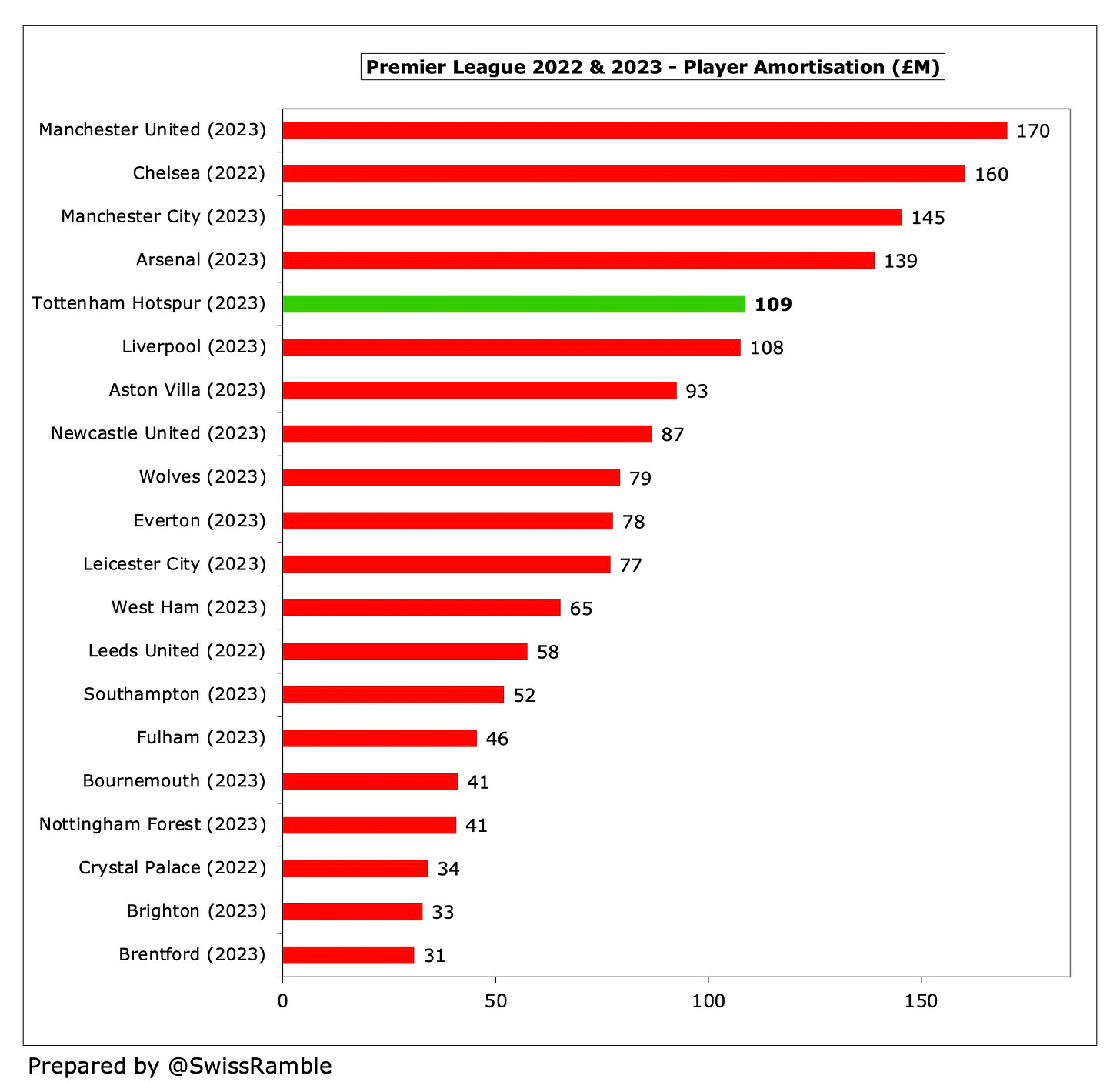

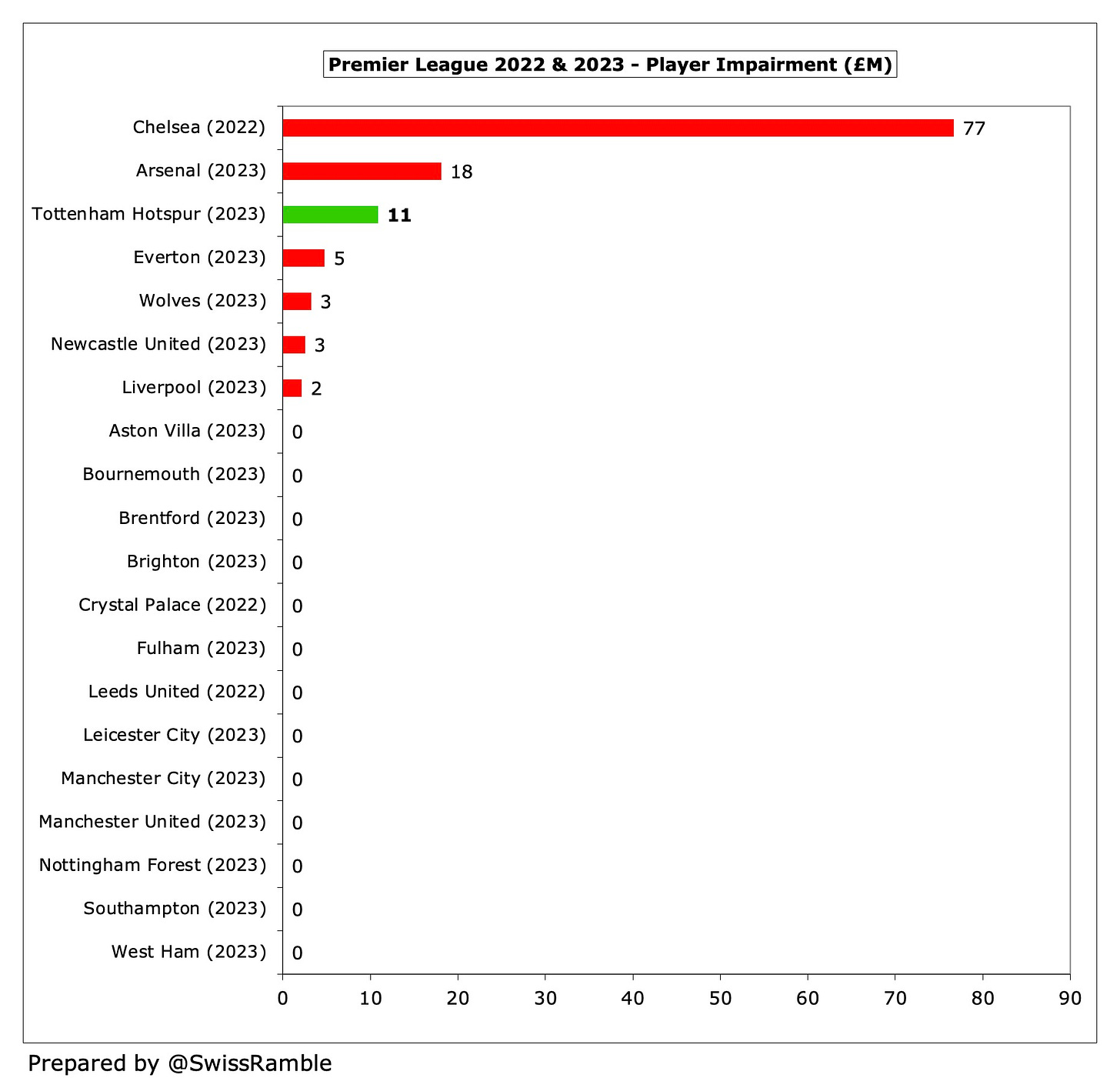

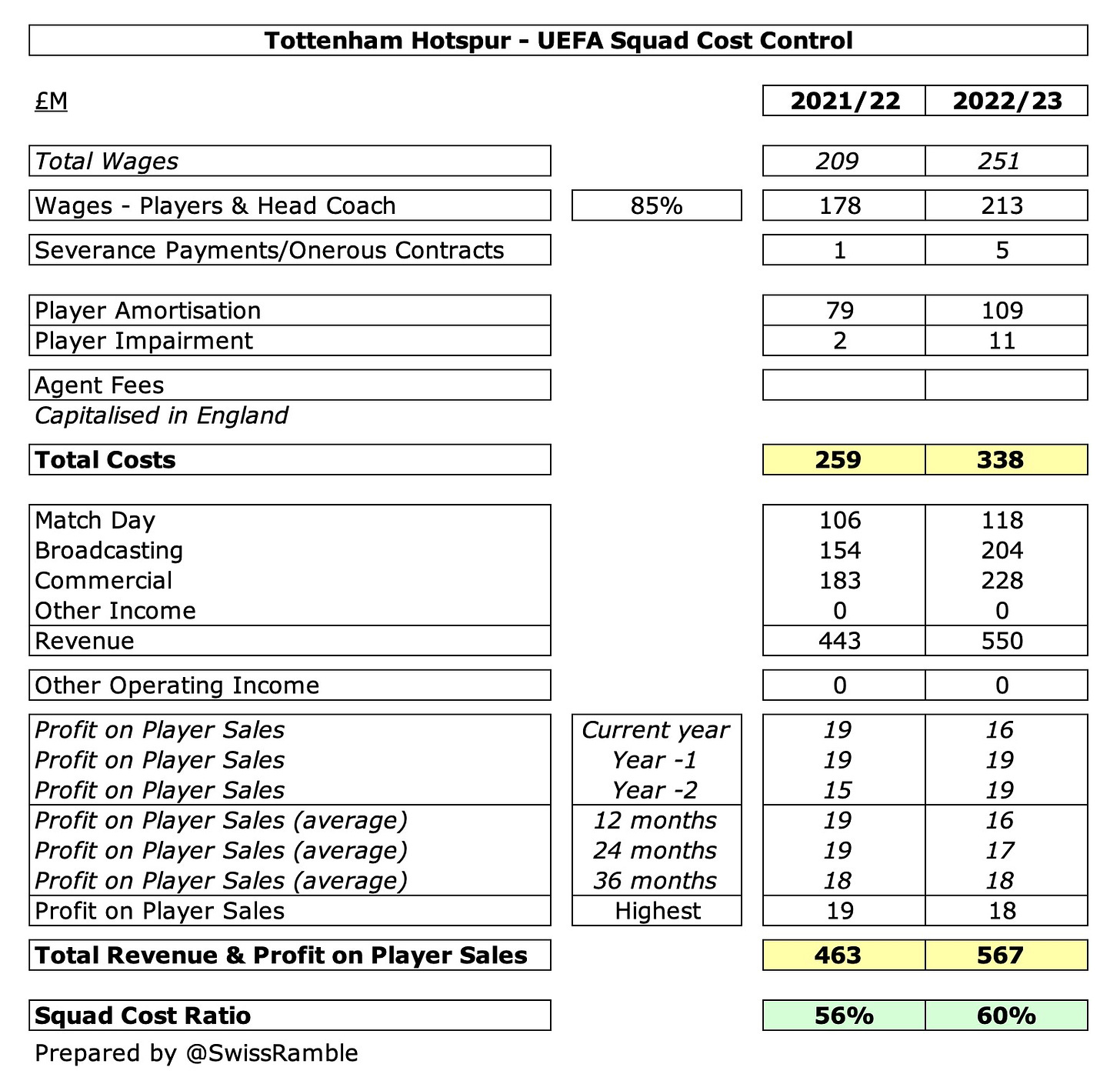

However, there were also chunky increases in staff costs, so the wage bill rose £42m (20%) from £209m to £251m, while player amortisation increased by £30m (37%) from £79m to £109m and player impairment was up from £2m to £11m.

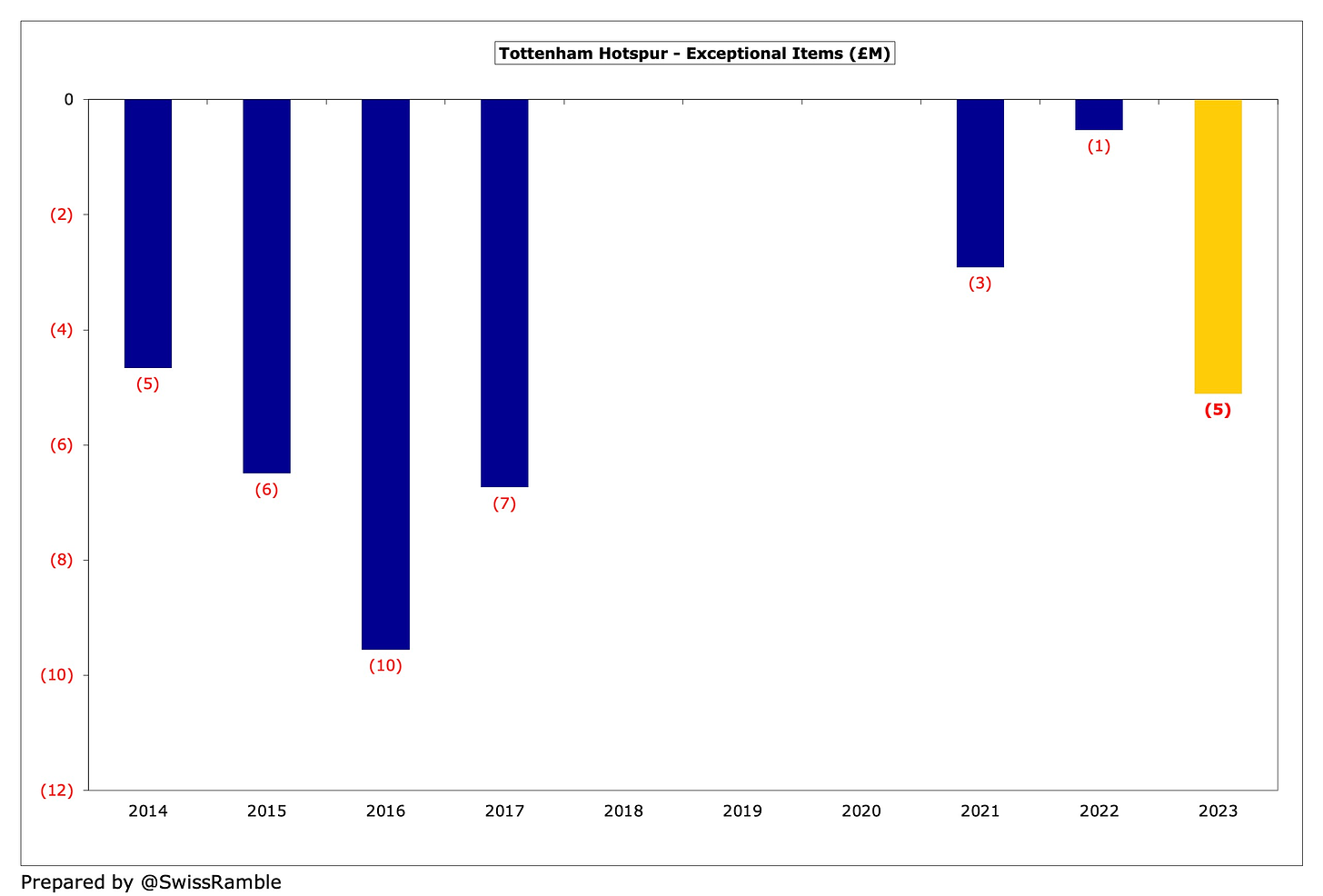

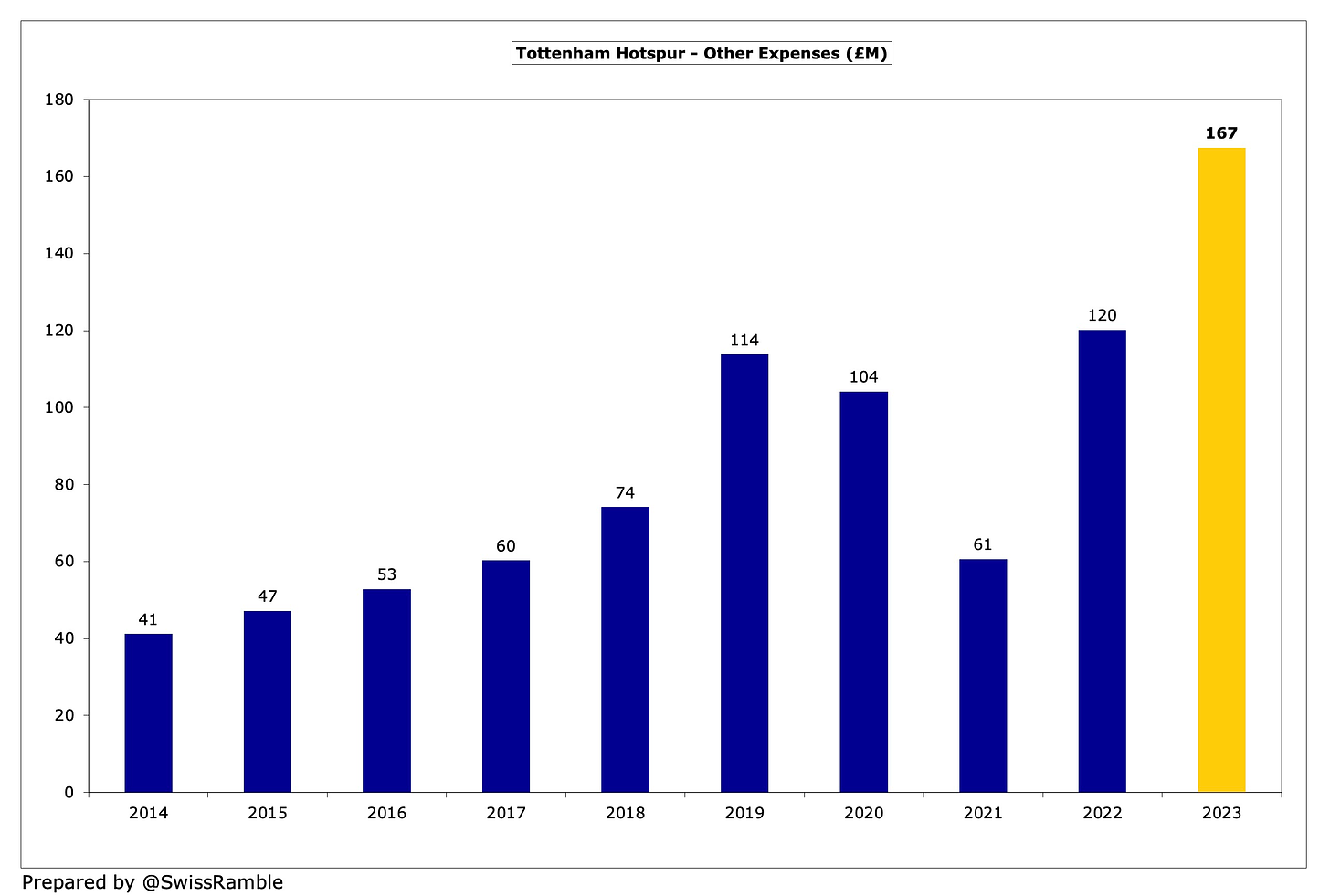

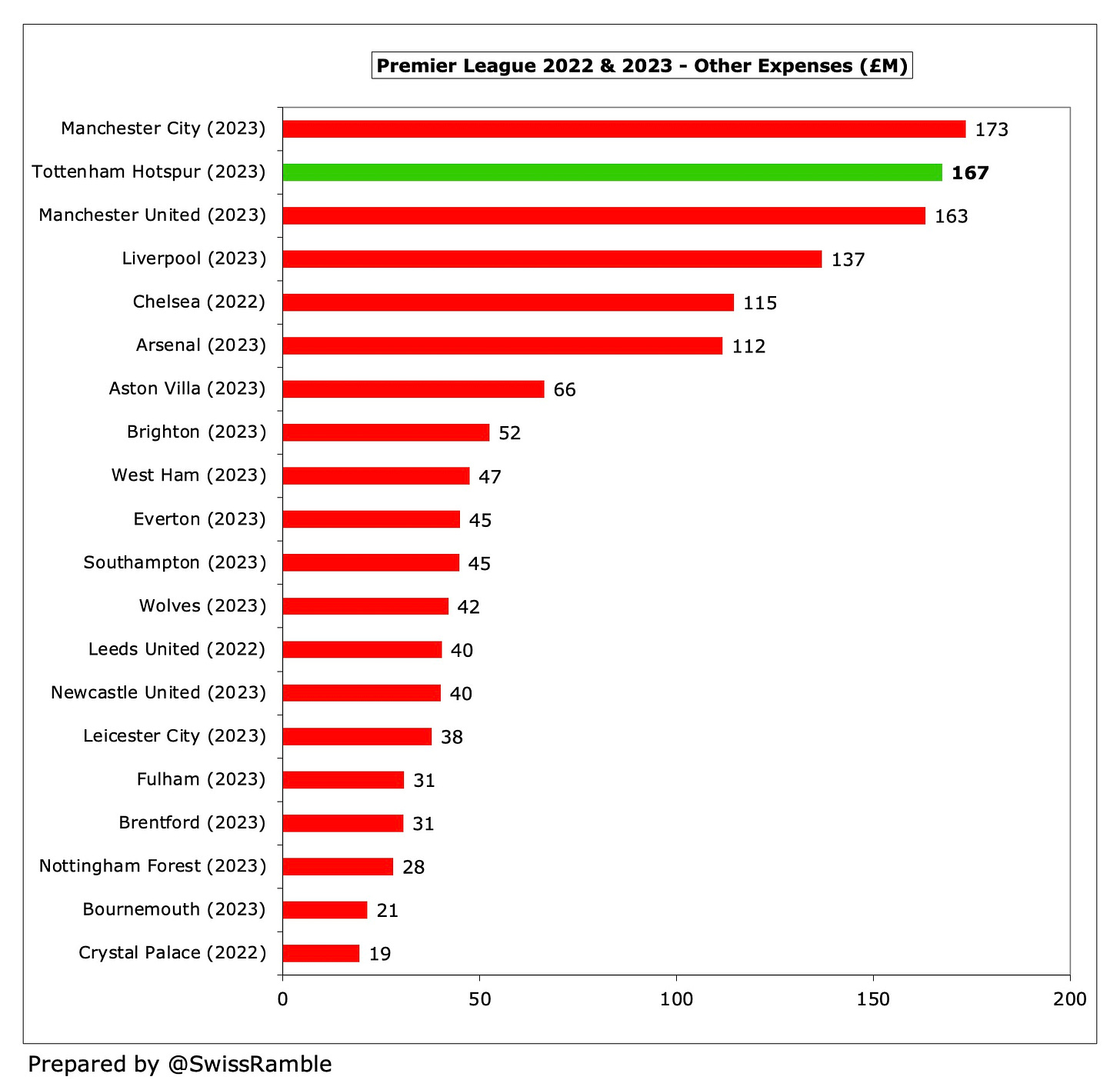

Other expenses shot up £47m (39%) from £120m to £167m, while exceptional charges increased from £1m to £5m for onerous employment contracts.

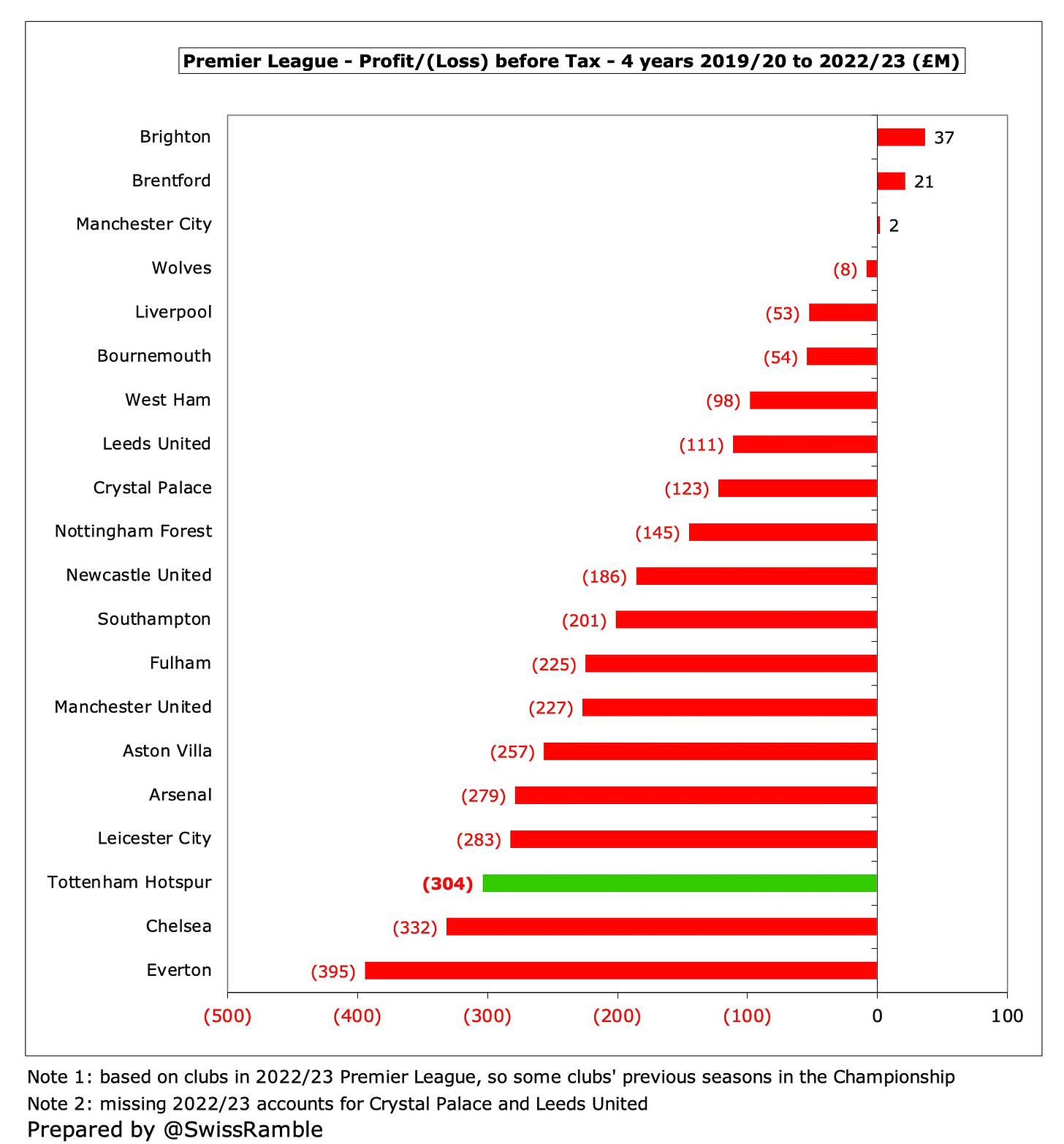

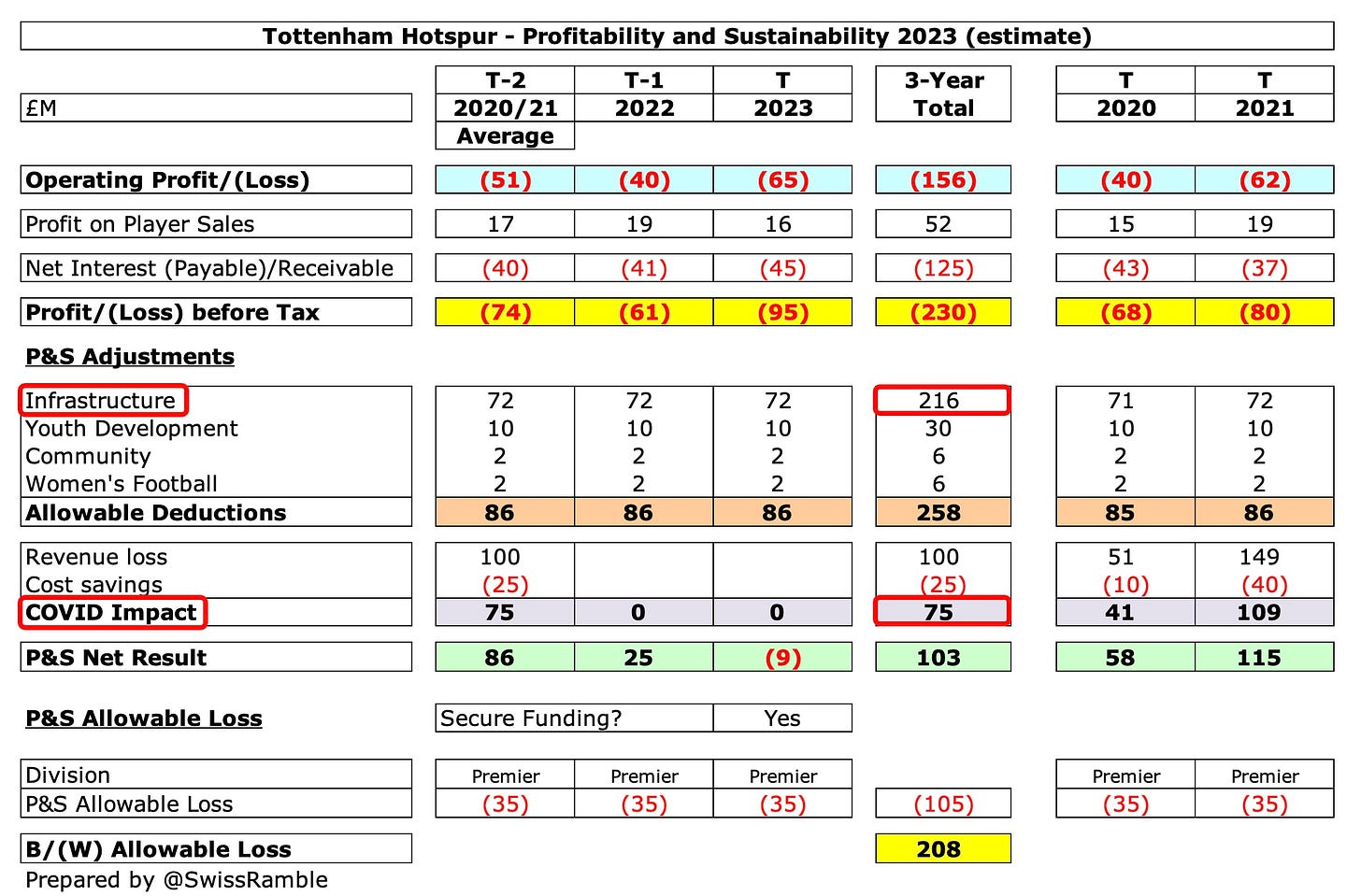

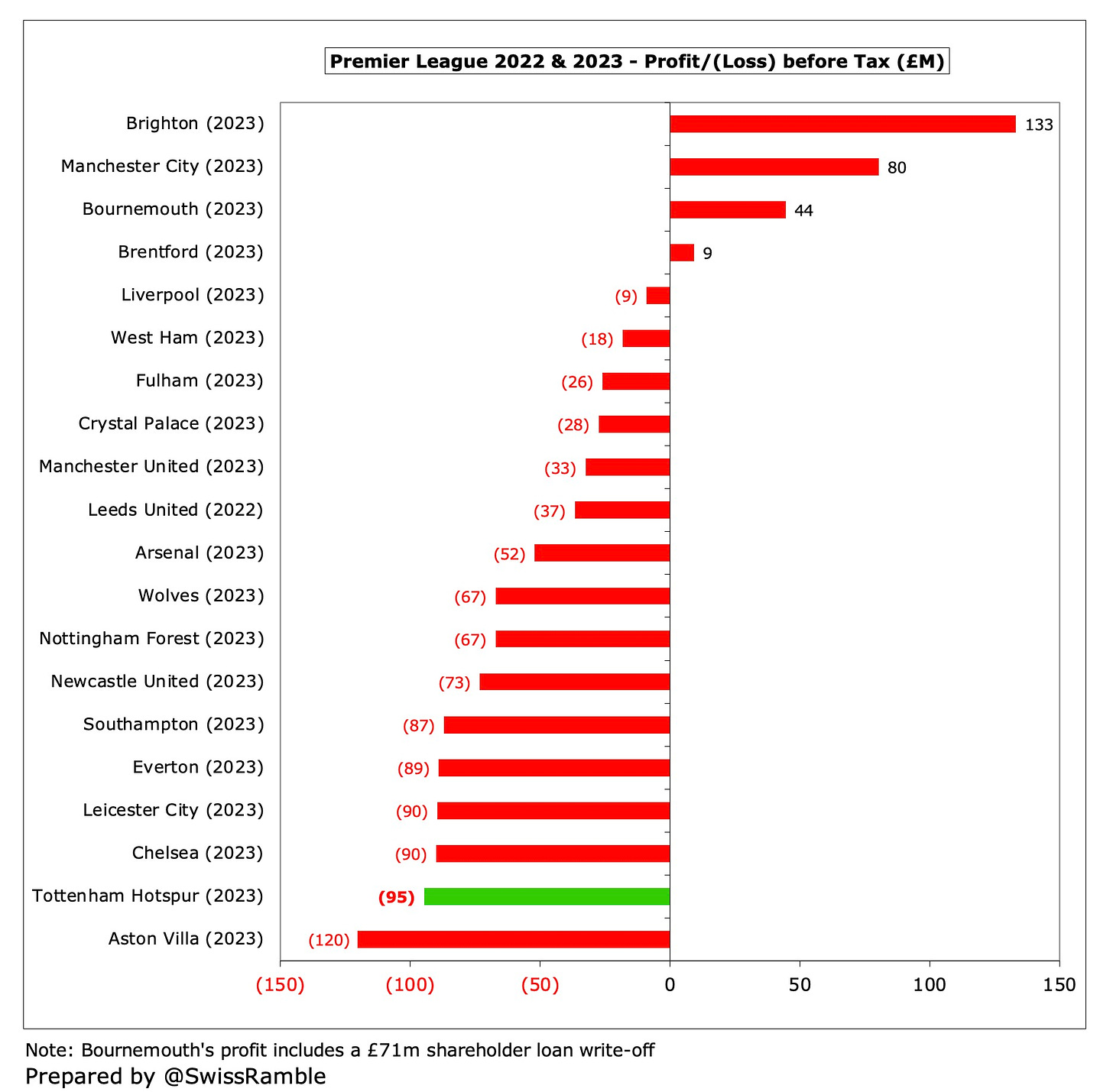

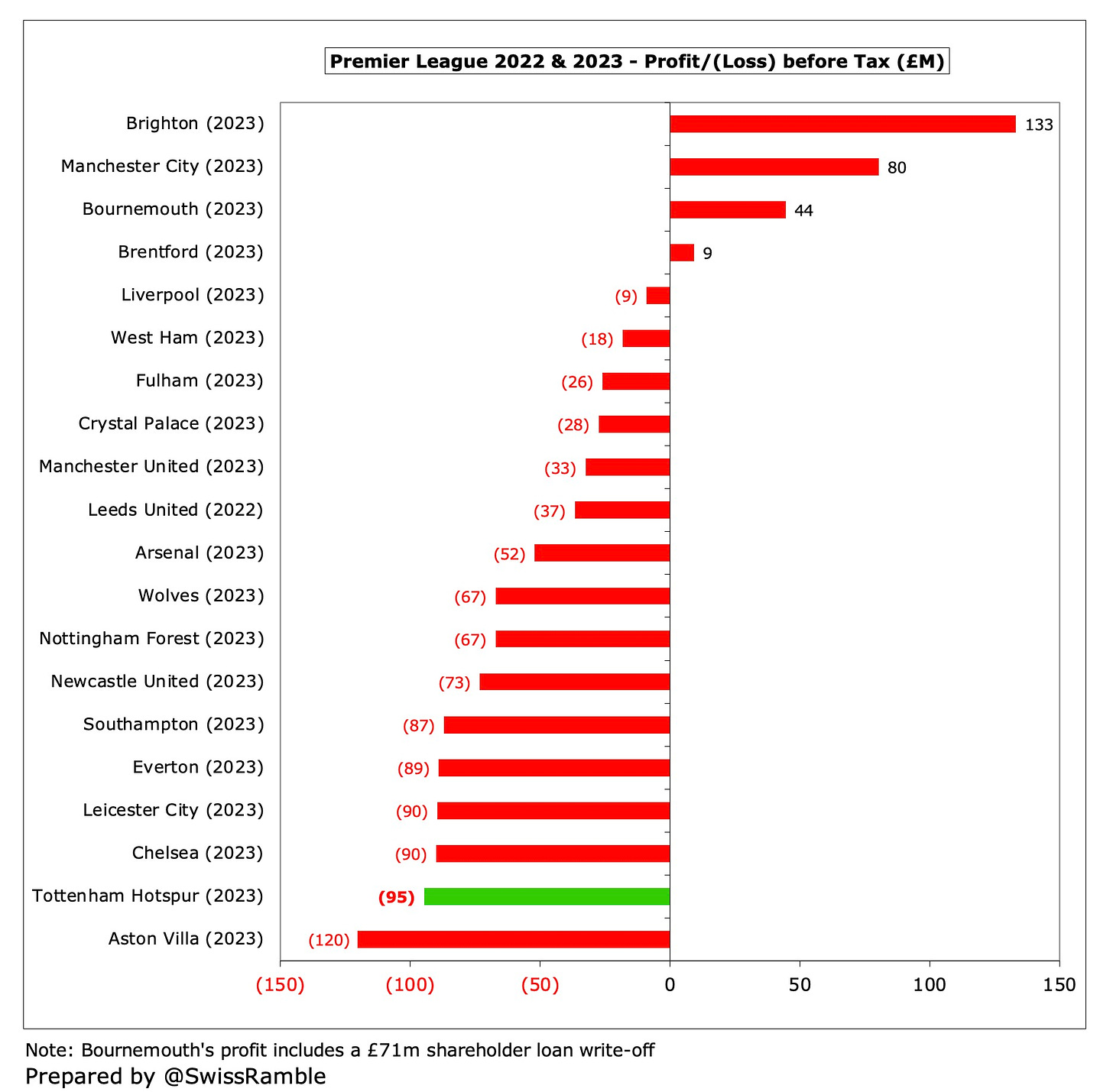

Tottenham’s £95m pre-tax loss is the second worst in the 2022/23 Premier League, only surpassed by Aston Villa’s £120m. That said, they are not alone in posting a large deficit, as half of the top flight lost more than £50m last season, including Chelsea £90m, Leicester City £90m and Everton £89m.

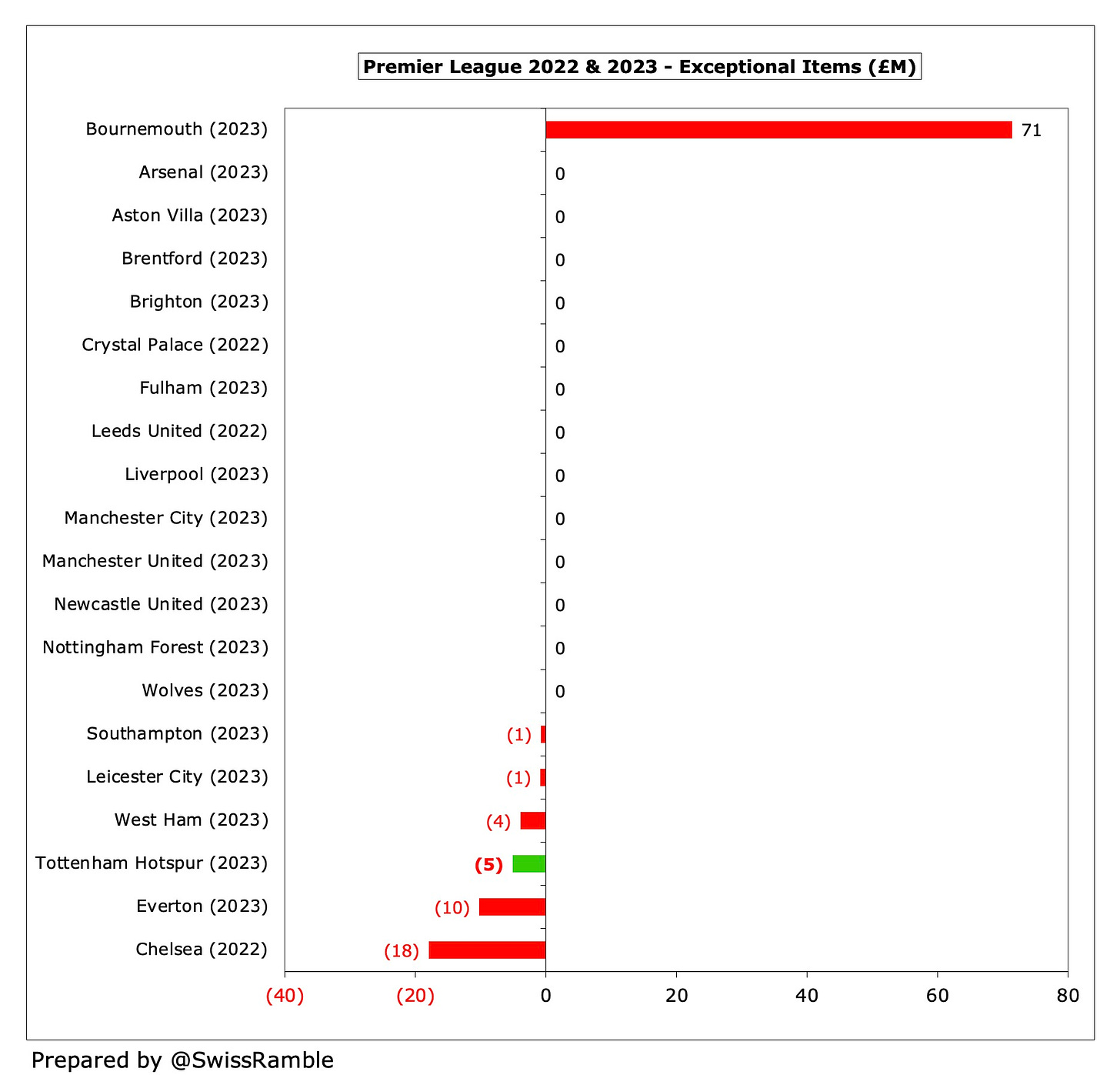

On the other hand, a few clubs did manage to generate a profit, most notably Brighton £133m and Manchester City £80m. Bournemouth also reported a £44m profit, though this would have been a £27m loss without a £71m owner loan write-off.

https://swissramble.substack.com/p/tottenham-hotspur-finances-202223

Tottenham Hotspur Finances 2022/23

That's Entertainment

Tottenham Hotspur’s 2022/23 accounts cover a season when they finished 8th in the Premier League, thus failing to qualify for Europe for the first time since 2010. However, they did reach the last 16 of the Champions League last year, before being eliminated by Milan.

The challenges on the pitch were underlined by the dismissal of head coach Antonio Conte in March 2023. The Italian was initially replaced by his assistant Cristian Stellini, but he lasted less than four weeks before Ryan Mason took over on an interim basis until the end of the season.

Ange Postecoglou was then lured from Celtic in June, after the popular Australian manager had won the domestic treble in Scotland.

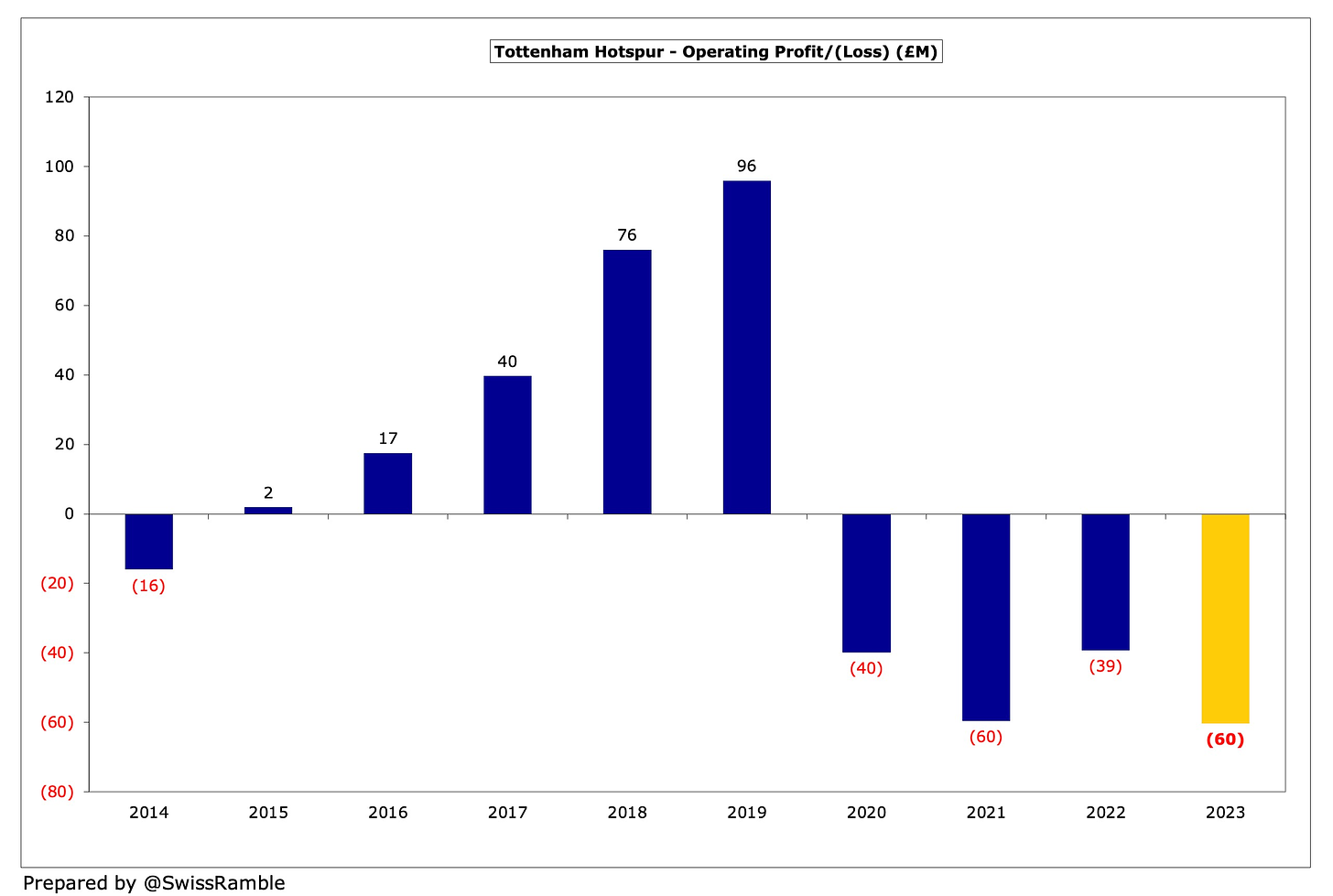

Profit/(Loss) 2022/23

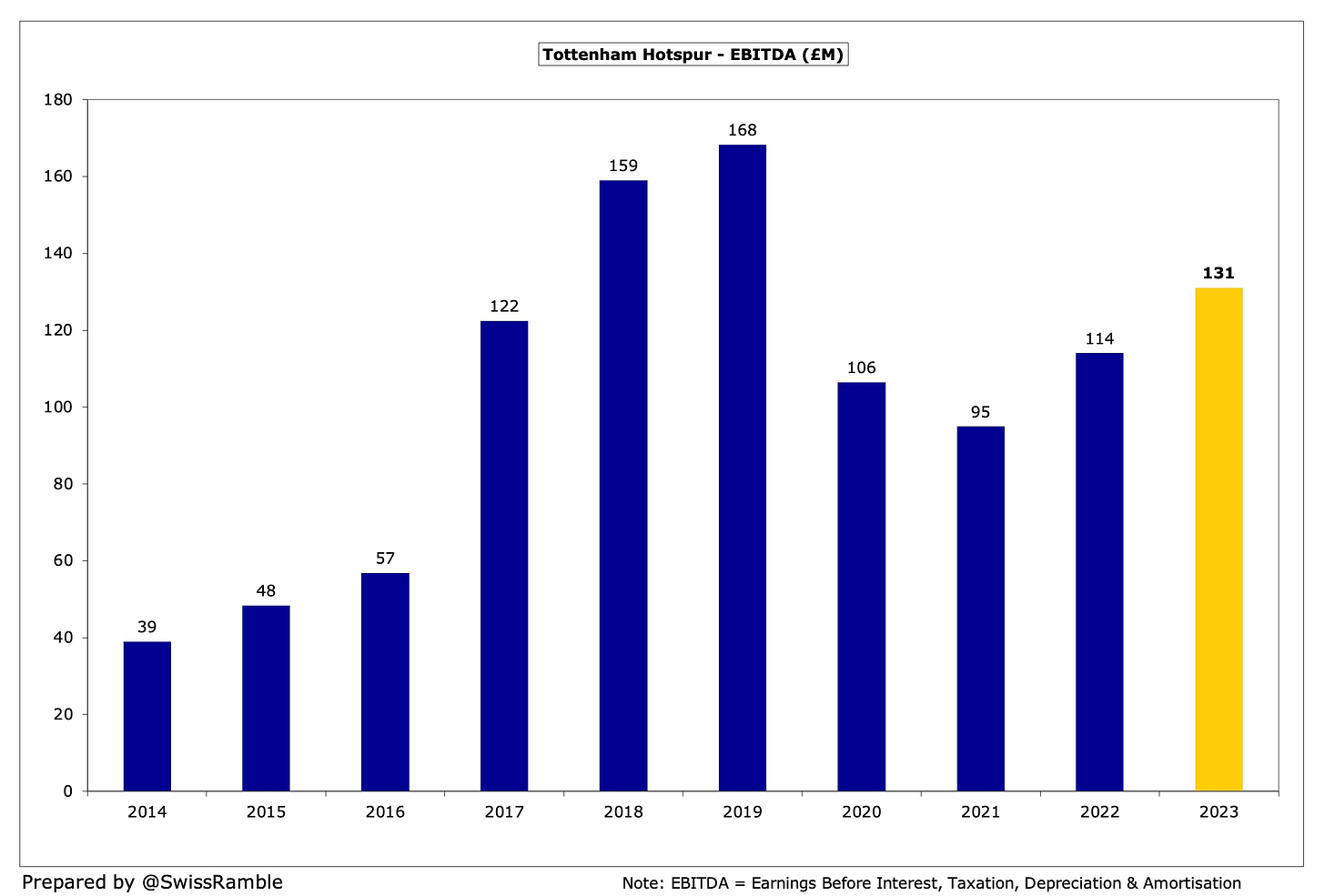

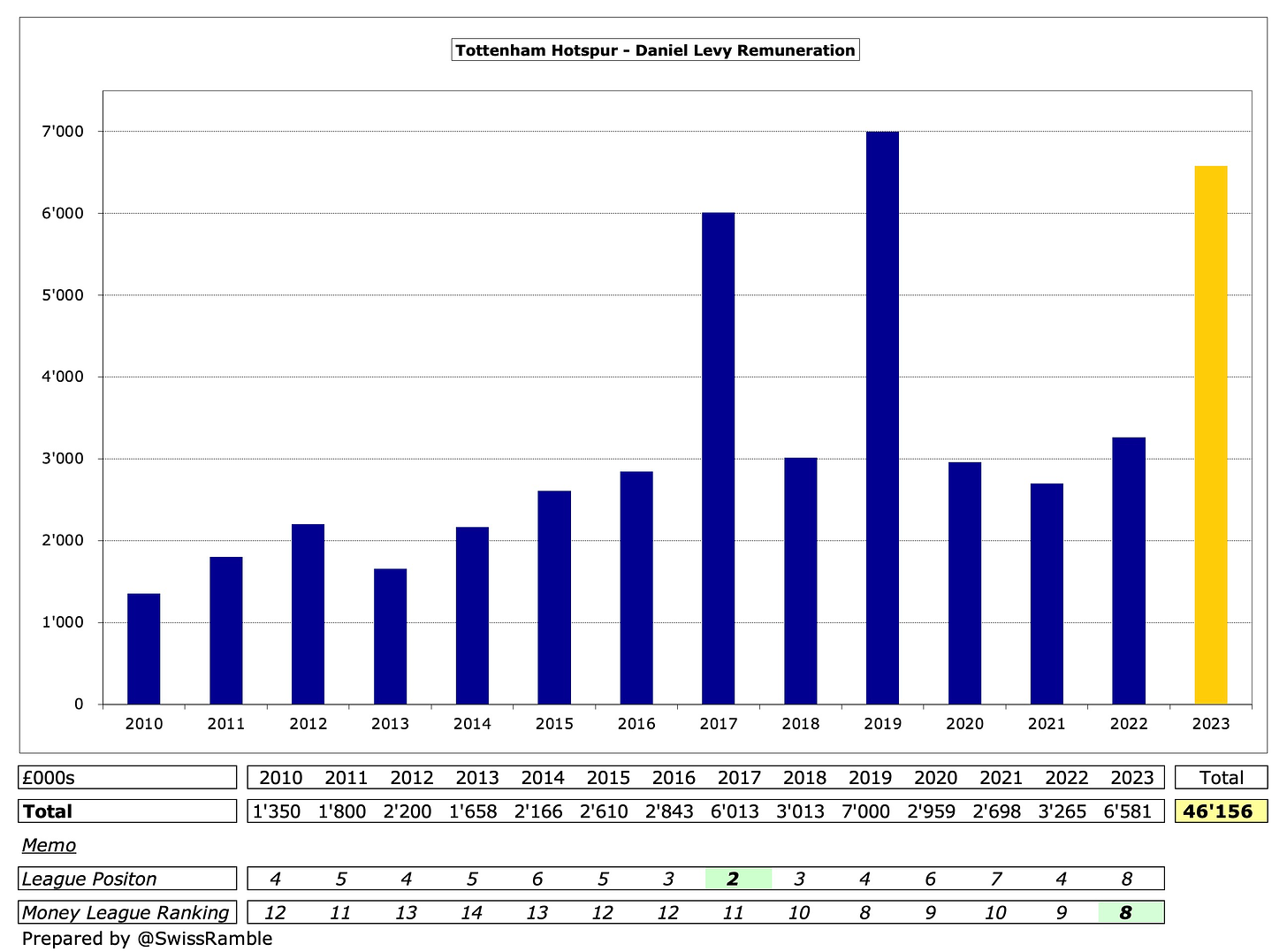

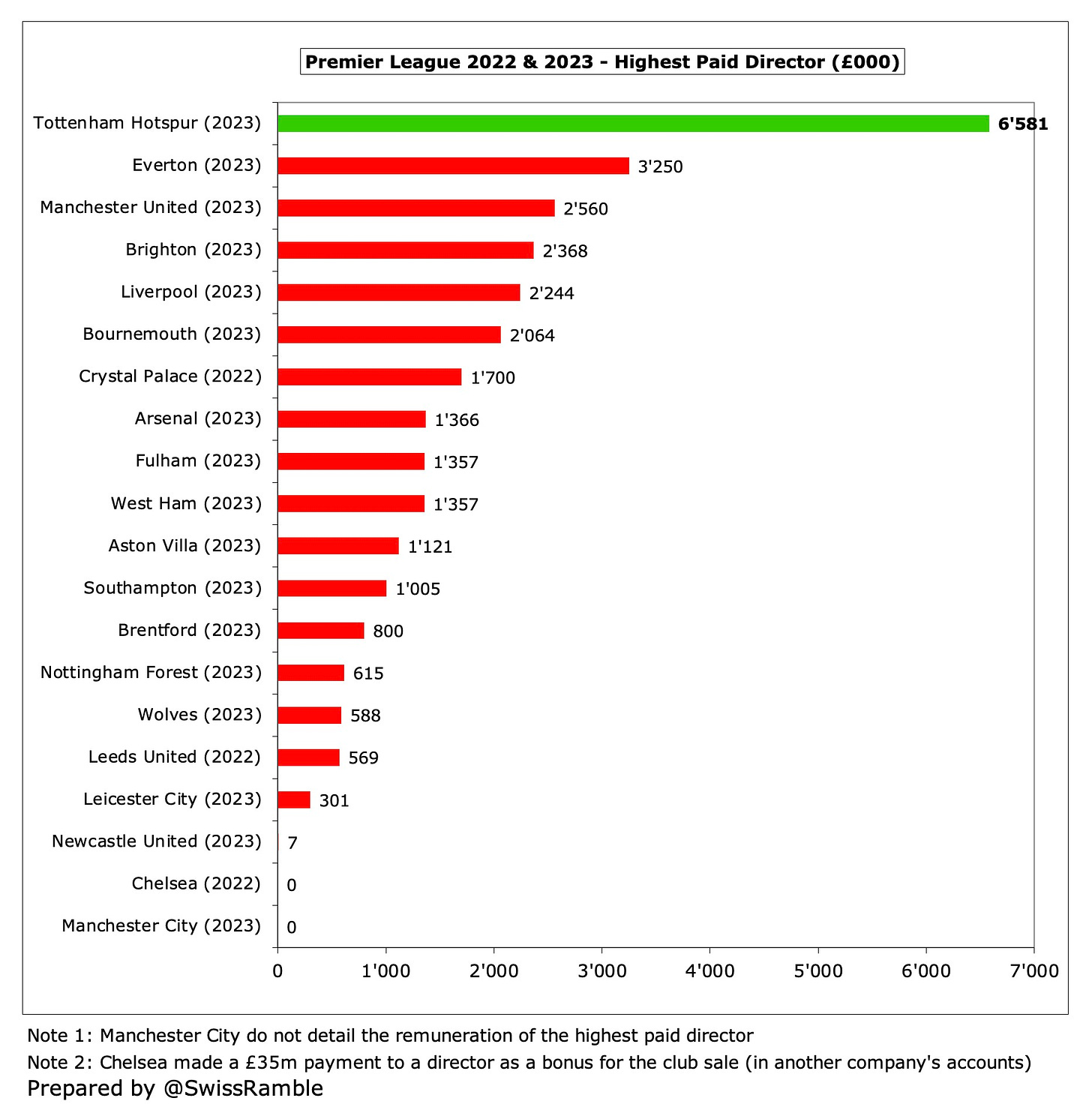

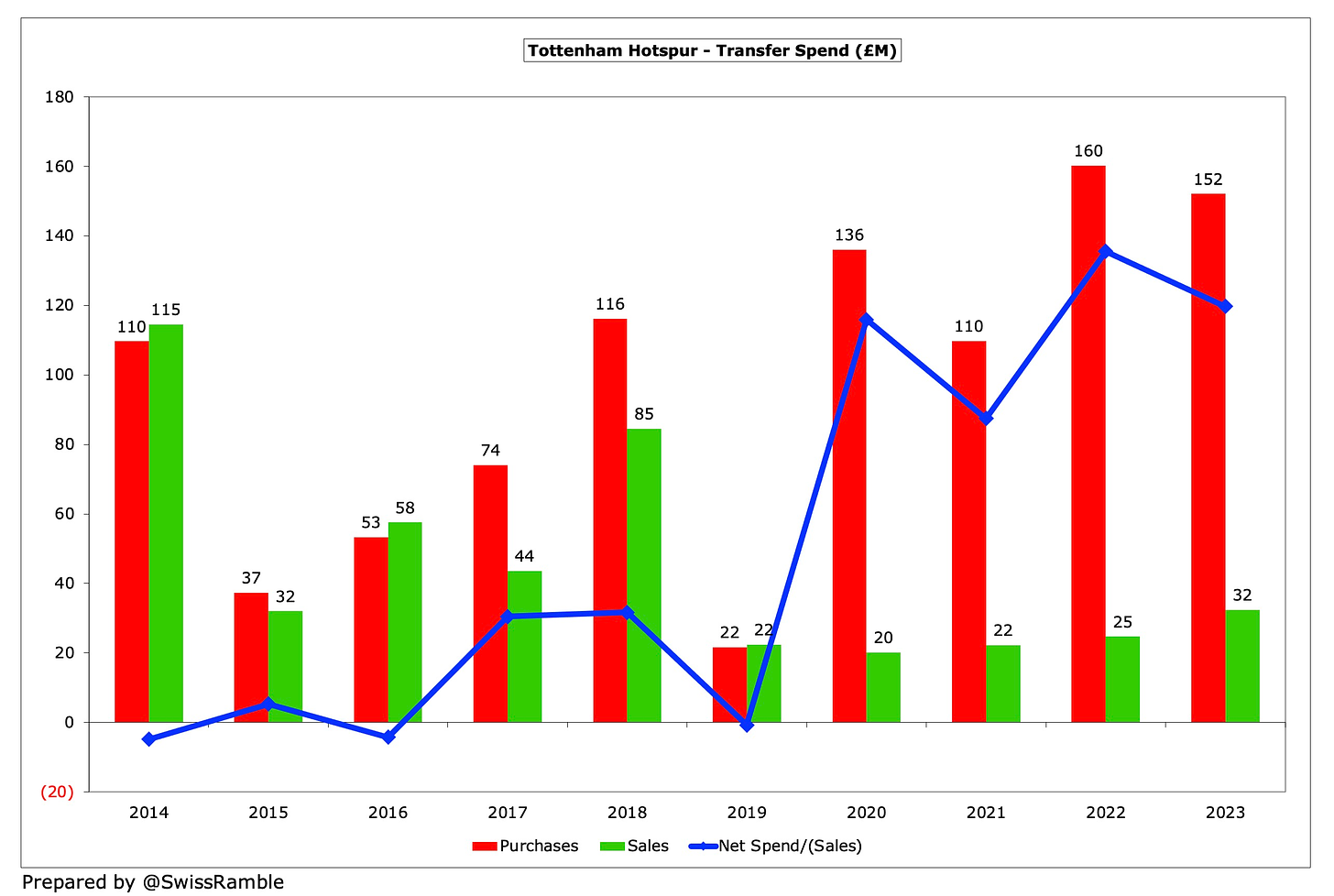

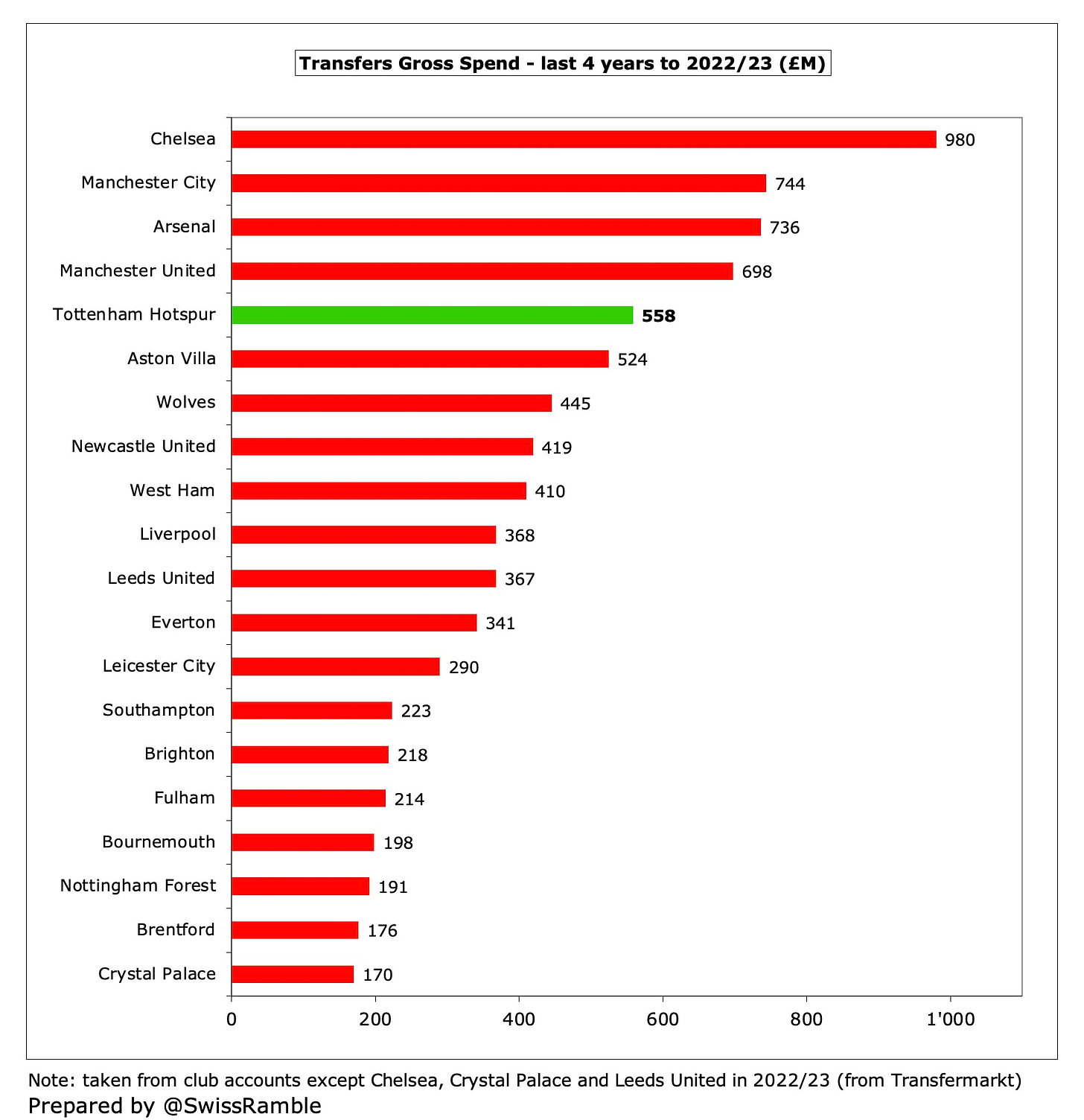

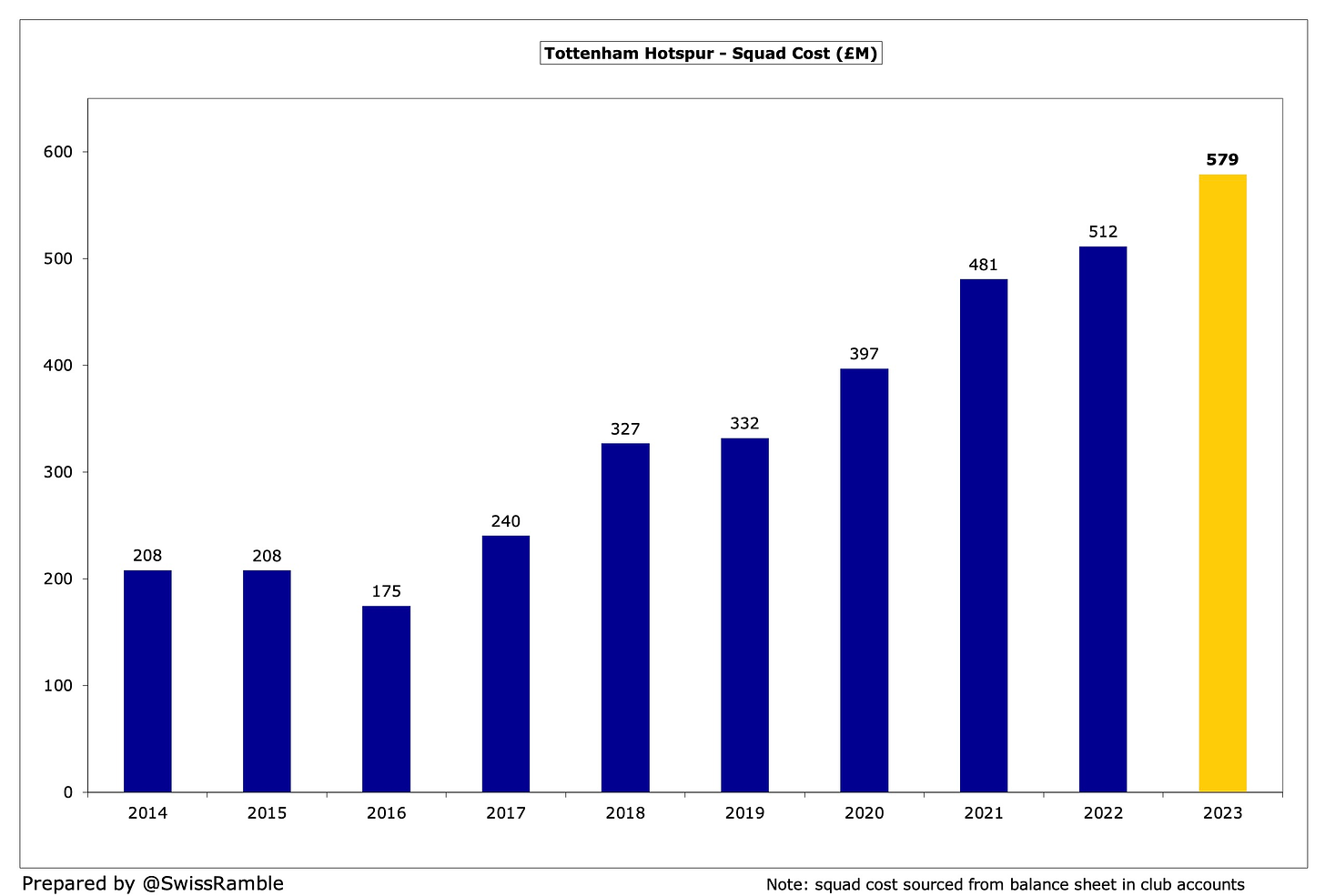

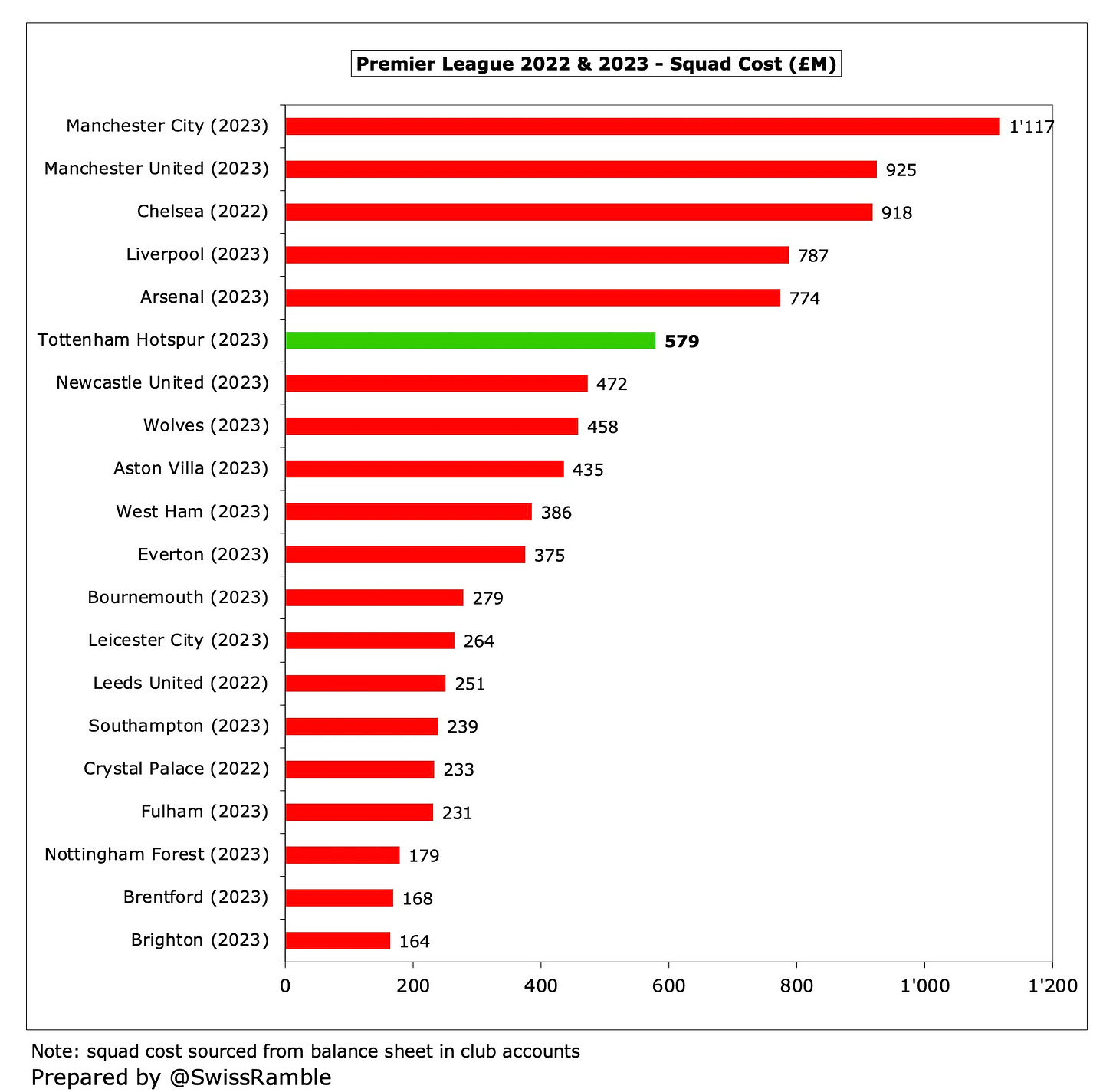

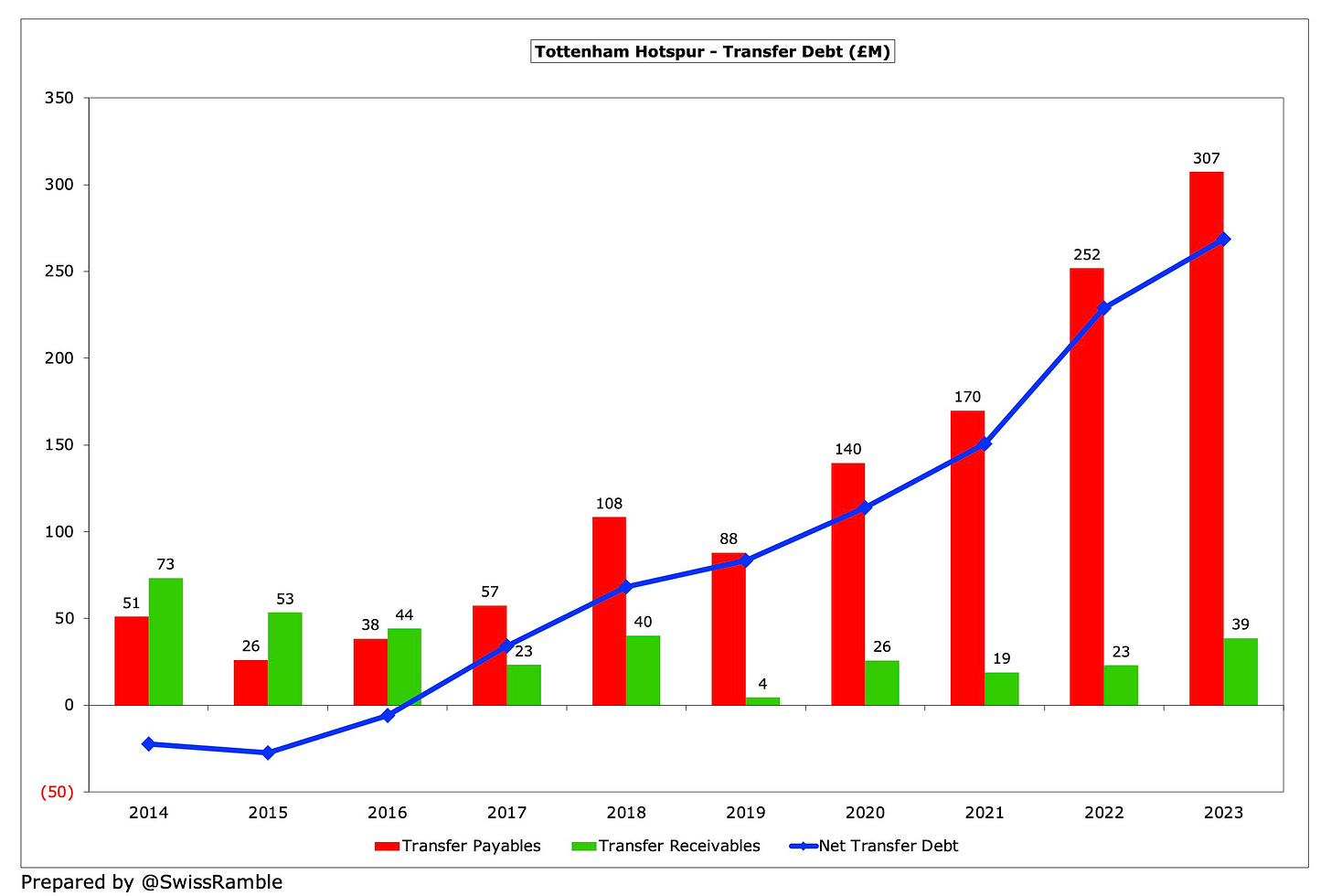

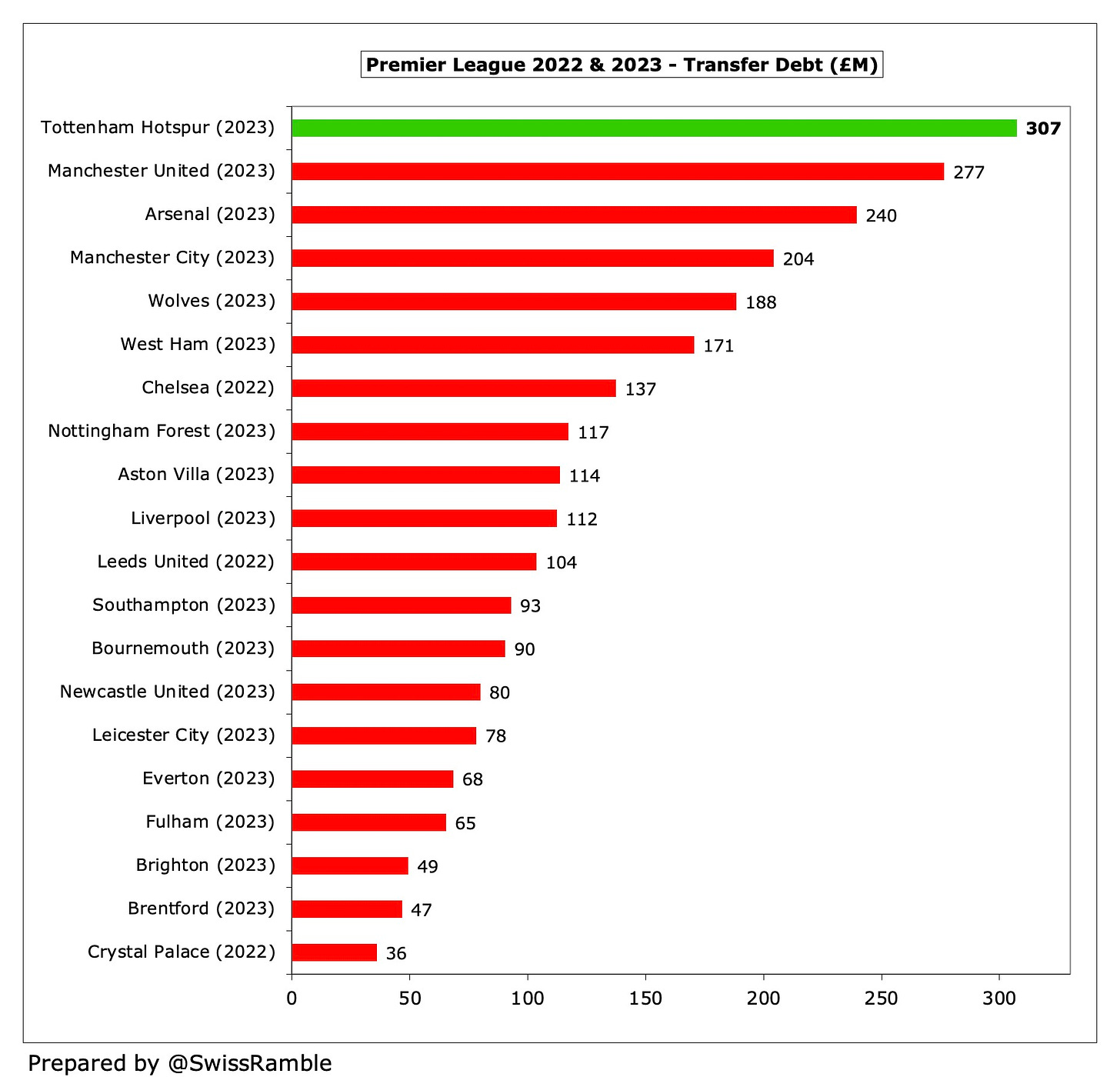

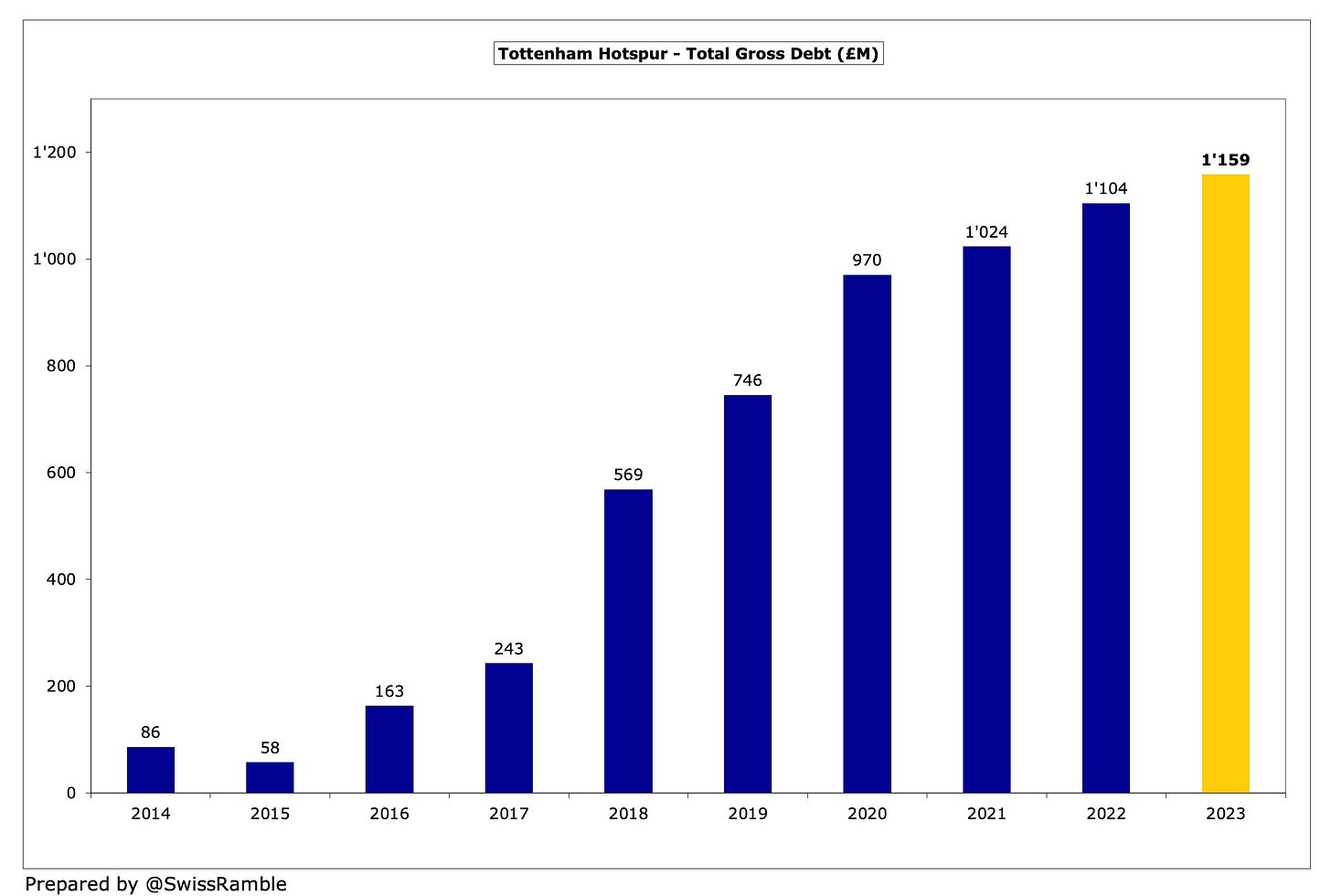

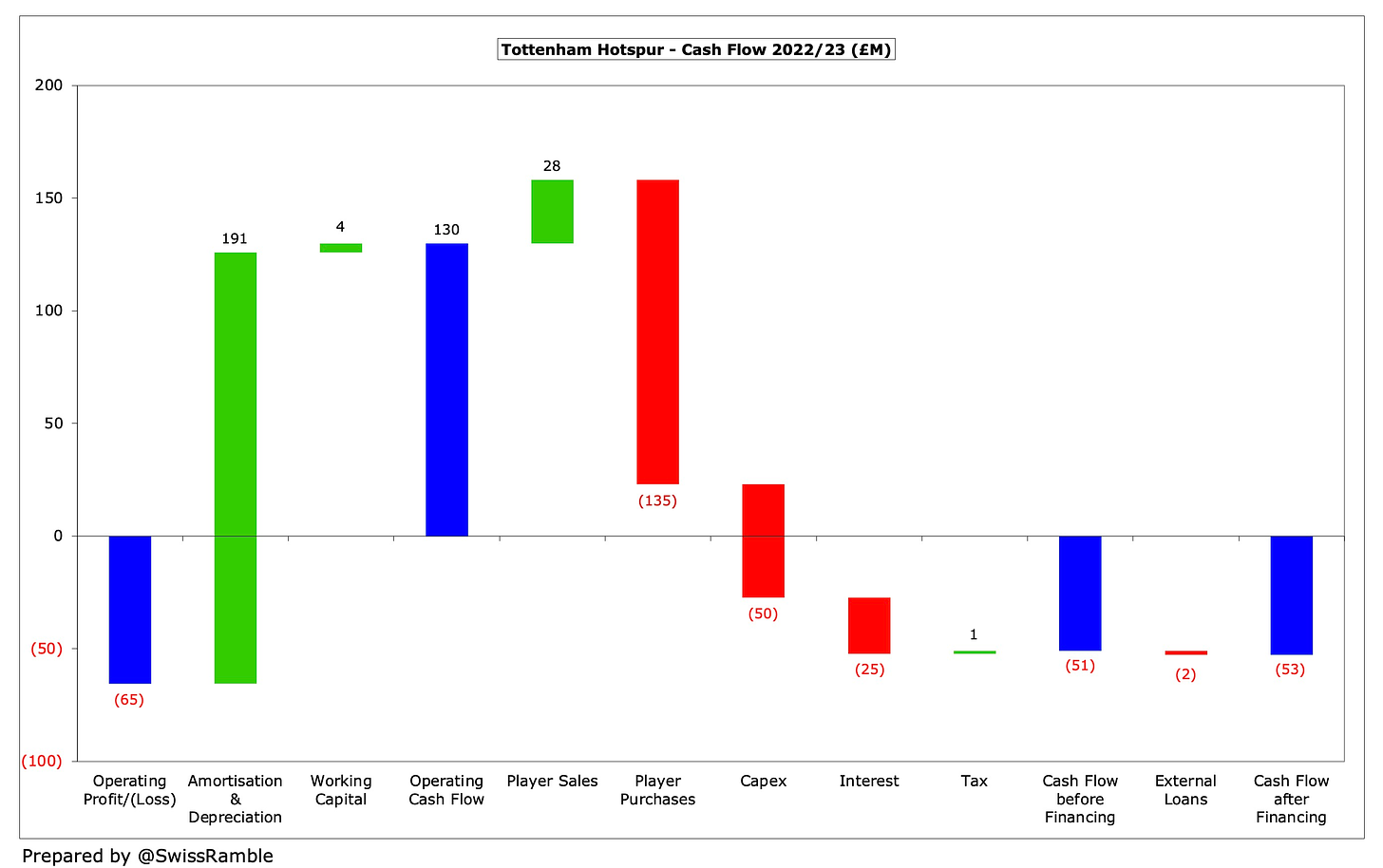

Tottenham’s pre-tax loss increased by more than 50% from £61m to £95m, which chairman Daniel Levy said was a reflection of “significant and continued investment in the playing squad.”Revenue rose £107m (24%) from £443m to £550m, which was a new club record, breaking through the half a billion pounds barrier for the first time. This was predominately due to participation in the Champions League and hosting major events at the Tottenham Hotspur Stadium.

However, the revenue growth was wiped out by a substantial increase in operating expenses, which were up £132m (27%) from £483m to £615m, while profit from player sales dropped from £19m to £16m.

In addition, net interest payable increased by £4m (10%) from £41m to £45m. It’s worth noting that this substantial charge contributed almost half of the club’s £95m pre-tax loss.

The loss after tax was a bit smaller at £87m, thanks to an £8m tax credit, though this was also a lot higher than the prior year’s £50m.

There were two main reasons for Tottenham’s revenue growth.

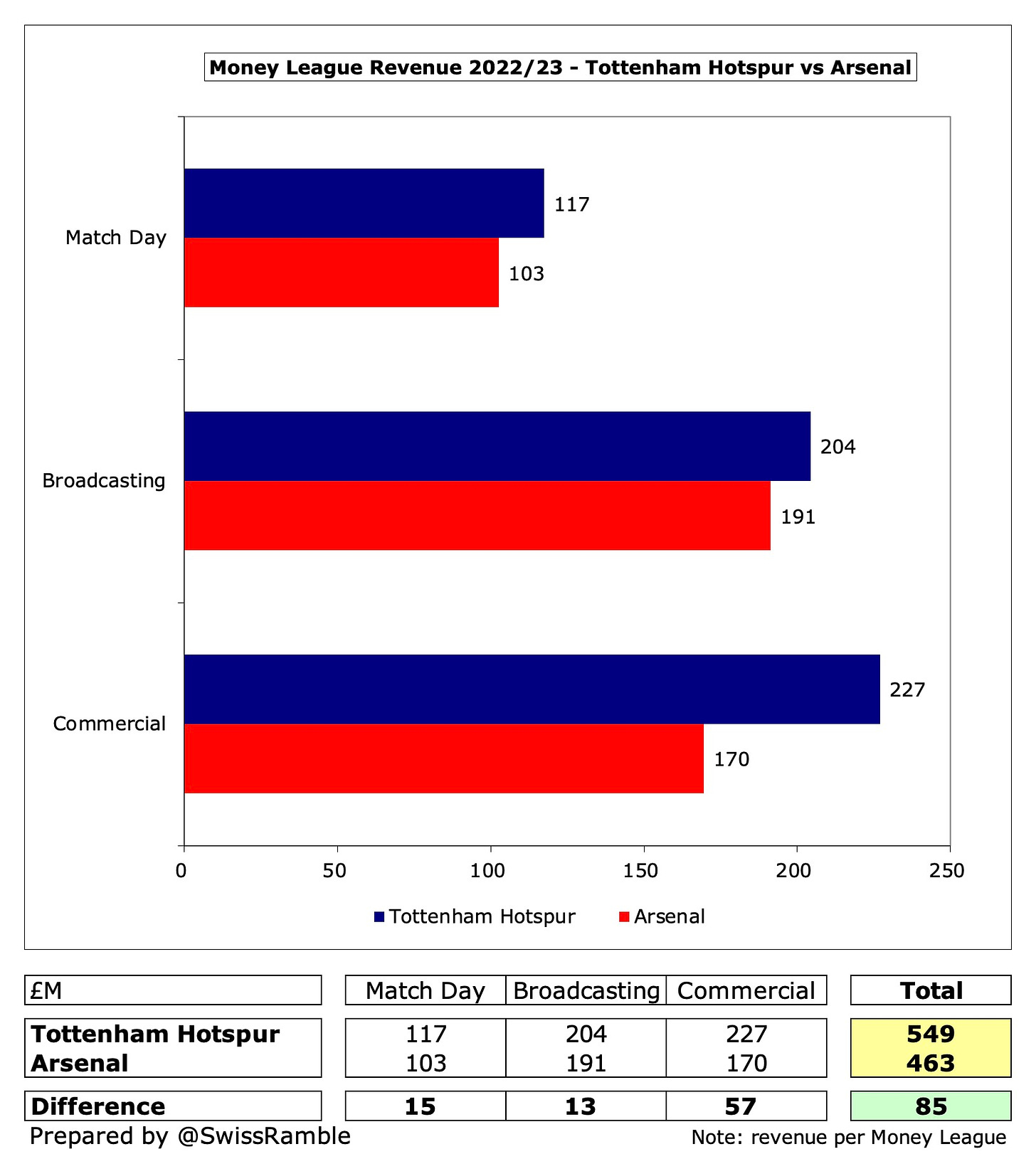

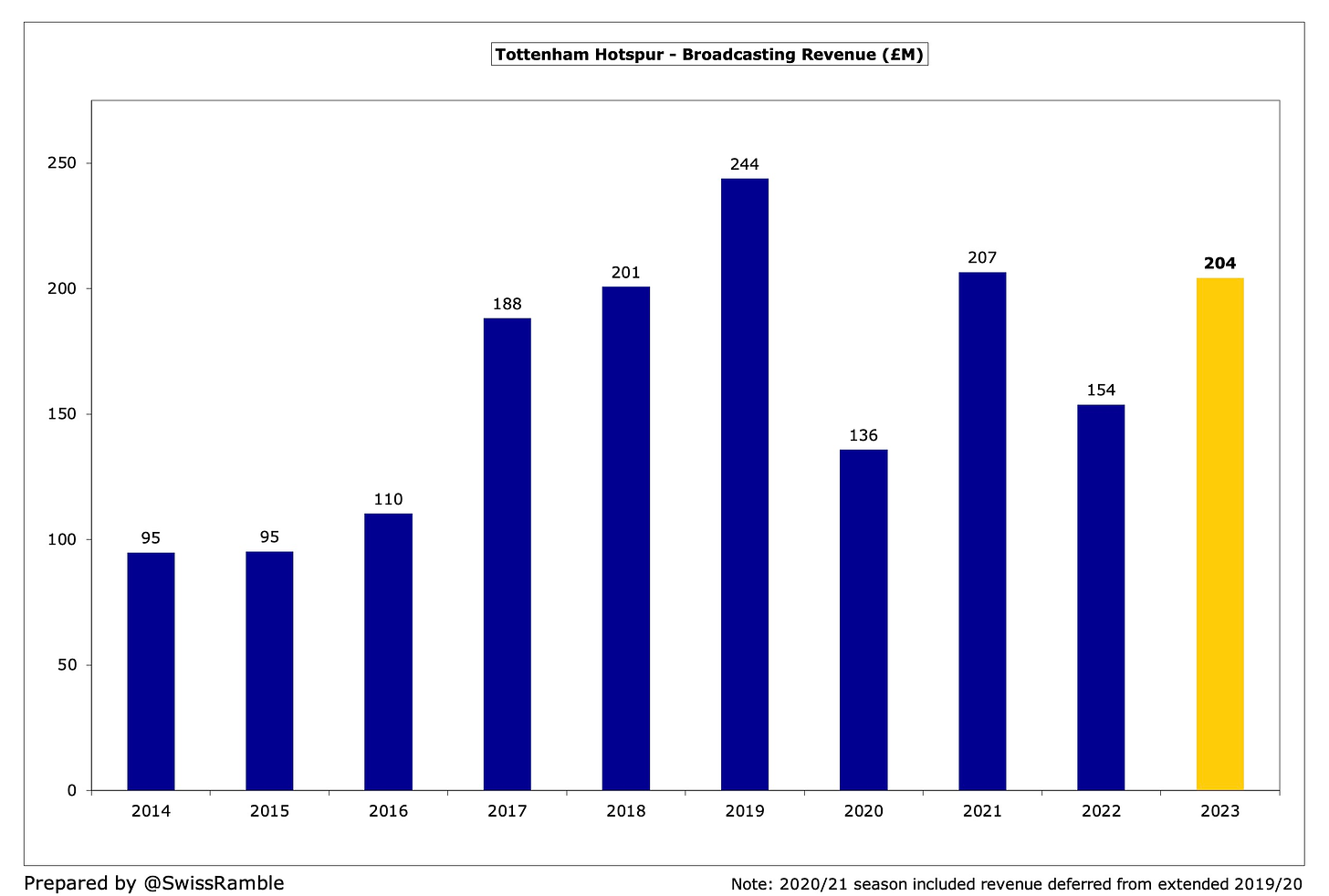

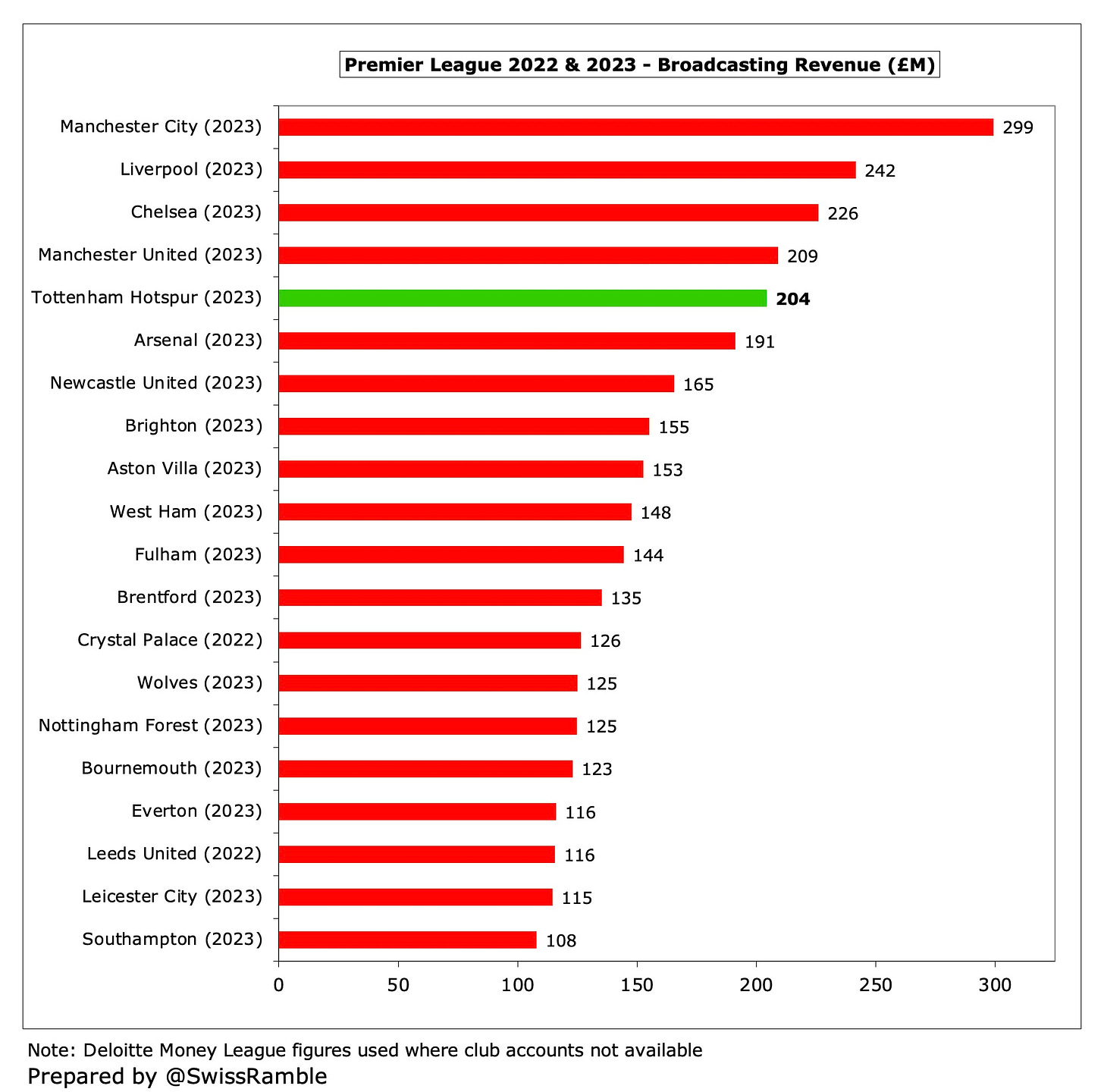

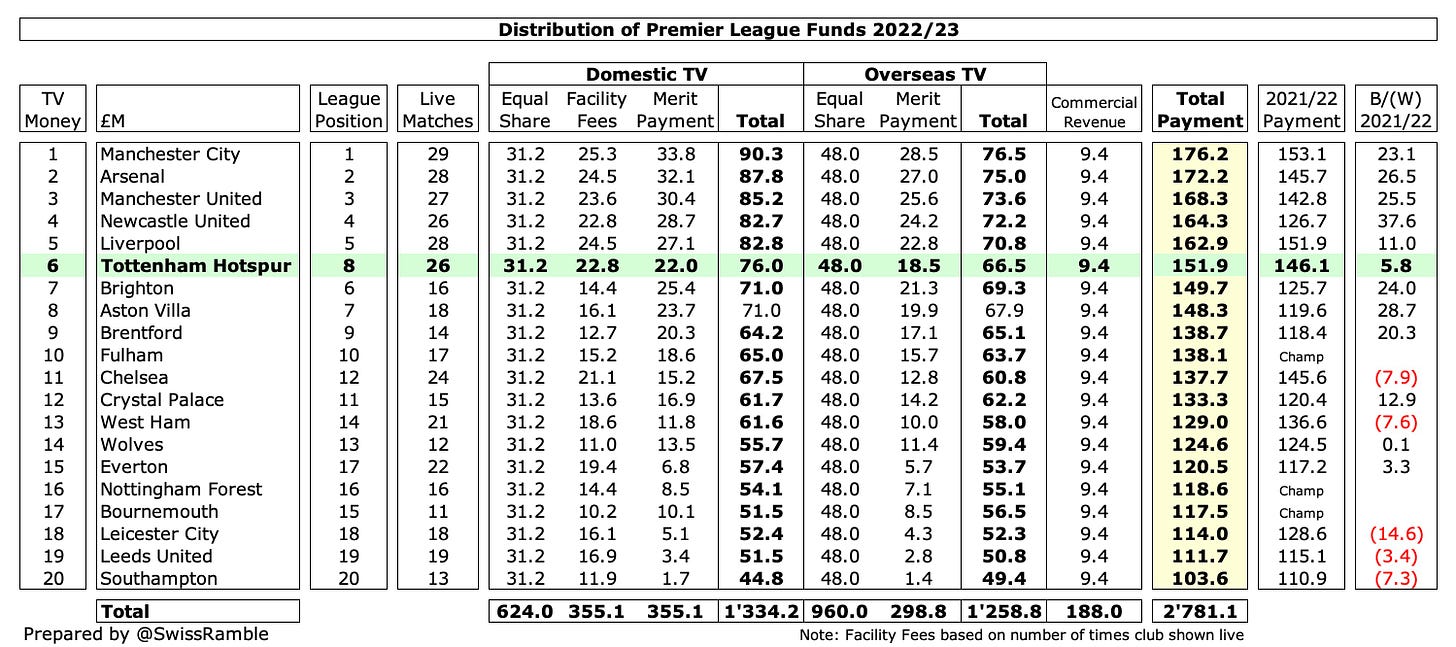

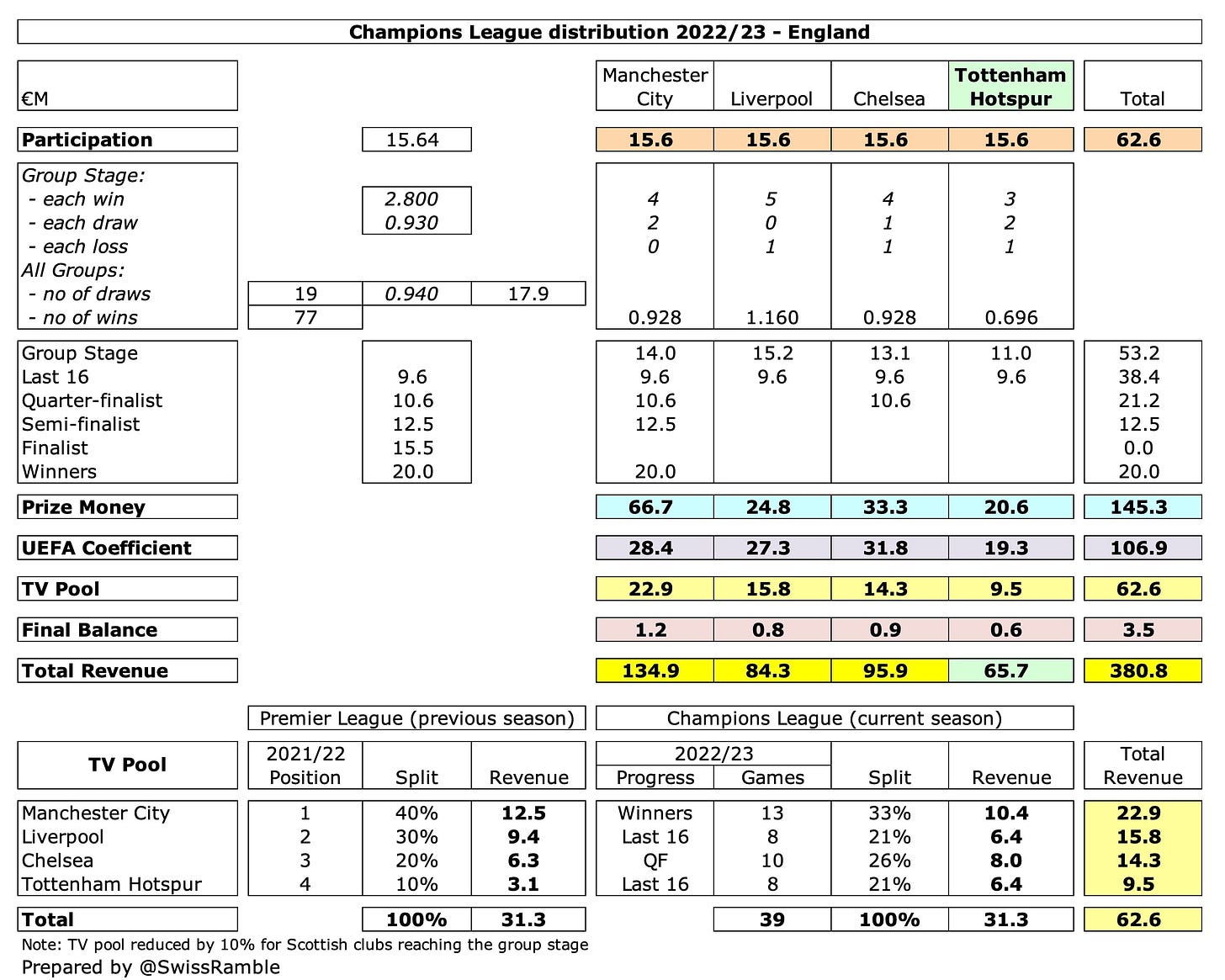

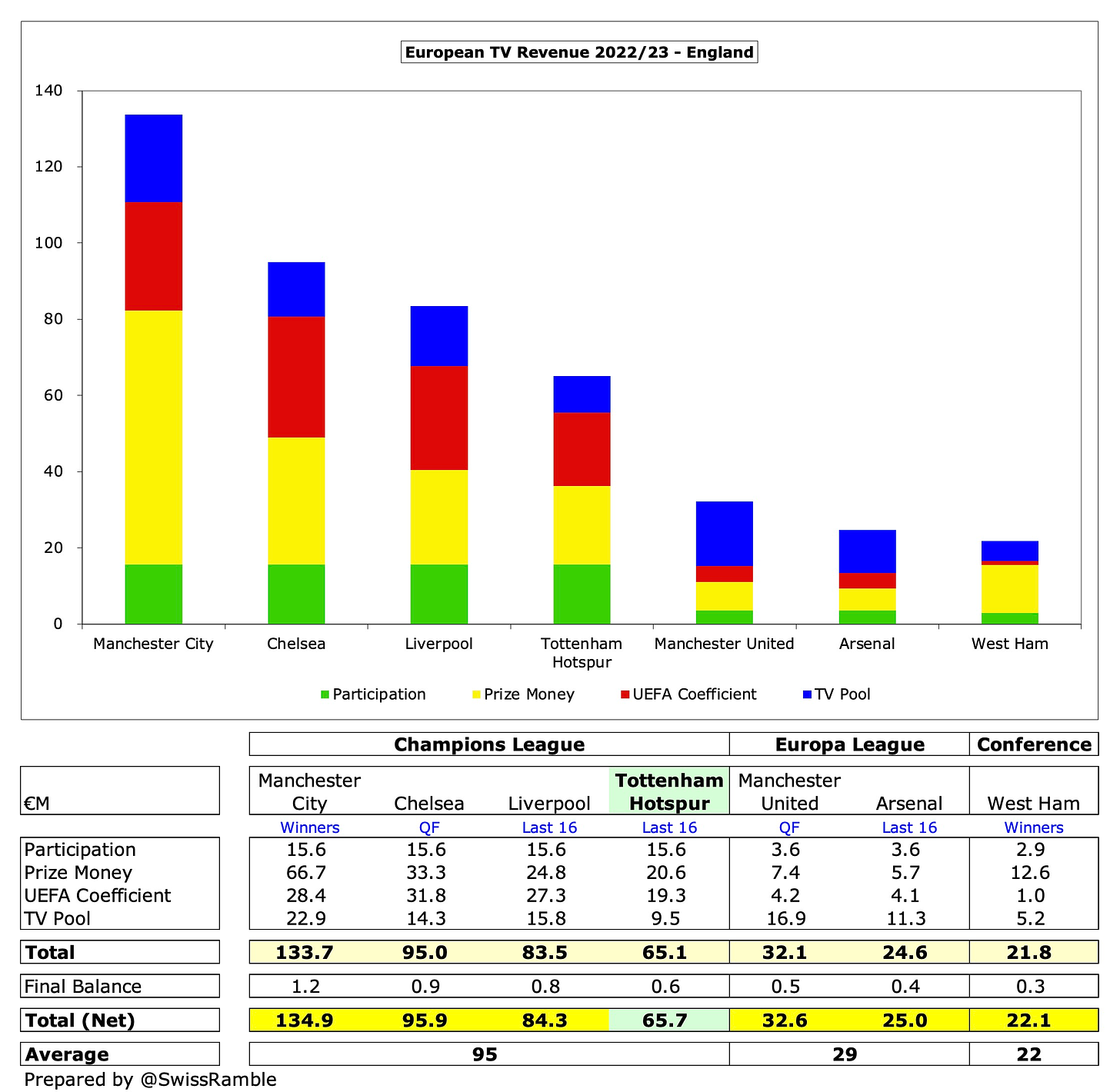

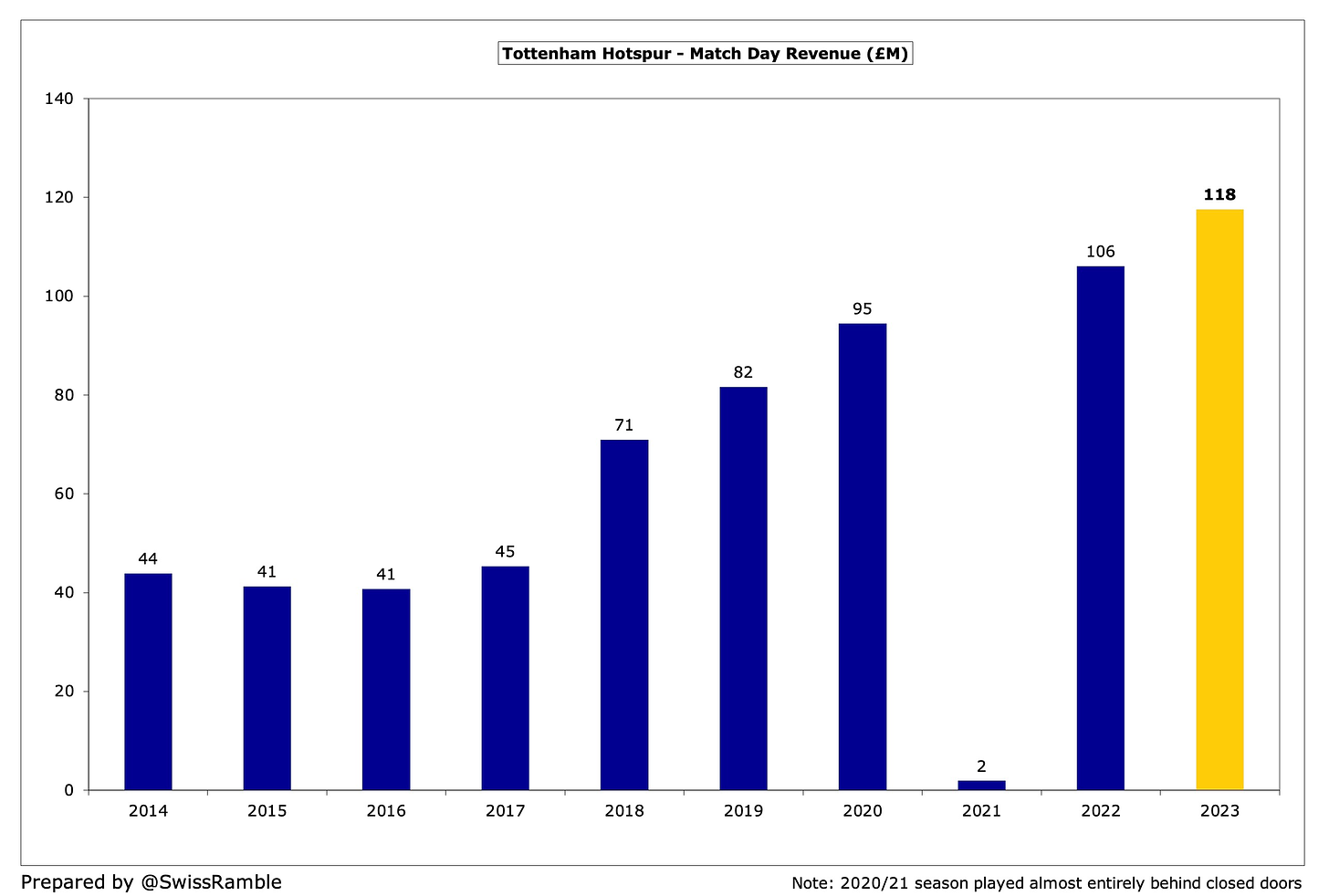

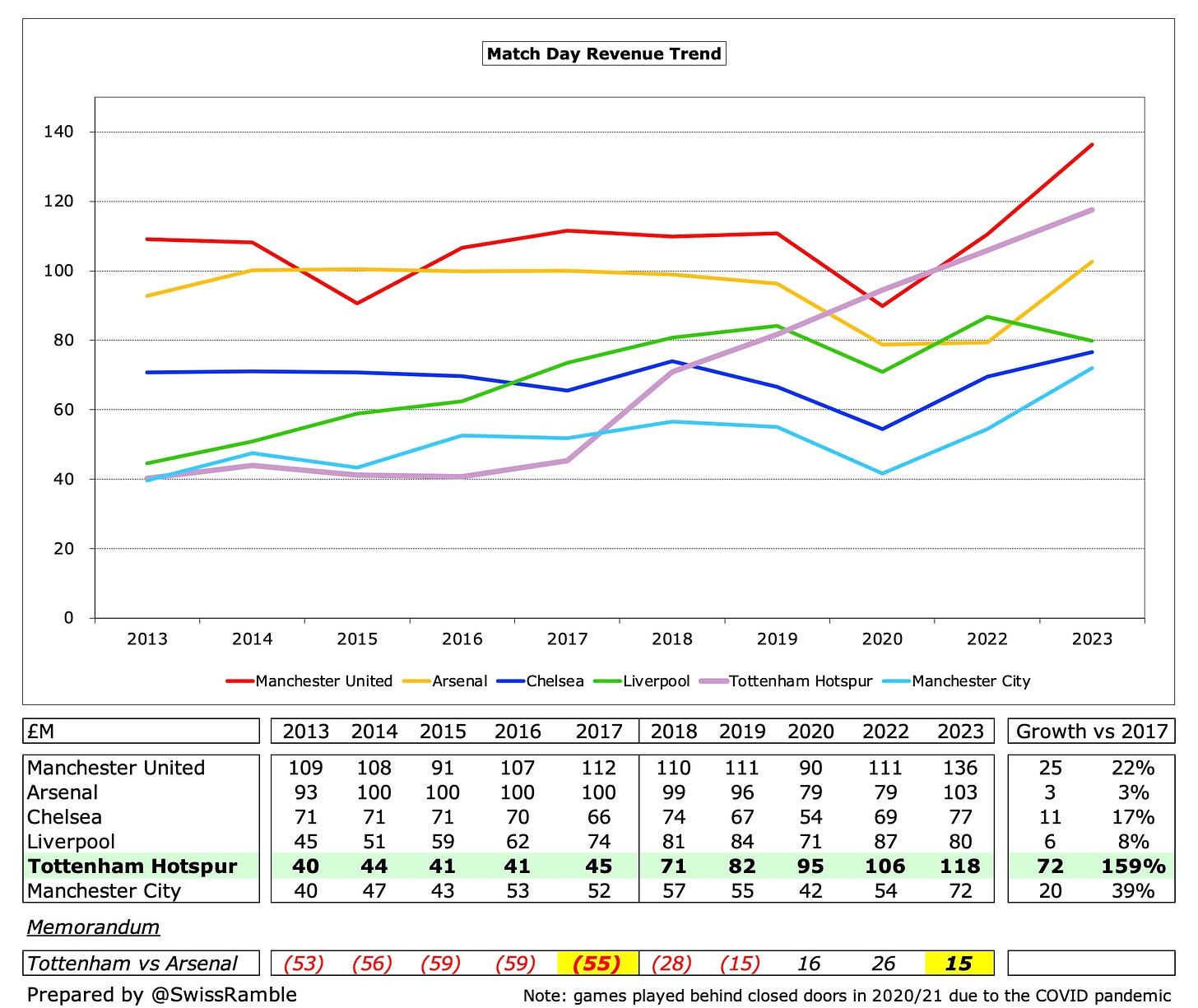

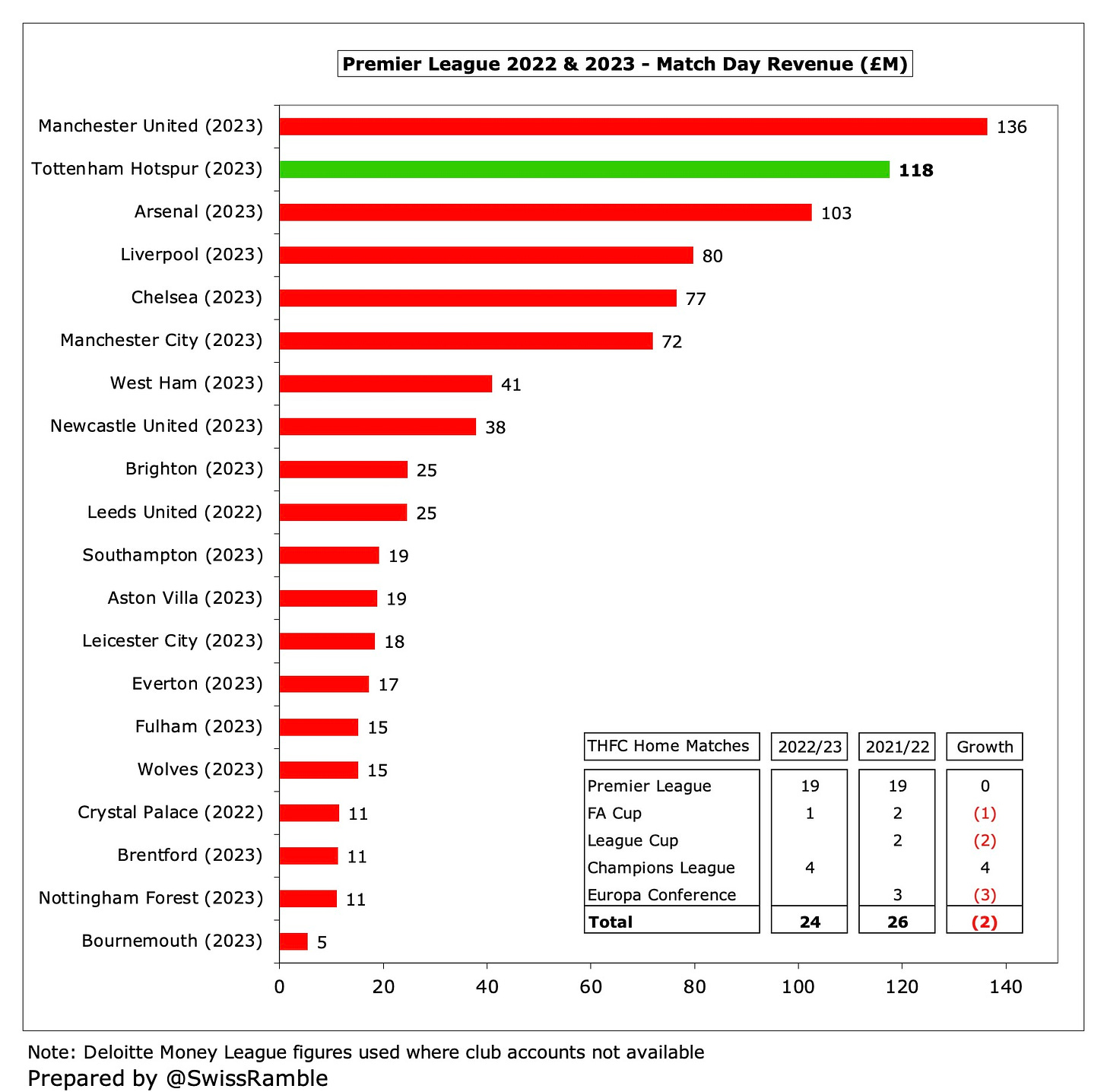

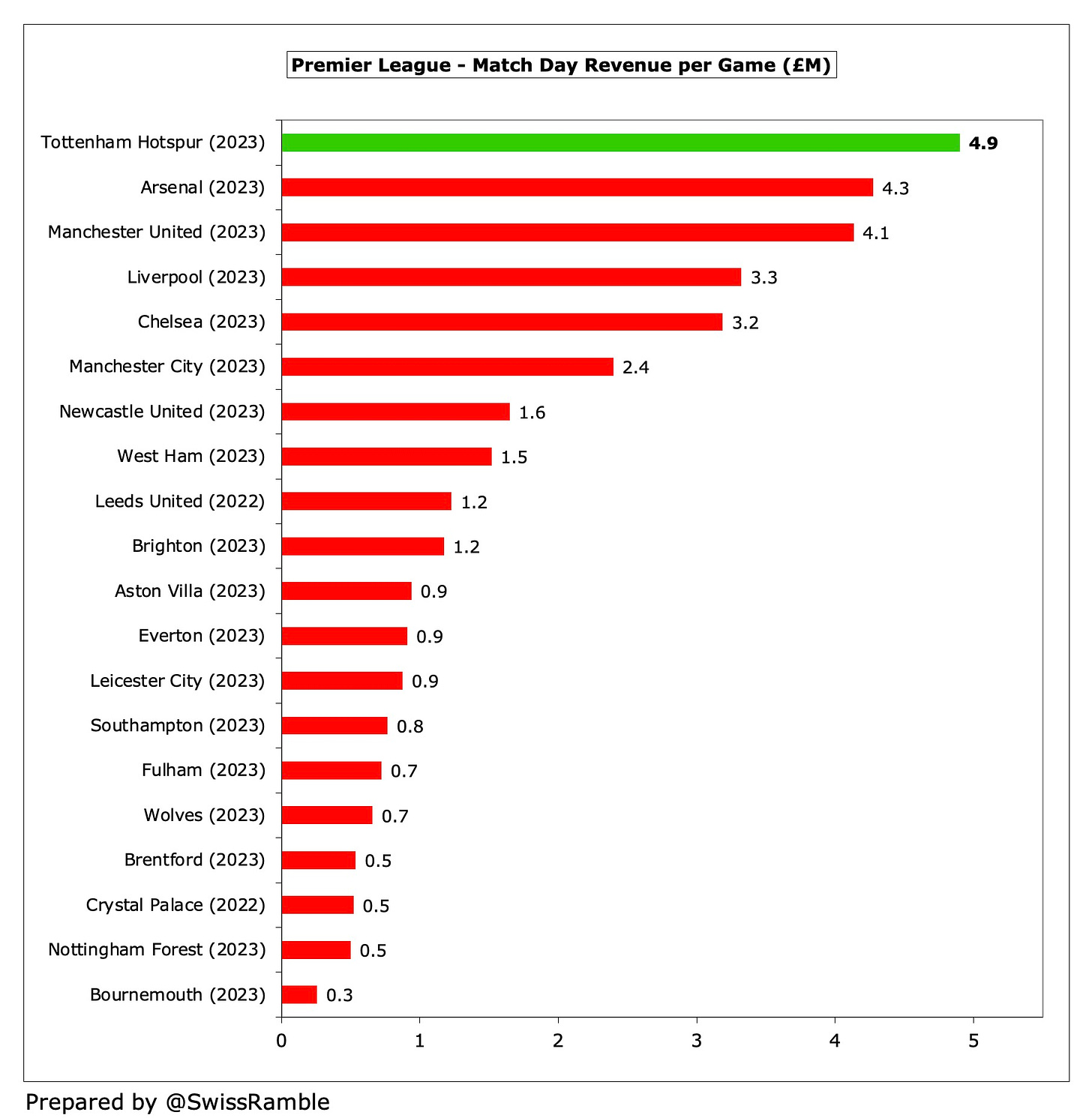

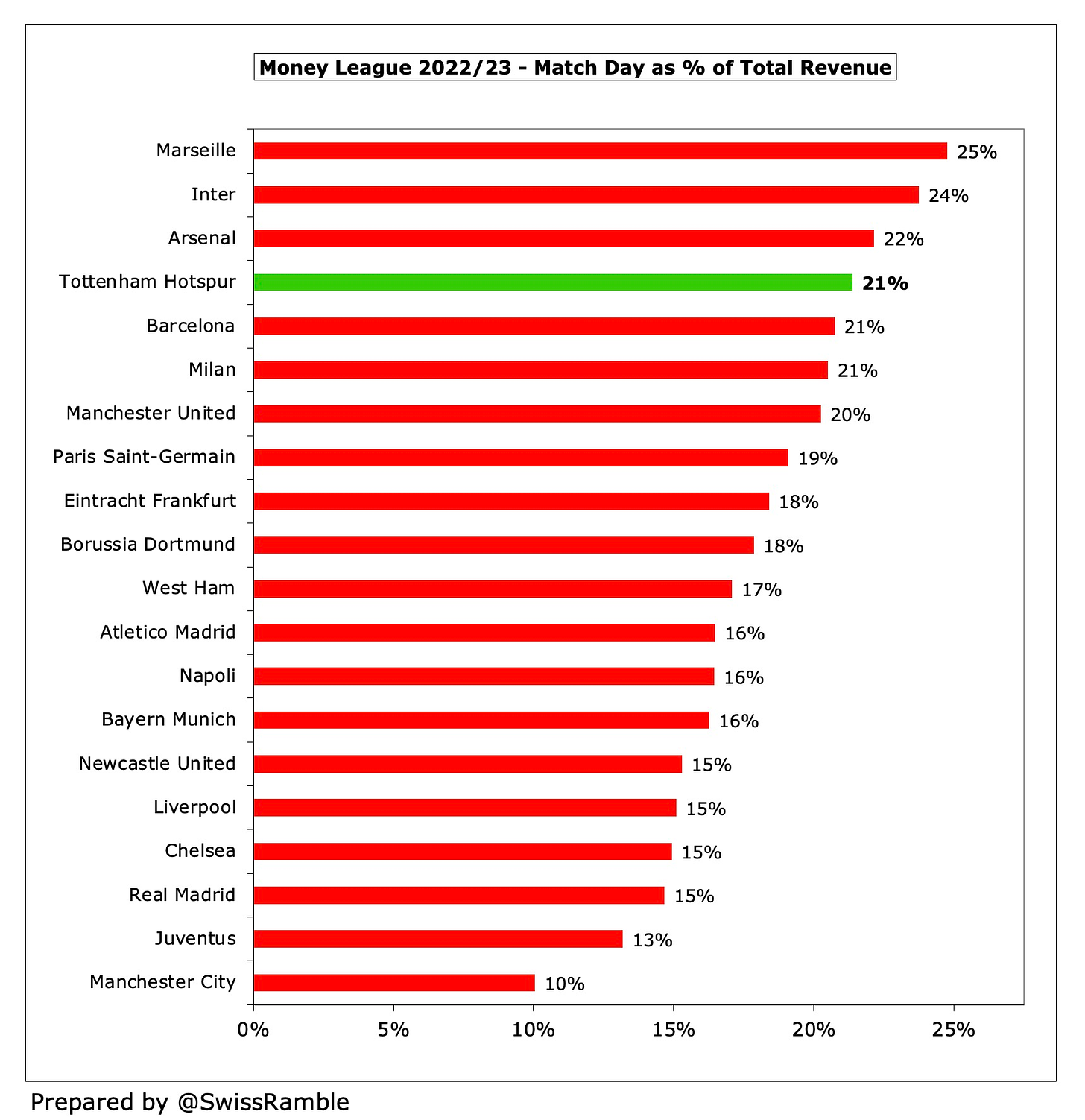

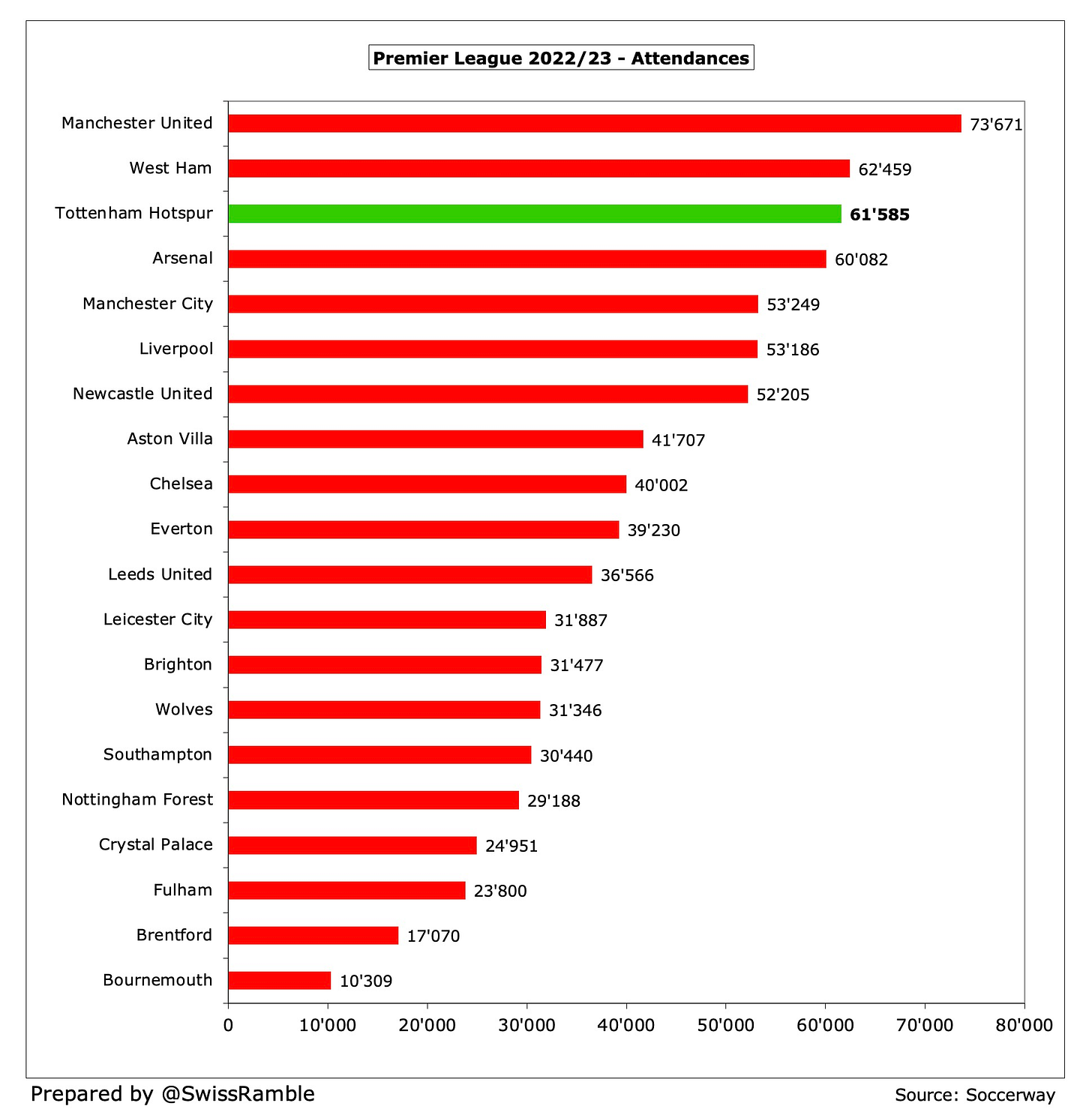

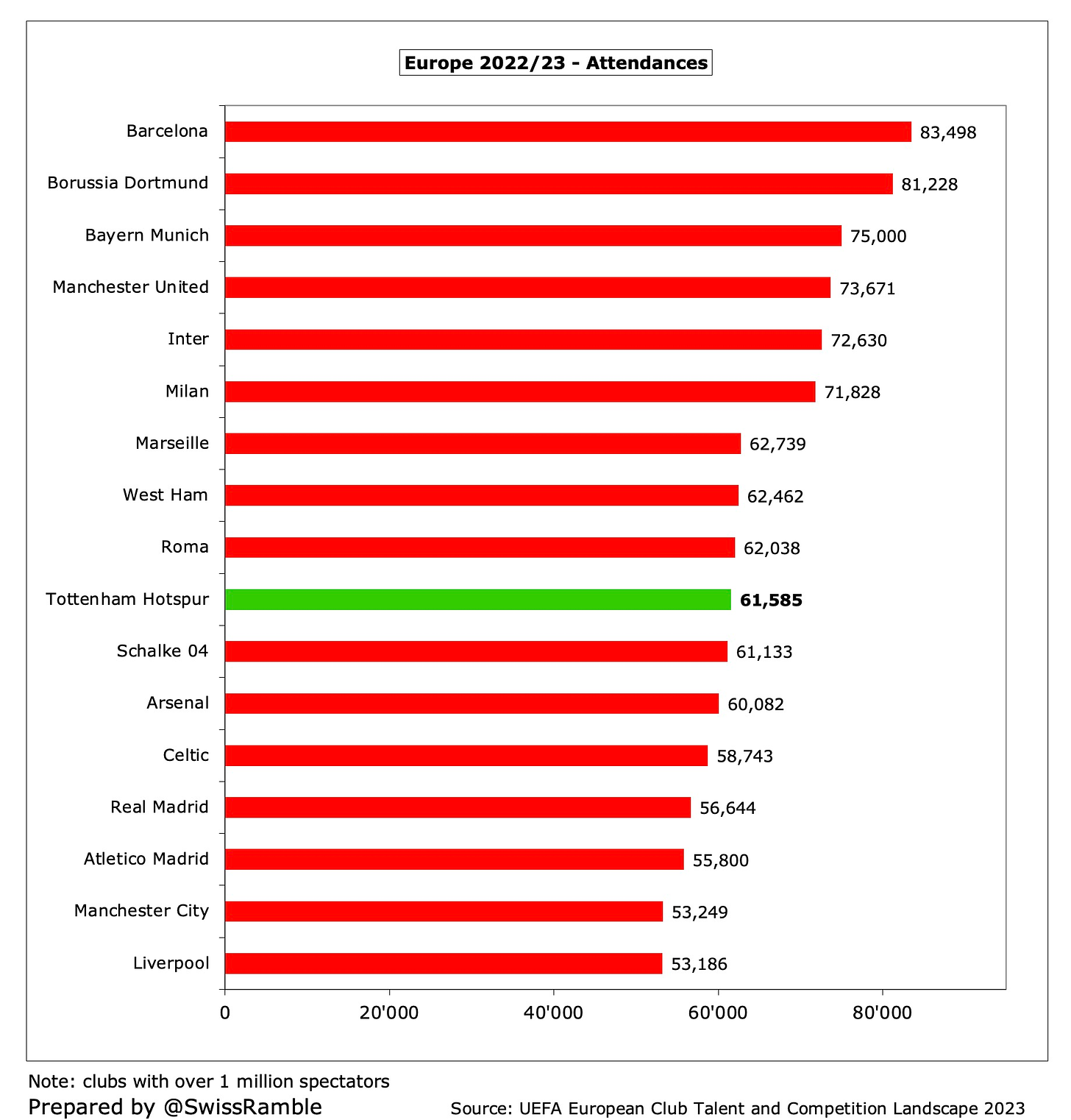

- The return to the Champions League led to significant increases in both broadcasting, up £50m (33%) from £154m to £204m, and match day, which rose £12m (11%) to a club record £118m.

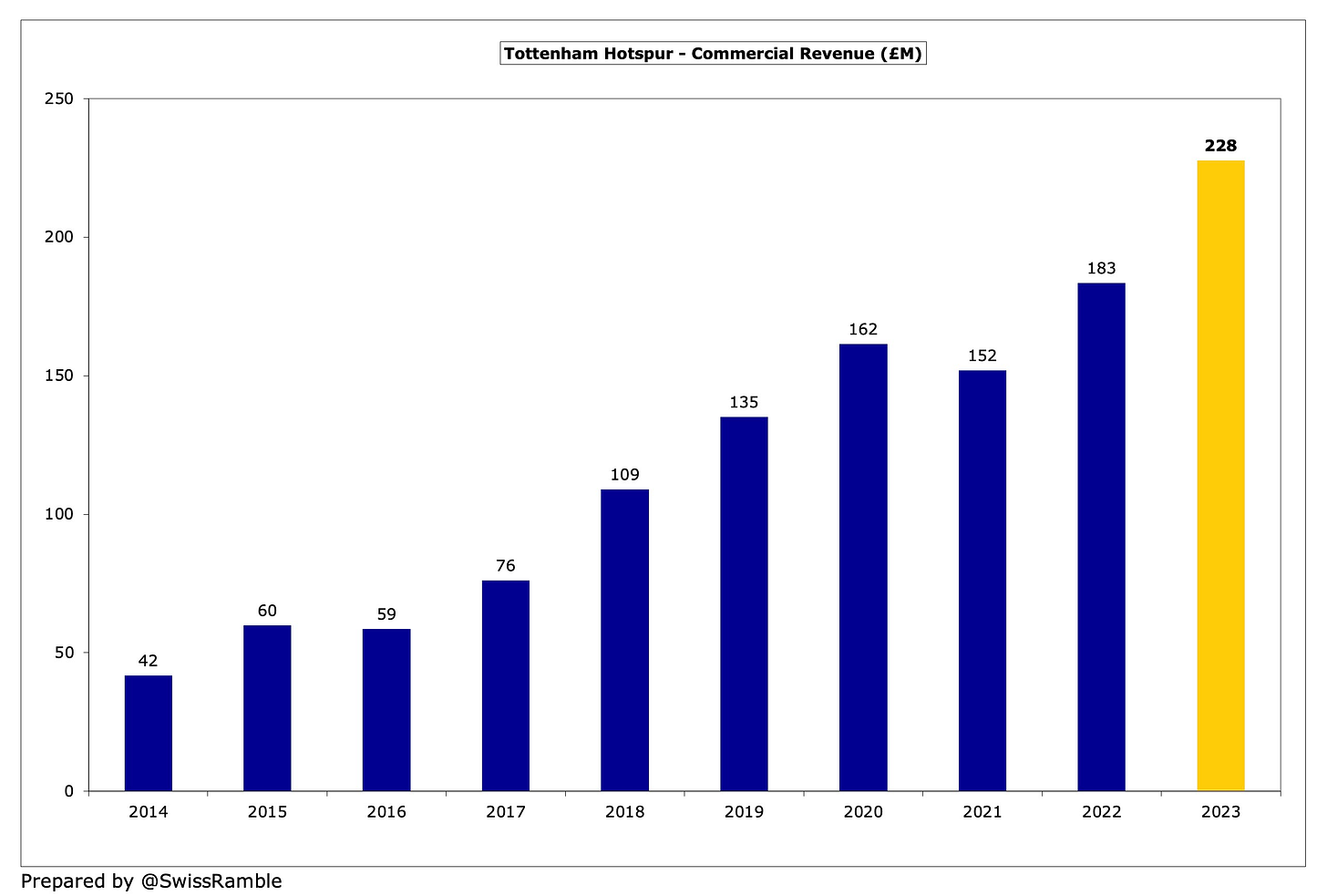

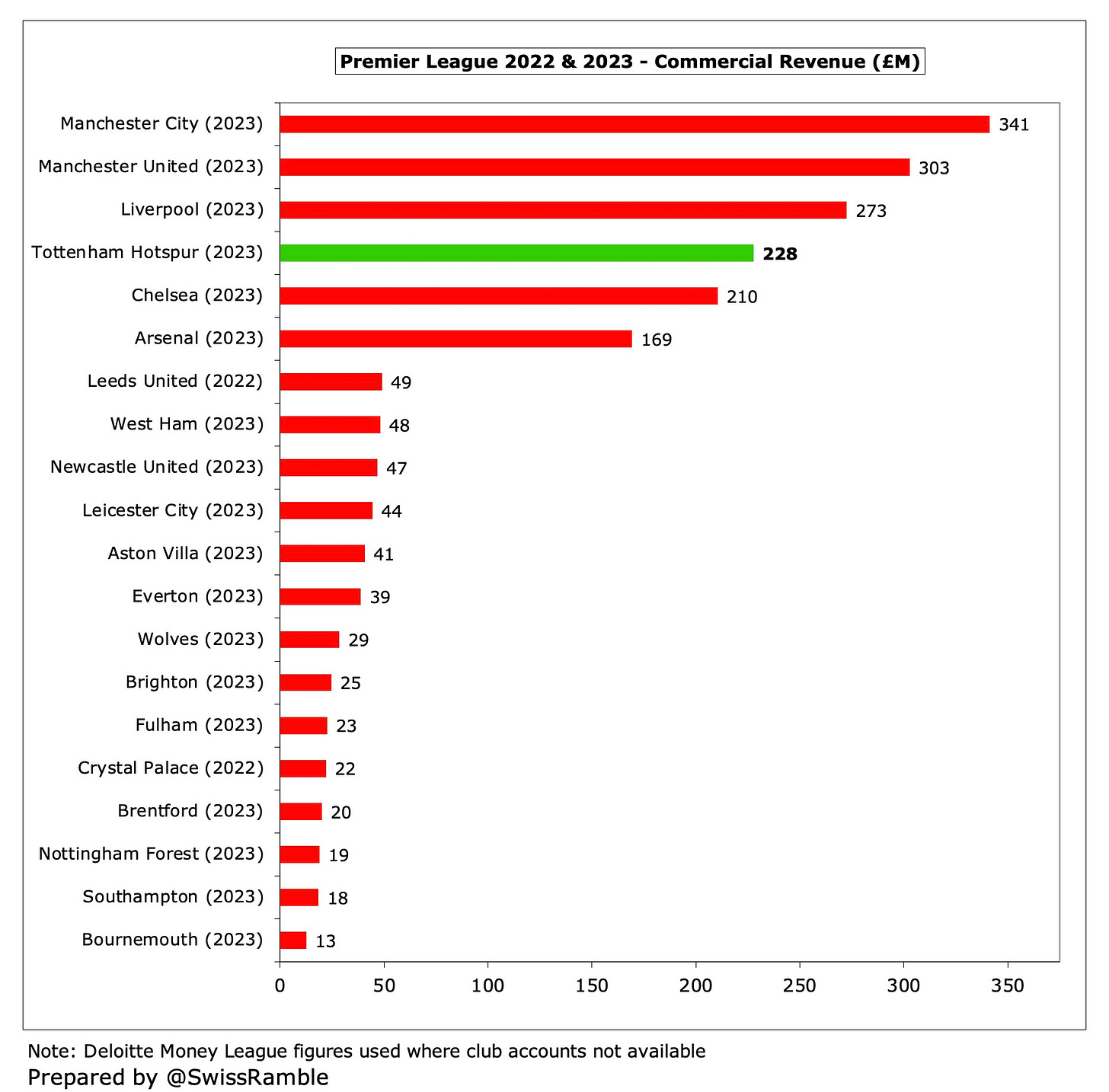

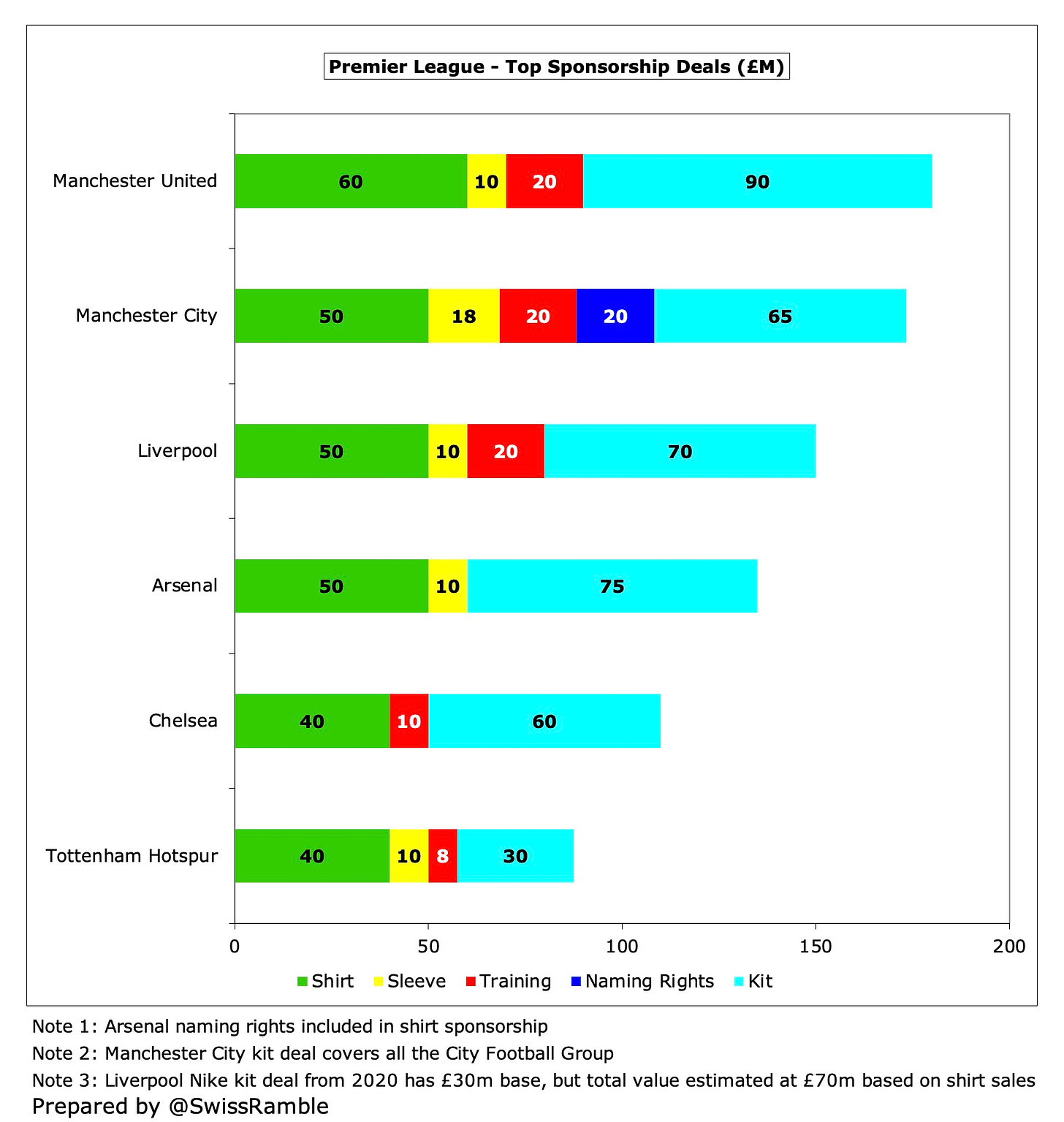

- Numerous third party events helped drive commercial up £44m (24%) from £184m to £228m, which was yet another club high.

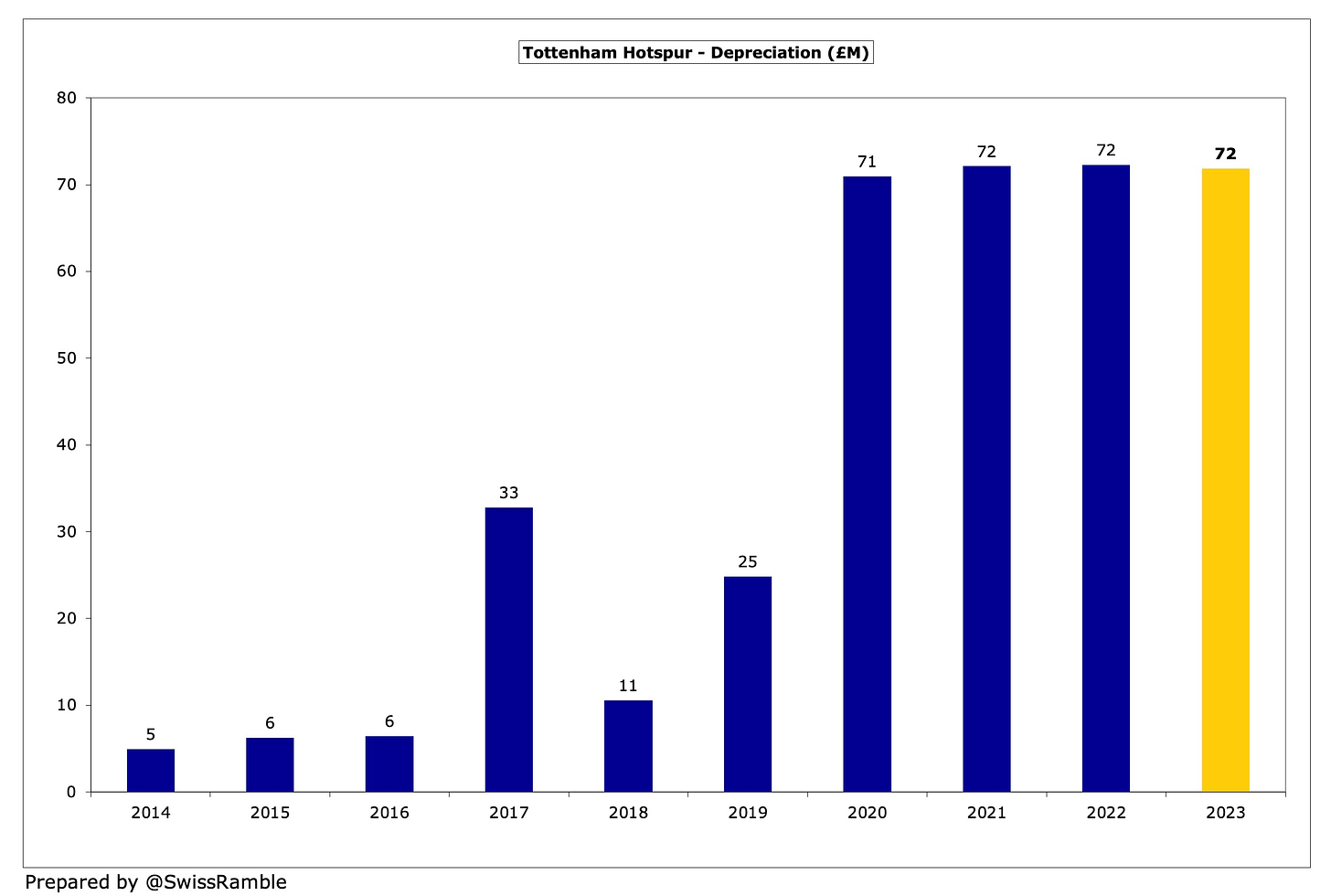

However, there were also chunky increases in staff costs, so the wage bill rose £42m (20%) from £209m to £251m, while player amortisation increased by £30m (37%) from £79m to £109m and player impairment was up from £2m to £11m.

Other expenses shot up £47m (39%) from £120m to £167m, while exceptional charges increased from £1m to £5m for onerous employment contracts.

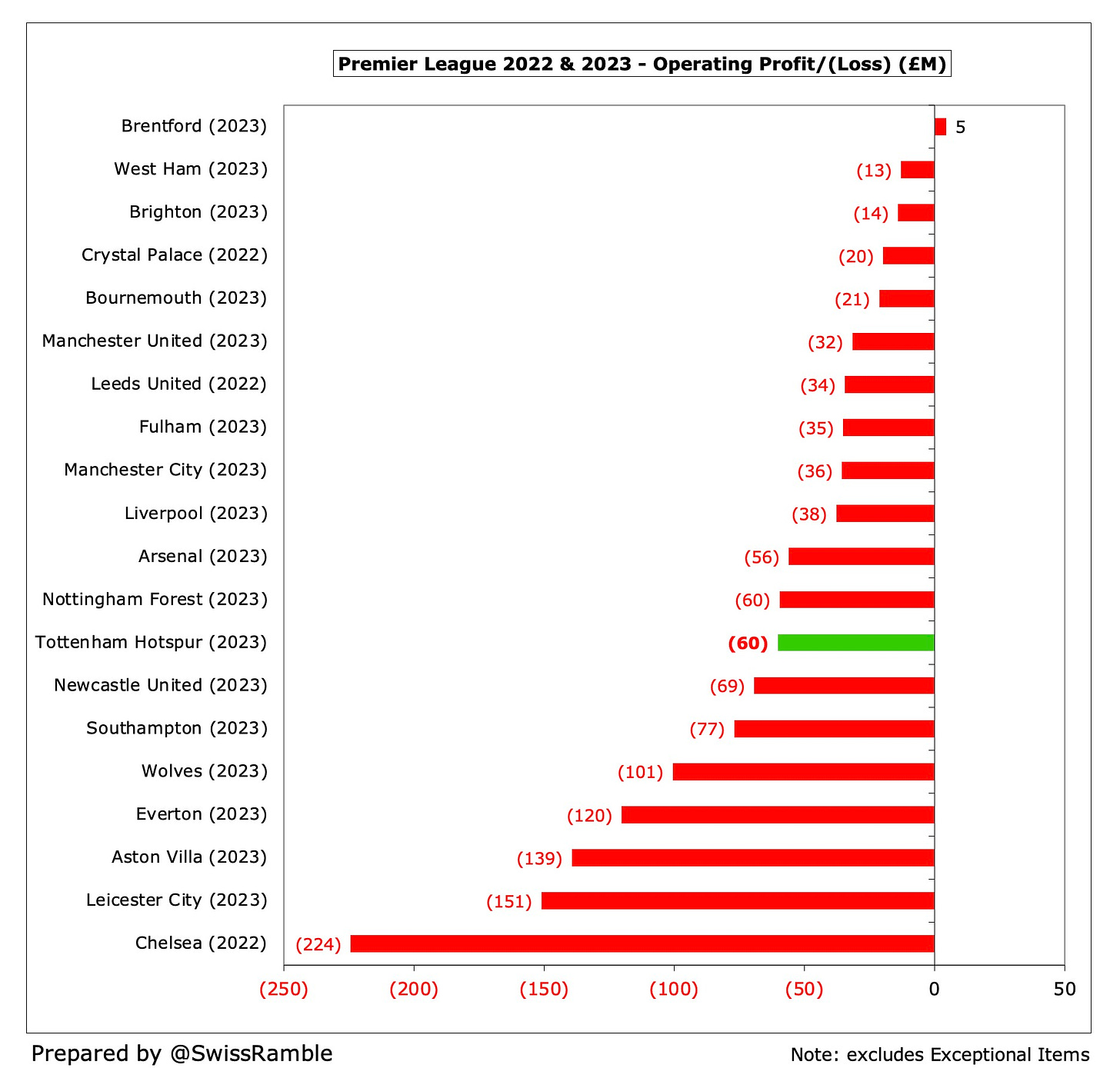

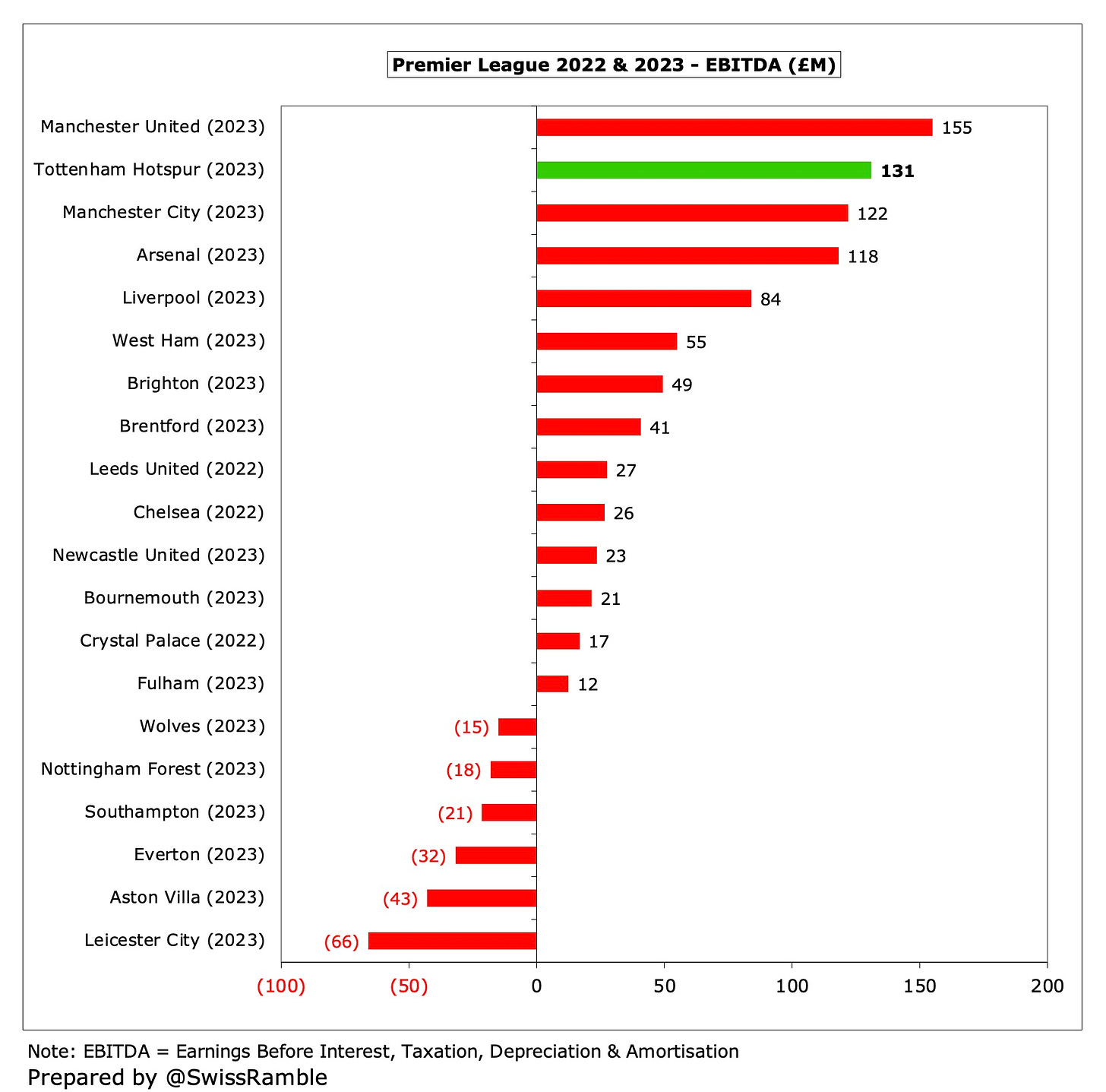

Tottenham’s £95m pre-tax loss is the second worst in the 2022/23 Premier League, only surpassed by Aston Villa’s £120m. That said, they are not alone in posting a large deficit, as half of the top flight lost more than £50m last season, including Chelsea £90m, Leicester City £90m and Everton £89m.

On the other hand, a few clubs did manage to generate a profit, most notably Brighton £133m and Manchester City £80m. Bournemouth also reported a £44m profit, though this would have been a £27m loss without a £71m owner loan write-off.

Last edited: